Research Journal of Economics & Business Studies - RJEBS - The ...

Research Journal of Economics & Business Studies - RJEBS - The ...

Research Journal of Economics & Business Studies - RJEBS - The ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

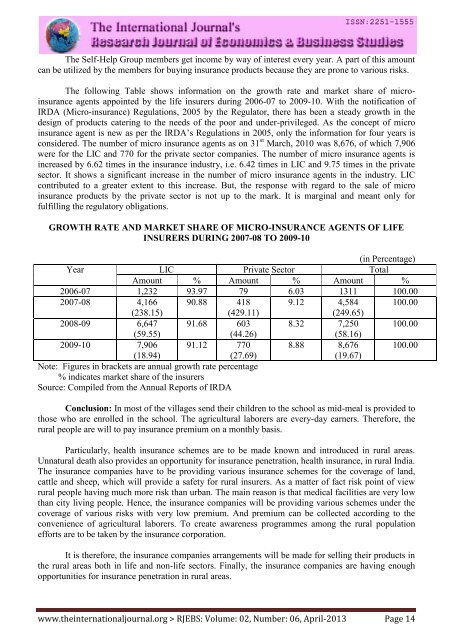

<strong>The</strong> Self-Help Group members get income by way <strong>of</strong> interest every year. A part <strong>of</strong> this amount<br />

can be utilized by the members for buying insurance products because they are prone to various risks.<br />

<strong>The</strong> following Table shows information on the growth rate and market share <strong>of</strong> microinsurance<br />

agents appointed by the life insurers during 2006-07 to 2009-10. With the notification <strong>of</strong><br />

IRDA (Micro-insurance) Regulations, 2005 by the Regulator, there has been a steady growth in the<br />

design <strong>of</strong> products catering to the needs <strong>of</strong> the poor and under-privileged. As the concept <strong>of</strong> micro<br />

insurance agent is new as per the IRDA’s Regulations in 2005, only the information for four years is<br />

considered. <strong>The</strong> number <strong>of</strong> micro insurance agents as on 31 st March, 2010 was 8,676, <strong>of</strong> which 7,906<br />

were for the LIC and 770 for the private sector companies. <strong>The</strong> number <strong>of</strong> micro insurance agents is<br />

increased by 6.62 times in the insurance industry, i.e. 6.42 times in LIC and 9.75 times in the private<br />

sector. It shows a significant increase in the number <strong>of</strong> micro insurance agents in the industry. LIC<br />

contributed to a greater extent to this increase. But, the response with regard to the sale <strong>of</strong> micro<br />

insurance products by the private sector is not up to the mark. It is marginal and meant only for<br />

fulfilling the regulatory obligations.<br />

GROWTH RATE AND MARKET SHARE OF MICRO-INSURANCE AGENTS OF LIFE<br />

INSURERS DURING 2007-08 TO 2009-10<br />

(in Percentage)<br />

Year LIC Private Sector Total<br />

Amount % Amount % Amount %<br />

2006-07 1,232 93.97 79 6.03 1311 100.00<br />

2007-08 4,166 90.88 418 9.12 4,584 100.00<br />

(238.15)<br />

(429.11)<br />

(249.65)<br />

2008-09 6,647 91.68 603 8.32 7,250 100.00<br />

(59.55)<br />

(44.26)<br />

2009-10 7,906 91.12 770<br />

(18.94)<br />

(27.69)<br />

Note: Figures in brackets are annual growth rate percentage<br />

% indicates market share <strong>of</strong> the insurers<br />

Source: Compiled from the Annual Reports <strong>of</strong> IRDA<br />

(58.16)<br />

8.88 8,676<br />

(19.67)<br />

100.00<br />

Conclusion: In most <strong>of</strong> the villages send their children to the school as mid-meal is provided to<br />

those who are enrolled in the school. <strong>The</strong> agricultural laborers are every-day earners. <strong>The</strong>refore, the<br />

rural people are will to pay insurance premium on a monthly basis.<br />

Particularly, health insurance schemes are to be made known and introduced in rural areas.<br />

Unnatural death also provides an opportunity for insurance penetration, health insurance, in rural India.<br />

<strong>The</strong> insurance companies have to be providing various insurance schemes for the coverage <strong>of</strong> land,<br />

cattle and sheep, which will provide a safety for rural insurers. As a matter <strong>of</strong> fact risk point <strong>of</strong> view<br />

rural people having much more risk than urban. <strong>The</strong> main reason is that medical facilities are very low<br />

than city living people. Hence, the insurance companies will be providing various schemes under the<br />

coverage <strong>of</strong> various risks with very low premium. And premium can be collected according to the<br />

convenience <strong>of</strong> agricultural laborers. To create awareness programmes among the rural population<br />

efforts are to be taken by the insurance corporation.<br />

It is therefore, the insurance companies arrangements will be made for selling their products in<br />

the rural areas both in life and non-life sectors. Finally, the insurance companies are having enough<br />

opportunities for insurance penetration in rural areas.<br />

www.theinternationaljournal.org > <strong>RJEBS</strong>: Volume: 02, Number: 06, April-2013 Page 14