Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

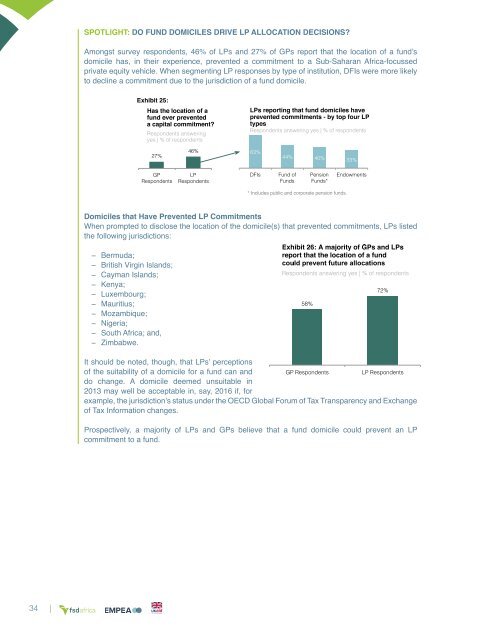

SPOTLIGHT: DO FUND DOMICILES DRIVE LP ALLOCATION DECISIONS?<br />

Amongst survey respondents, 46% <strong>of</strong> LPs and 27% <strong>of</strong> GPs report that the location <strong>of</strong> a fund’s<br />

domicile has, in their experience, prevented a commitment to a Sub-Saharan Africa-focussed<br />

private equity vehicle. When segmenting LP responses by type <strong>of</strong> institution, DFIs were more likely<br />

to decline a commitment due to the jurisdiction <strong>of</strong> a fund domicile.<br />

* Includes public and corporate pension funds.<br />

Domiciles that Have Prevented LP Commitments<br />

When prompted to disclose the location <strong>of</strong> the domicile(s) that prevented commitments, LPs listed<br />

the following jurisdictions:<br />

− Bermuda;<br />

− British Virgin Islands;<br />

− Cayman Islands;<br />

− Kenya;<br />

− Luxembourg;<br />

− Mauritius;<br />

− Mozambique;<br />

− Nigeria;<br />

− South Africa; and,<br />

− Zimbabwe.<br />

It should be noted, though, that LPs’ perceptions<br />

<strong>of</strong> the suitability <strong>of</strong> a domicile for a fund can and<br />

do change. A domicile deemed unsuitable in<br />

2013 may well be acceptable in, say, 2016 if, for<br />

example, the jurisdiction’s status under the OECD Global Forum <strong>of</strong> Tax Transparency and Exchange<br />

<strong>of</strong> Tax Information changes.<br />

Prospectively, a majority <strong>of</strong> LPs and GPs believe that a fund domicile could prevent an LP<br />

commitment to a fund.<br />

34 |