You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

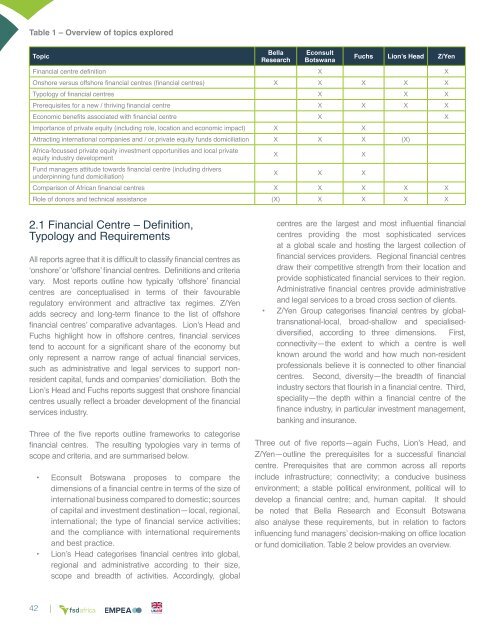

Table 1 – Overview <strong>of</strong> topics explored<br />

Topic<br />

Bella<br />

Research<br />

Econsult<br />

Botswana<br />

Fuchs Lion’s Head Z/Yen<br />

Financial centre definition X X<br />

Onshore versus <strong>of</strong>fshore financial centres (financial centres) X X X X X<br />

Typology <strong>of</strong> financial centres X X X<br />

Prerequisites for a new / thriving financial centre X X X X<br />

Economic benefits associated with financial centre X X<br />

Importance <strong>of</strong> private equity (including role, location and economic impact) X X<br />

Attracting international companies and / or private equity funds domiciliation X X X (X)<br />

Africa-focussed private equity investment opportunities and local private<br />

equity industry development<br />

X<br />

X<br />

Fund managers attitude towards financial centre (including drivers<br />

underpinning fund domiciliation)<br />

X X X<br />

Comparison <strong>of</strong> African financial centres X X X X X<br />

Role <strong>of</strong> donors and technical assistance (X) X X X X<br />

2.1 Financial Centre – Definition,<br />

Typology and Requirements<br />

All reports agree that it is difficult to classify financial centres as<br />

‘onshore’ or ‘<strong>of</strong>fshore’ financial centres. Definitions and criteria<br />

vary. Most reports outline how typically ‘<strong>of</strong>fshore’ financial<br />

centres are conceptualised in terms <strong>of</strong> their favourable<br />

regulatory environment and attractive tax regimes. Z/Yen<br />

adds secrecy and long-term finance to the list <strong>of</strong> <strong>of</strong>fshore<br />

financial centres’ comparative advantages. Lion’s Head and<br />

Fuchs highlight how in <strong>of</strong>fshore centres, financial services<br />

tend to account for a significant share <strong>of</strong> the economy but<br />

only represent a narrow range <strong>of</strong> actual financial services,<br />

such as administrative and legal services to support nonresident<br />

capital, funds and companies’ domiciliation. Both the<br />

Lion’s Head and Fuchs reports suggest that onshore financial<br />

centres usually reflect a broader development <strong>of</strong> the financial<br />

services industry.<br />

Three <strong>of</strong> the five reports outline frameworks to categorise<br />

financial centres. The resulting typologies vary in terms <strong>of</strong><br />

scope and criteria, and are summarised below.<br />

• Econsult Botswana proposes to compare the<br />

dimensions <strong>of</strong> a financial centre in terms <strong>of</strong> the size <strong>of</strong><br />

international business compared to domestic; sources<br />

<strong>of</strong> capital and investment destination—local, regional,<br />

international; the type <strong>of</strong> financial service activities;<br />

and the compliance with international requirements<br />

and best practice.<br />

• Lion’s Head categorises financial centres into global,<br />

regional and administrative according to their size,<br />

scope and breadth <strong>of</strong> activities. Accordingly, global<br />

centres are the largest and most influential financial<br />

centres providing the most sophisticated services<br />

at a global scale and hosting the largest collection <strong>of</strong><br />

financial services providers. Regional financial centres<br />

draw their competitive strength from their location and<br />

provide sophisticated financial services to their region.<br />

Administrative financial centres provide administrative<br />

and legal services to a broad cross section <strong>of</strong> clients.<br />

• Z/Yen Group categorises financial centres by globaltransnational-local,<br />

broad-shallow and specialiseddiversified,<br />

according to three dimensions. First,<br />

connectivity—the extent to which a centre is well<br />

known around the world and how much non-resident<br />

pr<strong>of</strong>essionals believe it is connected to other financial<br />

centres. Second, diversity—the breadth <strong>of</strong> financial<br />

industry sectors that flourish in a financial centre. Third,<br />

speciality—the depth within a financial centre <strong>of</strong> the<br />

finance industry, in particular investment management,<br />

banking and insurance.<br />

Three out <strong>of</strong> five reports—again Fuchs, Lion’s Head, and<br />

Z/Yen—outline the prerequisites for a successful financial<br />

centre. Prerequisites that are common across all reports<br />

include infrastructure; connectivity; a conducive business<br />

environment; a stable political environment, political will to<br />

develop a financial centre; and, human capital. It should<br />

be noted that Bella Research and Econsult Botswana<br />

also analyse these requirements, but in relation to factors<br />

influencing fund managers’ decision-making on <strong>of</strong>fice location<br />

or fund domiciliation. Table 2 below provides an overview.<br />

42 |