Annual REPORT

2015-Annual-Report-Financial-Statements

2015-Annual-Report-Financial-Statements

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ANNUAL <strong>REPORT</strong> AND FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 DECEMBER 2015<br />

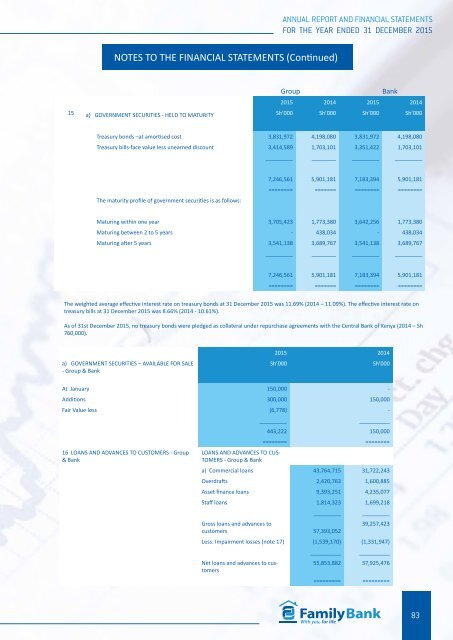

NOTES TO THE FINANCIAL STATEMENTS (Continued)<br />

Group<br />

Bank<br />

2015 2014 2015 2014<br />

15 a) GOVERNMENT SECURITIES - HELD TO MATURITY Sh’000 Sh’000 Sh’000 Sh’000<br />

Treasury bonds –at amortised cost 3,831,972 4,198,080 3,831,972 4,198,080<br />

Treasury bills-face value less unearned discount 3,414,589 1,703,101 3,351,422 1,703,101<br />

_________ ________ _________ _________<br />

The maturity profile of government securities is as follows:<br />

7,246,561 5,901,181 7,183,394 5,901,181<br />

======== ======= ======== ========<br />

Maturing within one year 3,705,423 1,773,380 3,642,256 1,773,380<br />

Maturing between 2 to 5 years - 438,034 - 438,034<br />

Maturing after 5 years 3,541,138 3,689,767 3,541,138 3,689,767<br />

_________ ________ _________ _________<br />

7,246,561 5,901,181 7,183,394 5,901,181<br />

======== ======= ======== ========<br />

The weighted average effective interest rate on treasury bonds at 31 December 2015 was 11.69% (2014 – 11.09%). The effective interest rate on<br />

treasury bills at 31 December 2015 was 8.66% (2014 - 10.61%).<br />

As of 31st December 2015, no treasury bonds were pledged as collateral under repurchase agreements with the Central Bank of Kenya (2014 – Sh<br />

760,000).<br />

a) GOVERNMENT SECURITIES – AVAILABLE FOR SALE<br />

- Group & Bank<br />

2015 2014<br />

Sh’000<br />

Sh’000<br />

At January 150,000 -<br />

Additions 300,000 150,000<br />

Fair Value loss (6,778) -<br />

_________<br />

__________<br />

443,222 150,000<br />

======== ========<br />

16 LOANS AND ADVANCES TO CUSTOMERS - Group<br />

& Bank<br />

LOANS AND ADVANCES TO CUS-<br />

TOMERS - Group & Bank<br />

a) Commercial loans 43,764,715 31,722,243<br />

Overdrafts 2,420,763 1,600,885<br />

Asset finance loans 9,393,251 4,235,077<br />

Staff loans 1,814,323 1,699,218<br />

_________ _________<br />

Gross loans and advances to<br />

39,257,423<br />

customers 57,393,052<br />

Less: Impairment losses (note 17) (1,539,170) (1,331,947)<br />

__________ __________<br />

Net loans and advances to customers<br />

55,853,882 37,925,476<br />

========= =========<br />

83