Uster Technologies Ltd | Annual Report 2009 Uster Technologies ...

Uster Technologies Ltd | Annual Report 2009 Uster Technologies ...

Uster Technologies Ltd | Annual Report 2009 Uster Technologies ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

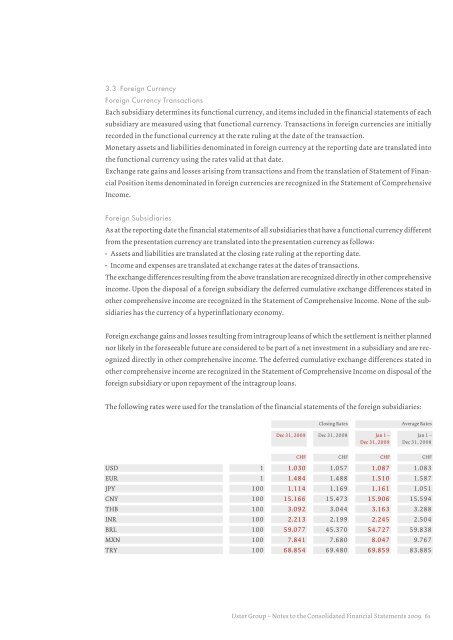

3.3 Foreign CurrencyForeign Currency TransactionsEach subsidiary determines its functional currency, and items included in the financial statements of eachsubsidiary are measured using that functional currency. Transactions in foreign currencies are initiallyrecorded in the functional currency at the rate ruling at the date of the transaction.Monetary assets and liabilities denominated in foreign currency at the reporting date are translated intothe functional currency using the rates valid at that date.Exchange rate gains and losses arising from transactions and from the translation of Statement of FinancialPosition items denominated in foreign currencies are recognized in the Statement of ComprehensiveIncome.Foreign SubsidiariesAs at the reporting date the financial statements of all subsidiaries that have a functional currency differentfrom the presentation currency are translated into the presentation currency as follows:• Assets and liabilities are translated at the closing rate ruling at the reporting date.• Income and expenses are translated at exchange rates at the dates of transactions.The exchange differences resulting from the above translation are recognized directly in other comprehensiveincome. Upon the disposal of a foreign subsidiary the deferred cumulative exchange differences stated inother comprehensive income are recognized in the Statement of Comprehensive Income. None of the subsidiarieshas the currency of a hyperinflationary economy.Foreign exchange gains and losses resulting from intragroup loans of which the settlement is neither plannednor likely in the foreseeable future are considered to be part of a net investment in a subsidiary and are recognizeddirectly in other comprehensive income. The deferred cumulative exchange differences stated inother comprehensive income are recognized in the Statement of Comprehensive Income on disposal of theforeign subsidiary or upon repayment of the intragroup loans.The following rates were used for the translation of the financial statements of the foreign subsidiaries:Closing RatesDec 31, <strong>2009</strong> Dec 31, 2008 Jan 1 –Dec 31, <strong>2009</strong>Average RatesJan 1 –Dec 31, 2008CHF CHF CHF CHFUSD 1 1.030 1.057 1.087 1.083EUR 1 1.484 1.488 1.510 1.587JPY 100 1.114 1.169 1.161 1.051CNY 100 15.166 15.473 15.906 15.594THB 100 3.092 3.044 3.163 3.288INR 100 2.213 2.199 2.245 2.504BRL 100 59.077 45.370 54.727 59.838MXN 100 7.841 7.680 8.047 9.767TRY 100 68.854 69.480 69.859 83.885<strong>Uster</strong> Group – Notes to the Consolidated Financial Statements <strong>2009</strong> 61