Annual REPORT

2015-Annual-Report-Financial-Statements

2015-Annual-Report-Financial-Statements

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ANNUAL <strong>REPORT</strong> AND FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 DECEMBER 2015<br />

NOTES TO THE FINANCIAL STATEMENTS (Continued)<br />

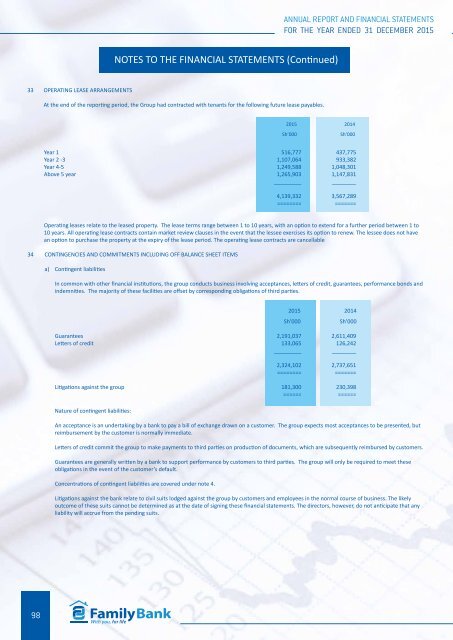

33 OPERATING LEASE ARRANGEMENTS<br />

At the end of the reporting period, the Group had contracted with tenants for the following future lease payables.<br />

2015 2014<br />

Sh’000<br />

Sh’000<br />

Year 1 516,777 437,775<br />

Year 2 -3 1,107,064 933,382<br />

Year 4-5 1,249,588 1,048,301<br />

Above 5 year 1,265,903 1,147,831<br />

_________<br />

________<br />

4,139,332 3,567,289<br />

======== =======<br />

Operating leases relate to the leased property. The lease terms range between 1 to 10 years, with an option to extend for a further period between 1 to<br />

10 years. All operating lease contracts contain market review clauses in the event that the lessee exercises its option to renew. The lessee does not have<br />

an option to purchase the property at the expiry of the lease period. The operating lease contracts are cancellable<br />

34 CONTINGENCIES AND COMMITMENTS INCLUDING OFF BALANCE SHEET ITEMS<br />

a) Contingent liabilities<br />

In common with other financial institutions, the group conducts business involving acceptances, letters of credit, guarantees, performance bonds and<br />

indemnities. The majority of these facilities are offset by corresponding obligations of third parties.<br />

2015 2014<br />

Sh’000<br />

Sh’000<br />

Guarantees 2,191,037 2,611,409<br />

Letters of credit 133,065 126,242<br />

_________<br />

________<br />

2,324,102 2,737,651<br />

======== =======<br />

Litigations against the group 181,300 230,398<br />

====== ======<br />

Nature of contingent liabilities:<br />

An acceptance is an undertaking by a bank to pay a bill of exchange drawn on a customer. The group expects most acceptances to be presented, but<br />

reimbursement by the customer is normally immediate.<br />

Letters of credit commit the group to make payments to third parties on production of documents, which are subsequently reimbursed by customers.<br />

Guarantees are generally written by a bank to support performance by customers to third parties. The group will only be required to meet these<br />

obligations in the event of the customer’s default.<br />

Concentrations of contingent liabilities are covered under note 4.<br />

Litigations against the bank relate to civil suits lodged against the group by customers and employees in the normal course of business. The likely<br />

outcome of these suits cannot be determined as at the date of signing these financial statements. The directors, however, do not anticipate that any<br />

liability will accrue from the pending suits.<br />

98