Uster Technologies Ltd | Annual Report 2009 Uster Technologies ...

Uster Technologies Ltd | Annual Report 2009 Uster Technologies ...

Uster Technologies Ltd | Annual Report 2009 Uster Technologies ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

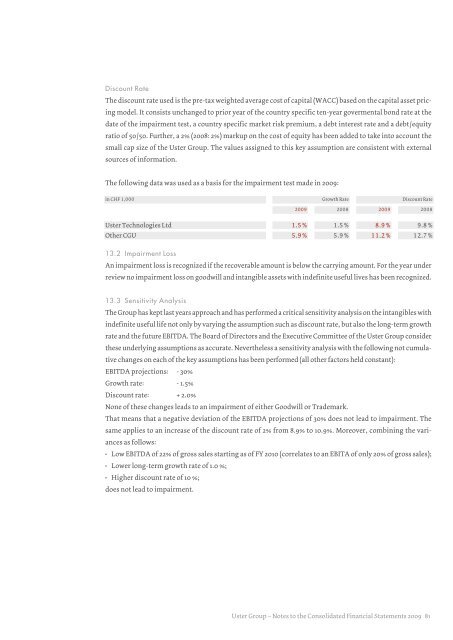

Discount RateThe discount rate used is the pre-tax weighted average cost of capital (WACC) based on the capital asset pricingmodel. It consists unchanged to prior year of the country specific ten-year govermental bond rate at thedate of the impairment test, a country specific market risk premium, a debt interest rate and a debt / equityratio of 50 / 50. Further, a 2% (2008: 2%) markup on the cost of equity has been added to take into account thesmall cap size of the <strong>Uster</strong> Group. The values assigned to this key assumption are consistent with externalsources of information.The following data was used as a basis for the impairment test made in <strong>2009</strong>:in CHF 1,000 Growth Rate Discount Rate<strong>2009</strong> 2008 <strong>2009</strong> 2008<strong>Uster</strong> <strong>Technologies</strong> <strong>Ltd</strong> 1.5% 1.5% 8.9% 9.8%Other CGU 5.9% 5.9% 11.2% 12.7%13.2 Impairment LossAn impairment loss is recognized if the recoverable amount is below the carrying amount. For the year underreview no impairment loss on goodwill and intangible assets with indefinite useful lives has been recognized.13.3 Sensitivity AnalysisThe Group has kept last years approach and has performed a critical sensitivity analysis on the intangibles withindefinite useful life not only by varying the assumption such as discount rate, but also the long-term growthrate and the future EBITDA. The Board of Directors and the Executive Committee of the <strong>Uster</strong> Group considerthese underlying assumptions as accurate. Nevertheless a sensitivity analysis with the following not cumulativechanges on each of the key assumptions has been performed (all other factors held constant):EBITDA projections: - 30%Growth rate: - 1.5%Discount rate: + 2.0%None of these changes leads to an impairment of either Goodwill or Trademark.That means that a negative deviation of the EBITDA projections of 30% does not lead to impairment. Thesame applies to an increase of the discount rate of 2% from 8.9% to 10.9%. Moreover, combining the variancesas follows:• Low EBITDA of 22% of gross sales starting as of FY 2010 (correlates to an EBITA of only 20% of gross sales);• Lower long-term growth rate of 1.0 %;• Higher discount rate of 10 %;does not lead to impairment.<strong>Uster</strong> Group – Notes to the Consolidated Financial Statements <strong>2009</strong> 81