Uster Technologies Ltd | Annual Report 2009 Uster Technologies ...

Uster Technologies Ltd | Annual Report 2009 Uster Technologies ...

Uster Technologies Ltd | Annual Report 2009 Uster Technologies ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

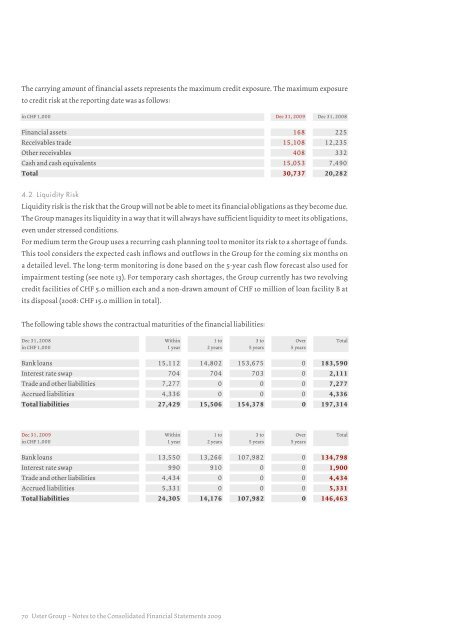

The carrying amount of financial assets represents the maximum credit exposure. The maximum exposureto credit risk at the reporting date was as follows:in CHF 1,000 Dec 31, <strong>2009</strong> Dec 31, 2008Financial assets 168 225Receivables trade 15,108 12,235Other receivables 408 332Cash and cash equivalents 15,053 7,490Total 30,737 20,2824.2 Liquidity RiskLiquidity risk is the risk that the Group will not be able to meet its financial obligations as they become due.The Group manages its liquidity in a way that it will always have sufficient liquidity to meet its obligations,even under stressed conditions.For medium term the Group uses a recurring cash planning tool to monitor its risk to a shortage of funds.This tool considers the expected cash inflows and outflows in the Group for the coming six months ona detailed level. The long-term monitoring is done based on the 5-year cash flow forecast also used forimpairment testing (see note 13). For temporary cash shortages, the Group currently has two revolvingcredit facilities of CHF 5.0 million each and a non-drawn amount of CHF 10 million of loan facility B atits disposal (2008: CHF 15.0 million in total).The following table shows the contractual maturities of the financial liabilities:Dec 31, 2008in CHF 1,000Within1 year1 to2 years3 to5 yearsOver5 yearsTotalBank loans 15,112 14,802 153,675 0 183,590Interest rate swap 704 704 703 0 2,111Trade and other liabilities 7,277 0 0 0 7,277Accrued liabilities 4,336 0 0 0 4,336Total liabilities 27,429 15,506 154,378 0 197,314Dec 31, <strong>2009</strong>in CHF 1,000Within1 year1 to2 years3 to5 yearsOver5 yearsTotalBank loans 13,550 13,266 107,982 0 134,798Interest rate swap 990 910 0 0 1,900Trade and other liabilities 4,434 0 0 0 4,434Accrued liabilities 5,331 0 0 0 5,331Total liabilities 24,305 14,176 107,982 0 146,46370 <strong>Uster</strong> Group – Notes to the Consolidated Financial Statements <strong>2009</strong>