Annual REPORT

2015-Annual-Report-Financial-Statements

2015-Annual-Report-Financial-Statements

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS (Continued)<br />

ANNUAL <strong>REPORT</strong> AND FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 DECEMBER 2015<br />

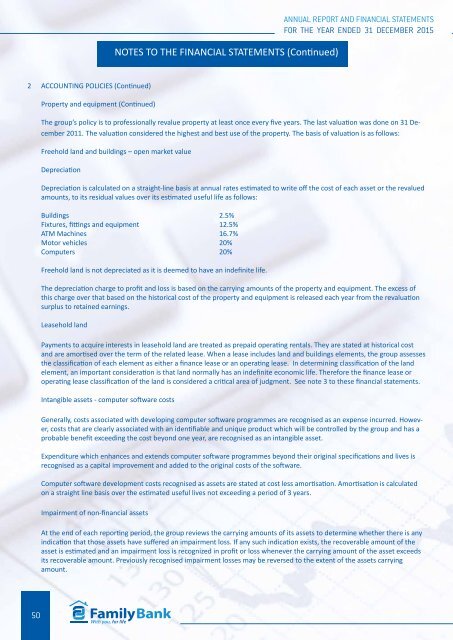

2 ACCOUNTING POLICIES (Continued)<br />

Property and equipment (Continued)<br />

The group’s policy is to professionally revalue property at least once every five years. The last valuation was done on 31 December<br />

2011. The valuation considered the highest and best use of the property. The basis of valuation is as follows:<br />

Freehold land and buildings – open market value<br />

Depreciation<br />

Depreciation is calculated on a straight-line basis at annual rates estimated to write off the cost of each asset or the revalued<br />

amounts, to its residual values over its estimated useful life as follows:<br />

Buildings 2.5%<br />

Fixtures, fittings and equipment 12.5%<br />

ATM Machines 16.7%<br />

Motor vehicles 20%<br />

Computers 20%<br />

Freehold land is not depreciated as it is deemed to have an indefinite life.<br />

The depreciation charge to profit and loss is based on the carrying amounts of the property and equipment. The excess of<br />

this charge over that based on the historical cost of the property and equipment is released each year from the revaluation<br />

surplus to retained earnings.<br />

Leasehold land<br />

Payments to acquire interests in leasehold land are treated as prepaid operating rentals. They are stated at historical cost<br />

and are amortised over the term of the related lease. When a lease includes land and buildings elements, the group assesses<br />

the classification of each element as either a finance lease or an operating lease. In determining classification of the land<br />

element, an important consideration is that land normally has an indefinite economic life. Therefore the finance lease or<br />

operating lease classification of the land is considered a critical area of judgment. See note 3 to these financial statements.<br />

Intangible assets - computer software costs<br />

Generally, costs associated with developing computer software programmes are recognised as an expense incurred. However,<br />

costs that are clearly associated with an identifiable and unique product which will be controlled by the group and has a<br />

probable benefit exceeding the cost beyond one year, are recognised as an intangible asset.<br />

Expenditure which enhances and extends computer software programmes beyond their original specifications and lives is<br />

recognised as a capital improvement and added to the original costs of the software.<br />

Computer software development costs recognised as assets are stated at cost less amortisation. Amortisation is calculated<br />

on a straight line basis over the estimated useful lives not exceeding a period of 3 years.<br />

Impairment of non-financial assets<br />

At the end of each reporting period, the group reviews the carrying amounts of its assets to determine whether there is any<br />

indication that those assets have suffered an impairment loss. If any such indication exists, the recoverable amount of the<br />

asset is estimated and an impairment loss is recognized in profit or loss whenever the carrying amount of the asset exceeds<br />

its recoverable amount. Previously recognised impairment losses may be reversed to the extent of the assets carrying<br />

amount.<br />

50