Annual REPORT

2015-Annual-Report-Financial-Statements

2015-Annual-Report-Financial-Statements

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ANNUAL <strong>REPORT</strong> AND FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 DECEMBER 2015<br />

NOTES TO THE FINANCIAL STATEMENTS (Continued)<br />

4 FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (Continued)<br />

(c)<br />

Market risks<br />

Market risk is the risk that fair value or future cash flows of a financial instrument will fluctuate because of changes in<br />

market prices. Market risk arise from open positions in interest rates, currency and equity products, all of which are<br />

exposed to general and specific market movements and changes in the level of volatility of market rates or prices such<br />

as interest rates, equity prices, foreign exchange rates and credit spreads. The objective of market risk management is<br />

to manage and control market risk exposures within acceptable parameters, while optimising the return on risk.<br />

The group separates exposures to market risk into either trading or non-trading portfolios. Trading portfolios include<br />

those positions arising from market-making transactions where the group acts as principal with clients or with the<br />

market. Non-trading portfolios mainly arise from the interest rate management of the entity’s retail and commercial<br />

banking assets and liabilities.<br />

Management of market risks<br />

Overall responsibility of managing market risk rests with the Asset and Liability Committee. The Treasury department<br />

is responsible for the development of detailed risk management policies (subject to review and approval by ALCO) and<br />

for the day-to-day review of their implementation. The board of directors sets limits on the level of mismatch of interest<br />

rate repricing that may be undertaken which is monitored daily.<br />

i) Interest rate risk<br />

The principal risk to which non-trading portfolios are exposed is the risk of loss from fluctuations in the future cash<br />

flows or fair values of financial instruments because of a change in market interest rates. The ALCO is the monitoring<br />

body for compliance with these limits and is assisted by Treasury Department in its day-to-day monitoring activities.<br />

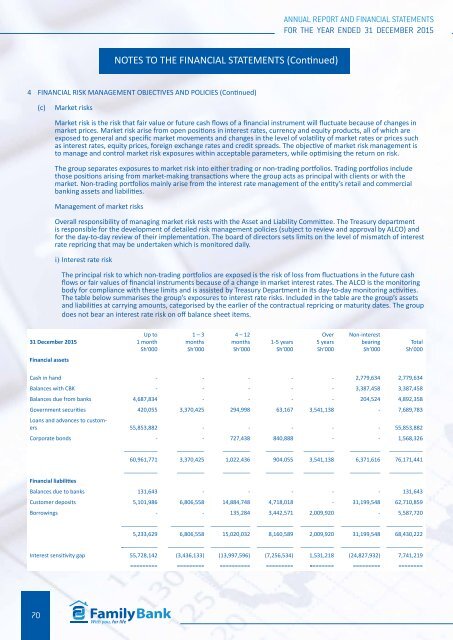

The table below summarises the group’s exposures to interest rate risks. Included in the table are the group’s assets<br />

and liabilities at carrying amounts, categorised by the earlier of the contractual repricing or maturity dates. The group<br />

does not bear an interest rate risk on off balance sheet items.<br />

31 December 2015<br />

Up to<br />

1 month<br />

Sh’000<br />

1 – 3<br />

months<br />

Sh’000<br />

4 – 12<br />

months<br />

Sh’000<br />

1-5 years<br />

Sh’000<br />

Over<br />

5 years<br />

Sh’000<br />

Non-interest<br />

bearing<br />

Sh’000<br />

Total<br />

Sh’000<br />

Financial assets<br />

Cash in hand - - - - - 2,779,634 2,779,634<br />

Balances with CBK - - - - - 3,387,458 3,387,458<br />

Balances due from banks 4,687,834 - - - - 204,524 4,892,358<br />

Government securities 420,055 3,370,425 294,998 63,167 3,541,138 - 7,689,783<br />

Loans and advances to customers<br />

55,853,882 - - - - - 55,853,882<br />

Corporate bonds - - 727,438 840,888 - - 1,568,326<br />

___________ _________ _________ _________ __________ __________ ___________<br />

60,961,771 3,370,425 1,022,436 904,055 3,541,138 6,371,616 76,171,441<br />

___________ _________ _________ _________ __________ __________ ___________<br />

Financial liabilities<br />

Balances due to banks 131,643 - - - - - 131,643<br />

Customer deposits 5,101,986 6,806,558 14,884,748 4,718,018 - 31,199,548 62,710,859<br />

Borrowings - - 135,284 3,442,571 2,009,920 - 5,587,720<br />

____________ ___________ _____________ ____________ ___________ _____________ ____________<br />

5,233,629 6,806,558 15,020,032 8,160,589 2,009,920 31,199,548 68,430,222<br />

____________ ____________ _____________ ____________ ___________ _____________ ____________<br />

Interest sensitivity gap 55,728,142 (3,436,133) (13,997,596) (7,256,534) 1,531,218 (24,827,932) 7,741,219<br />

========= ========= ========== ========= ======== ========= ========<br />

70