You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2.3 African Financial Centres –<br />

Current and Future Outlook<br />

All five reports compare existing African financial centres and<br />

analyse their prospects for the future, but the comparisons<br />

focus on different dimensions:<br />

• Bella Research provides a detailed analysis <strong>of</strong> Mauritius<br />

and then compares it to other African financial centres<br />

according to legal and cultural aspects considered by<br />

fund managers;<br />

• Econsult Botswana compares African financial centres<br />

based on their regulatory environment (including<br />

political will to support financial centre development)<br />

and on how these centres fare in selected classifications<br />

or assessments <strong>of</strong> financial centres including the<br />

IMF’s listing <strong>of</strong> Offshore Financial Centres, Z/Yen’s<br />

Global Financial Centres Index, the OECD-Global<br />

Forum Assessment, and the Tax Justice Network’s<br />

assessment <strong>of</strong> financial secrecy;<br />

• Fuchs compares African financial centres according to<br />

the size <strong>of</strong> their private sector compared to GDP, the<br />

size <strong>of</strong> their private sector asset base and the volume<br />

<strong>of</strong> private equity investment they attract;<br />

• Lion’s Head compares African financial centres on the<br />

characteristics <strong>of</strong> a financial centre that are important<br />

to financial practitioners, including the strength <strong>of</strong><br />

capital markets, GDP, financial market institutions,<br />

infrastructure, quality <strong>of</strong> life, legal framework, stability<br />

and pr<strong>of</strong>essional services; and,<br />

• Z/Yen compares selected African financial centres and<br />

peer group financial centres based on data from the<br />

Global Financial Centres Index and according to the<br />

financial centre type and stability, their competitiveness,<br />

and their reputational advantage. Financial centre<br />

performance is also explored across sectors <strong>of</strong><br />

financial services (investment management, banking,<br />

insurance, government and regulatory, pr<strong>of</strong>essional<br />

services) and dimensions <strong>of</strong> competitiveness<br />

(business environment, financial sector development,<br />

infrastructure, human capital, reputation and general<br />

factors).<br />

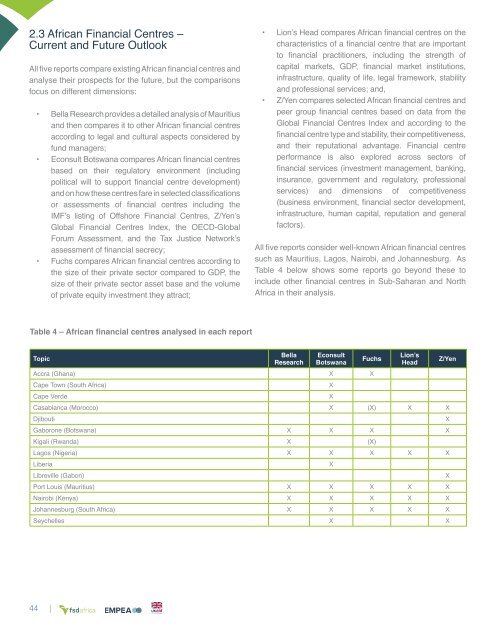

All five reports consider well-known African financial centres<br />

such as Mauritius, Lagos, Nairobi, and Johannesburg. As<br />

Table 4 below shows some reports go beyond these to<br />

include other financial centres in Sub-Saharan and North<br />

Africa in their analysis.<br />

Table 4 – African financial centres analysed in each report<br />

Topic<br />

Bella<br />

Research<br />

Econsult<br />

Botswana<br />

Accra (Ghana) X X<br />

Cape Town (South Africa)<br />

X<br />

Cape Verde<br />

X<br />

Casablanca (Morocco) X (X) X X<br />

Djibouti<br />

X<br />

Gaborone (Botswana) X X X X<br />

Kigali (Rwanda) X (X)<br />

Lagos (Nigeria) X X X X X<br />

Liberia<br />

X<br />

Libreville (Gabon)<br />

X<br />

Port Louis (Mauritius) X X X X X<br />

Nairobi (Kenya) X X X X X<br />

Johannesburg (South Africa) X X X X X<br />

Seychelles X X<br />

Fuchs<br />

Lion’s<br />

Head<br />

Z/Yen<br />

44 |