The carrying amount of financial assets represents the maximum credit exposure. The maximum exposureto credit risk at the reporting date was as follows:in CHF 1,000 Dec 31, <strong>2009</strong> Dec 31, 2008Financial assets 168 225Receivables trade 15,108 12,235Other receivables 408 332Cash and cash equivalents 15,053 7,490Total 30,737 20,2824.2 Liquidity RiskLiquidity risk is the risk that the Group will not be able to meet its financial obligations as they become due.The Group manages its liquidity in a way that it will always have sufficient liquidity to meet its obligations,even under stressed conditions.For medium term the Group uses a recurring cash planning tool to monitor its risk to a shortage of funds.This tool considers the expected cash inflows and outflows in the Group for the coming six months ona detailed level. The long-term monitoring is done based on the 5-year cash flow forecast also used forimpairment testing (see note 13). For temporary cash shortages, the Group currently has two revolvingcredit facilities of CHF 5.0 million each and a non-drawn amount of CHF 10 million of loan facility B atits disposal (2008: CHF 15.0 million in total).The following table shows the contractual maturities of the financial liabilities:Dec 31, 2008in CHF 1,000Within1 year1 to2 years3 to5 yearsOver5 yearsTotalBank loans 15,112 14,802 153,675 0 183,590Interest rate swap 704 704 703 0 2,111Trade and other liabilities 7,277 0 0 0 7,277Accrued liabilities 4,336 0 0 0 4,336Total liabilities 27,429 15,506 154,378 0 197,314Dec 31, <strong>2009</strong>in CHF 1,000Within1 year1 to2 years3 to5 yearsOver5 yearsTotalBank loans 13,550 13,266 107,982 0 134,798Interest rate swap 990 910 0 0 1,900Trade and other liabilities 4,434 0 0 0 4,434Accrued liabilities 5,331 0 0 0 5,331Total liabilities 24,305 14,176 107,982 0 146,46370 <strong>Uster</strong> Group – Notes to the Consolidated Financial Statements <strong>2009</strong>

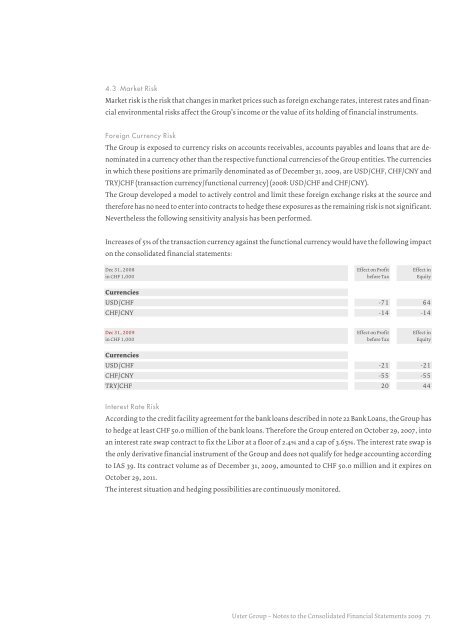

4.3 Market RiskMarket risk is the risk that changes in market prices such as foreign exchange rates, interest rates and financialenvironmental risks affect the Group’s income or the value of its holding of financial instruments.Foreign Currency RiskThe Group is exposed to currency risks on accounts receivables, accounts payables and loans that are denominatedin a currency other than the respective functional currencies of the Group entities. The currenciesin which these positions are primarily denominated as of December 31, <strong>2009</strong>, are USD / CHF, CHF / CNY andTRY/CHF (transaction currency / functional currency) (2008: USD / CHF and CHF / CNY).The Group developed a model to actively control and limit these foreign exchange risks at the source andtherefore has no need to enter into contracts to hedge these exposures as the remaining risk is not significant.Nevertheless the following sensitivity analysis has been performed.Increases of 5% of the transaction currency against the functional currency would have the following impacton the consolidated financial statements:Dec 31, 2008in CHF 1,000Effect on Profitbefore TaxEffect inEquityCurrenciesUSD / CHF -71 64CHF / CNY -14 -14Dec 31, <strong>2009</strong>in CHF 1,000Effect on Profitbefore TaxEffect inEquityCurrenciesUSD / CHF -21 -21CHF / CNY -55 -55TRY/CHF 20 44Interest Rate RiskAccording to the credit facility agreement for the bank loans described in note 22 Bank Loans, the Group hasto hedge at least CHF 50.0 million of the bank loans. Therefore the Group entered on October 29, 2007, intoan interest rate swap contract to fix the Libor at a floor of 2.4% and a cap of 3.65%. The interest rate swap isthe only derivative financial instrument of the Group and does not qualify for hedge accounting accordingto IAS 39. Its contract volume as of December 31, <strong>2009</strong>, amounted to CHF 50.0 million and it expires onOctober 29, 2011.The interest situation and hedging possibilities are continuously monitored.<strong>Uster</strong> Group – Notes to the Consolidated Financial Statements <strong>2009</strong> 71

