You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4.1. Where do Private Equity Fund<br />

Managers Domicile Their Funds?<br />

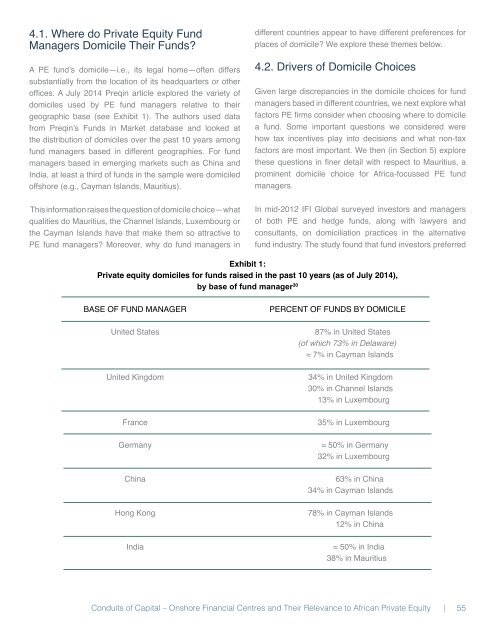

A PE fund’s domicile—i.e., its legal home—<strong>of</strong>ten differs<br />

substantially from the location <strong>of</strong> its headquarters or other<br />

<strong>of</strong>fices. A July 2014 Preqin article explored the variety <strong>of</strong><br />

domiciles used by PE fund managers relative to their<br />

geographic base (see Exhibit 1). The authors used data<br />

from Preqin’s Funds in Market database and looked at<br />

the distribution <strong>of</strong> domiciles over the past 10 years among<br />

fund managers based in different geographies. For fund<br />

managers based in emerging markets such as China and<br />

India, at least a third <strong>of</strong> funds in the sample were domiciled<br />

<strong>of</strong>fshore (e.g., Cayman Islands, Mauritius).<br />

different countries appear to have different preferences for<br />

places <strong>of</strong> domicile? We explore these themes below.<br />

4.2. Drivers <strong>of</strong> Domicile Choices<br />

Given large discrepancies in the domicile choices for fund<br />

managers based in different countries, we next explore what<br />

factors PE firms consider when choosing where to domicile<br />

a fund. Some important questions we considered were<br />

how tax incentives play into decisions and what non-tax<br />

factors are most important. We then (in Section 5) explore<br />

these questions in finer detail with respect to Mauritius, a<br />

prominent domicile choice for Africa-focussed PE fund<br />

managers.<br />

This information raises the question <strong>of</strong> domicile choice—what<br />

qualities do Mauritius, the Channel Islands, Luxembourg or<br />

the Cayman Islands have that make them so attractive to<br />

PE fund managers? Moreover, why do fund managers in<br />

In mid-2012 IFI Global surveyed investors and managers<br />

<strong>of</strong> both PE and hedge funds, along with lawyers and<br />

consultants, on domiciliation practices in the alternative<br />

fund industry. The study found that fund investors preferred<br />

Exhibit 1:<br />

Private equity domiciles for funds raised in the past 10 years (as <strong>of</strong> July 2014),<br />

by base <strong>of</strong> fund manager 30<br />

BASE OF FUND MANAGER<br />

PERCENT OF FUNDS BY DOMICILE<br />

United States<br />

87% in United States<br />

(<strong>of</strong> which 73% in Delaware)<br />

≈ 7% in Cayman Islands<br />

United Kingdom<br />

34% in United Kingdom<br />

30% in Channel Islands<br />

13% in Luxembourg<br />

France<br />

35% in Luxembourg<br />

Germany<br />

≈ 50% in Germany<br />

32% in Luxembourg<br />

China<br />

63% in China<br />

34% in Cayman Islands<br />

Hong Kong<br />

78% in Cayman Islands<br />

12% in China<br />

India<br />

≈ 50% in India<br />

38% in Mauritius<br />

<strong>Conduits</strong> <strong>of</strong> <strong>Capital</strong> – Onshore Financial Centres and Their Relevance to African Private Equity<br />

| 55