Research Journal of Economics & Business Studies - RJEBS - The ...

Research Journal of Economics & Business Studies - RJEBS - The ...

Research Journal of Economics & Business Studies - RJEBS - The ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

esponded by (7.6%) <strong>of</strong> the members. This indicates members in Gohe cooperatives saving and credit<br />

union more value their saving security, secondly access to credit to get loan and thirdly return on their<br />

savings.<br />

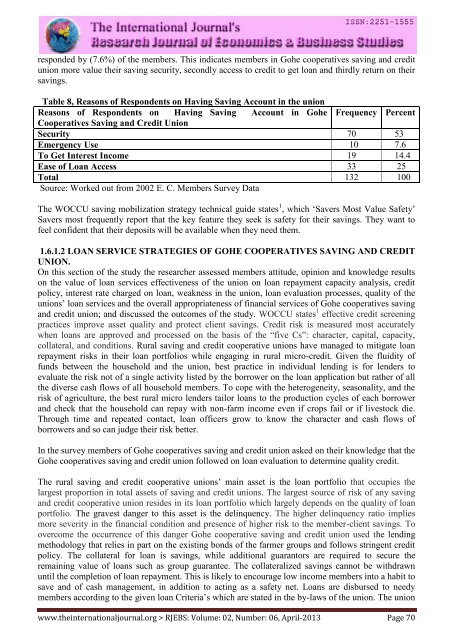

Table 8, Reasons <strong>of</strong> Respondents on Having Saving Account in the union<br />

Reasons <strong>of</strong> Respondents on Having Saving Account in Gohe Frequency Percent<br />

Cooperatives Saving and Credit Union<br />

Security 70 53<br />

Emergency Use 10 7.6<br />

To Get Interest Income 19 14.4<br />

Ease <strong>of</strong> Loan Access 33 25<br />

Total 132 100<br />

Source: Worked out from 2002 E. C. Members Survey Data<br />

<strong>The</strong> WOCCU saving mobilization strategy technical guide states 1 , which ‘Savers Most Value Safety’<br />

Savers most frequently report that the key feature they seek is safety for their savings. <strong>The</strong>y want to<br />

feel confident that their deposits will be available when they need them.<br />

1.6.1.2 LOAN SERVICE STRATEGIES OF GOHE COOPERATIVES SAVING AND CREDIT<br />

UNION.<br />

On this section <strong>of</strong> the study the researcher assessed members attitude, opinion and knowledge results<br />

on the value <strong>of</strong> loan services effectiveness <strong>of</strong> the union on loan repayment capacity analysis, credit<br />

policy, interest rate charged on loan, weakness in the union, loan evaluation processes, quality <strong>of</strong> the<br />

unions’ loan services and the overall appropriateness <strong>of</strong> financial services <strong>of</strong> Gohe cooperatives saving<br />

and credit union; and discussed the outcomes <strong>of</strong> the study. WOCCU states 1 effective credit screening<br />

practices improve asset quality and protect client savings. Credit risk is measured most accurately<br />

when loans are approved and processed on the basis <strong>of</strong> the “five Cs”: character, capital, capacity,<br />

collateral, and conditions. Rural saving and credit cooperative unions have managed to mitigate loan<br />

repayment risks in their loan portfolios while engaging in rural micro-credit. Given the fluidity <strong>of</strong><br />

funds between the household and the union, best practice in individual lending is for lenders to<br />

evaluate the risk not <strong>of</strong> a single activity listed by the borrower on the loan application but rather <strong>of</strong> all<br />

the diverse cash flows <strong>of</strong> all household members. To cope with the heterogeneity, seasonality, and the<br />

risk <strong>of</strong> agriculture, the best rural micro lenders tailor loans to the production cycles <strong>of</strong> each borrower<br />

and check that the household can repay with non-farm income even if crops fail or if livestock die.<br />

Through time and repeated contact, loan <strong>of</strong>ficers grow to know the character and cash flows <strong>of</strong><br />

borrowers and so can judge their risk better.<br />

In the survey members <strong>of</strong> Gohe cooperatives saving and credit union asked on their knowledge that the<br />

Gohe cooperatives saving and credit union followed on loan evaluation to determine quality credit.<br />

<strong>The</strong> rural saving and credit cooperative unions’ main asset is the loan portfolio that occupies the<br />

largest proportion in total assets <strong>of</strong> saving and credit unions. <strong>The</strong> largest source <strong>of</strong> risk <strong>of</strong> any saving<br />

and credit cooperative union resides in its loan portfolio which largely depends on the quality <strong>of</strong> loan<br />

portfolio. <strong>The</strong> gravest danger to this asset is the delinquency. <strong>The</strong> higher delinquency ratio implies<br />

more severity in the financial condition and presence <strong>of</strong> higher risk to the member-client savings. To<br />

overcome the occurrence <strong>of</strong> this danger Gohe cooperative saving and credit union used the lending<br />

methodology that relies in part on the existing bonds <strong>of</strong> the farmer groups and follows stringent credit<br />

policy. <strong>The</strong> collateral for loan is savings, while additional guarantors are required to secure the<br />

remaining value <strong>of</strong> loans such as group guarantee. <strong>The</strong> collateralized savings cannot be withdrawn<br />

until the completion <strong>of</strong> loan repayment. This is likely to encourage low income members into a habit to<br />

save and <strong>of</strong> cash management, in addition to acting as a safety net. Loans are disbursed to needy<br />

members according to the given loan Criteria’s which are stated in the by-laws <strong>of</strong> the union. <strong>The</strong> union<br />

www.theinternationaljournal.org > <strong>RJEBS</strong>: Volume: 02, Number: 06, April-2013 Page 70