- Page 1 and 2:

Uster Technologies Ltd | Annual Rep

- Page 3 and 4:

Achievements 2009• EBITA margin m

- Page 5:

PortraitThe Uster Group is the lead

- Page 8 and 9:

Table of ContentsInhaltsverzeichnis

- Page 10 and 11:

Max-Ulrich Zellweger, Geoffrey Scot

- Page 12 and 13:

Quality means the customercomes bac

- Page 14 and 15:

Operational ReviewOperativer Rückb

- Page 16 and 17:

Inconsistent quality meansloss of p

- Page 18 and 19:

position as the world leader and au

- Page 20 and 21:

Poor quality can destroybrand reput

- Page 22 and 23:

Sales and MarketingVertrieb und Mar

- Page 24 and 25:

The hidden cost of poor qualityThin

- Page 26 and 27: Research and InnovationForschung un

- Page 28 and 29: OperationsProduktion und LogistikIn

- Page 30 and 31: OutlookAusblickSeveral trends and l

- Page 32 and 33: Corporate GovernanceThe information

- Page 34 and 35: • On February 10, 2009, Lombard O

- Page 36 and 37: 2.4 Shares and Participation Certif

- Page 38 and 39: Board of DirectorsMembers of the Bo

- Page 40 and 41: Harald Rönn, Member of the Board o

- Page 42 and 43: The Board of Directors may entrust

- Page 44 and 45: Nomination and Compensation Committ

- Page 46 and 47: Executive CommitteeMembers of the E

- Page 48 and 49: 4 Executive Committee4.1 Members of

- Page 50 and 51: Harold R. Hoke Jr., Head of Sales a

- Page 52 and 53: 6.2 Statutory QuorumsUnless mandato

- Page 54 and 55: 9 Information PolicyUster Technolog

- Page 56 and 57: Comment on the Consolidated Financi

- Page 58 and 59: Uster Group - Consolidated Financia

- Page 60 and 61: Consolidated Statement of Cash Flow

- Page 62 and 63: Consolidated Statement of Changes i

- Page 64 and 65: 2.5 Impairment of Goodwill and Inta

- Page 66 and 67: Standards, Amendments and Interpret

- Page 68 and 69: 3.4 Intangible AssetsBusiness Combi

- Page 70 and 71: 3.6 Financial InstrumentsFinancial

- Page 72 and 73: 3.7 InventoriesInventories are meas

- Page 74 and 75: 3.13 Revenue RecognitionRevenue fro

- Page 78 and 79: The table below sets out the carryi

- Page 80 and 81: The fair value of the bank loans ha

- Page 82 and 83: 8.4 Personnel Expensein CHF 1,000 J

- Page 84 and 85: 12 Intangible Assetsin CHF 1,000 Cu

- Page 86 and 87: 13 Impairment Testing of Goodwill a

- Page 88 and 89: 14 Property, Plant and Equipmentin

- Page 90 and 91: The changes in the present value of

- Page 92 and 93: 16 Income TaxStatement of Comprehen

- Page 94 and 95: Movements in Temporary DifferencesT

- Page 96 and 97: The ageing of these receivables is

- Page 98 and 99: 21.3 DividendsThe holders of regist

- Page 100 and 101: Restructuring ProvisionsThe Company

- Page 102 and 103: 26 Operating Lease CommitmentsNon-c

- Page 104 and 105: Report of the Statutory Auditor on

- Page 106 and 107: Uster Technologies Ltd - Financial

- Page 108 and 109: Uster Technologies Ltd - Notes to t

- Page 110 and 111: 10 Investments in SubsidiariesAs of

- Page 112 and 113: Executive Committeein CHF 2008Name

- Page 114 and 115: Report of the Statutory Auditor on

- Page 116 and 117: Information for InvestorsShare Info

- Page 118 and 119: Key Figuresin CHF 1,000 Jan 1 -Dec

- Page 120 and 121: in CHF 1,000 2009 2008 2007 2006 1)

- Page 122: ImprintContent Concept and EditingI