Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

THE CURRENT STATE OF PLAY<br />

FOR SUB-SAHARAN AFRICA-<br />

FOCUSSED PRIVATE EQUITY<br />

FUND DOMICILES<br />

While private equity in Sub-Saharan Africa remains a<br />

relatively nascent industry in comparison to other emerging<br />

market regions, interest in the subcontinent has exploded<br />

over the last several years. According to EMPEA data,<br />

US$12.8 billion has been raised for Sub-Saharan Africafocussed<br />

private equity funds between January 2010 and<br />

March 2015, while EMPEA’s annual Global Limited Partners<br />

Survey reveals that the region has ranked as one <strong>of</strong> the top<br />

three most attractive emerging markets for private equity<br />

investment over the last three years. This dynamic has<br />

resulted in a growing number <strong>of</strong> new entrants—both local<br />

and global—investing in the region, as well as an increase<br />

in the number <strong>of</strong> fund<br />

managers raising larger<br />

vehicles (US$700+<br />

million funds).<br />

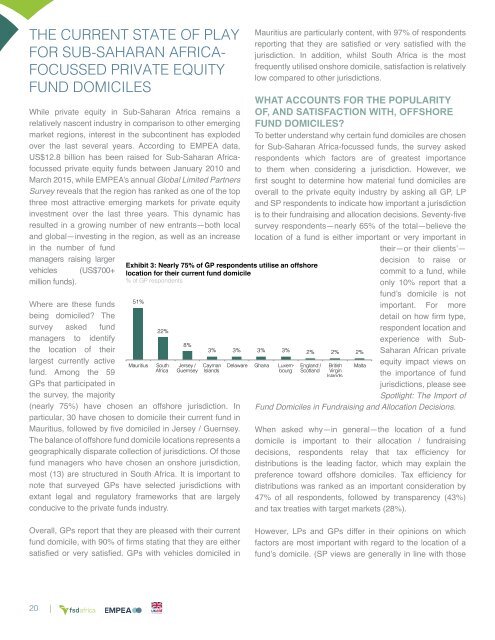

Where are these funds<br />

being domiciled? The<br />

survey asked fund<br />

managers to identify<br />

the location <strong>of</strong> their<br />

largest currently active<br />

fund. Among the 59<br />

GPs that participated in<br />

the survey, the majority<br />

(nearly 75%) have chosen an <strong>of</strong>fshore jurisdiction. In<br />

particular, 30 have chosen to domicile their current fund in<br />

Mauritius, followed by five domiciled in Jersey / Guernsey.<br />

The balance <strong>of</strong> <strong>of</strong>fshore fund domicile locations represents a<br />

geographically disparate collection <strong>of</strong> jurisdictions. Of those<br />

fund managers who have chosen an onshore jurisdiction,<br />

most (13) are structured in South Africa. It is important to<br />

note that surveyed GPs have selected jurisdictions with<br />

extant legal and regulatory frameworks that are largely<br />

conducive to the private funds industry.<br />

Overall, GPs report that they are pleased with their current<br />

fund domicile, with 90% <strong>of</strong> firms stating that they are either<br />

satisfied or very satisfied. GPs with vehicles domiciled in<br />

Mauritius are particularly content, with 97% <strong>of</strong> respondents<br />

reporting that they are satisfied or very satisfied with the<br />

jurisdiction. In addition, whilst South Africa is the most<br />

frequently utilised onshore domicile, satisfaction is relatively<br />

low compared to other jurisdictions.<br />

WHAT ACCOUNTS FOR THE POPULARITY<br />

OF, AND SATISFACTION WITH, OFFSHORE<br />

FUND DOMICILES?<br />

To better understand why certain fund domiciles are chosen<br />

for Sub-Saharan Africa-focussed funds, the survey asked<br />

respondents which factors are <strong>of</strong> greatest importance<br />

to them when considering a jurisdiction. However, we<br />

first sought to determine how material fund domiciles are<br />

overall to the private equity industry by asking all GP, LP<br />

and SP respondents to indicate how important a jurisdiction<br />

is to their fundraising and allocation decisions. Seventy-five<br />

survey respondents—nearly 65% <strong>of</strong> the total—believe the<br />

location <strong>of</strong> a fund is either important or very important in<br />

their—or their clients’—<br />

decision to raise or<br />

commit to a fund, while<br />

only 10% report that a<br />

fund’s domicile is not<br />

important. For more<br />

detail on how firm type,<br />

respondent location and<br />

experience with Sub-<br />

Saharan African private<br />

equity impact views on<br />

the importance <strong>of</strong> fund<br />

jurisdictions, please see<br />

Spotlight: The Import <strong>of</strong><br />

Fund Domiciles in Fundraising and Allocation Decisions.<br />

When asked why—in general—the location <strong>of</strong> a fund<br />

domicile is important to their allocation / fundraising<br />

decisions, respondents relay that tax efficiency for<br />

distributions is the leading factor, which may explain the<br />

preference toward <strong>of</strong>fshore domiciles. Tax efficiency for<br />

distributions was ranked as an important consideration by<br />

47% <strong>of</strong> all respondents, followed by transparency (43%)<br />

and tax treaties with target markets (28%).<br />

However, LPs and GPs differ in their opinions on which<br />

factors are most important with regard to the location <strong>of</strong> a<br />

fund’s domicile. (SP views are generally in line with those<br />

20 |