Annual REPORT

2015-Annual-Report-Financial-Statements

2015-Annual-Report-Financial-Statements

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ANNUAL <strong>REPORT</strong> AND FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 DECEMBER 2015<br />

NOTES TO THE FINANCIAL STATEMENTS (Continued)<br />

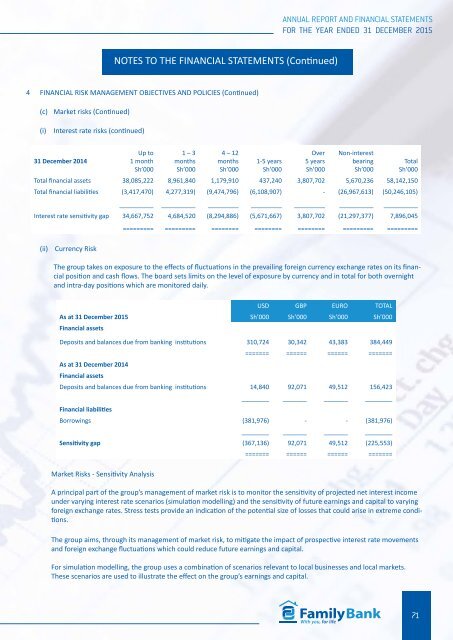

4 FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (Continued)<br />

(c) Market risks (Continued)<br />

(i)<br />

Interest rate risks (continued)<br />

31 December 2014<br />

Up to<br />

1 month<br />

Sh’000<br />

1 – 3<br />

months<br />

Sh’000<br />

4 – 12<br />

months<br />

Sh’000<br />

1-5 years<br />

Sh’000<br />

Over<br />

5 years<br />

Sh’000<br />

Non-interest<br />

bearing<br />

Sh’000<br />

Total<br />

Sh’000<br />

Total financial assets 38,085,222 8,961,840 1,179,910 437,240 3,807,702 5,670,236 58,142,150<br />

Total financial liabilities (3,417,470) 4,277,319) (9,474,796) (6,108,907) - (26,967,613) (50,246,105)<br />

__________ __________ _________ _________ _________ __________ __________<br />

Interest rate sensitivity gap 34,667,752 4,684,520 (8,294,886) (5,671,667) 3,807,702 (21,297,377) 7,896,045<br />

========= ========= ======== ======== ======== ========= =========<br />

(ii)<br />

Currency Risk<br />

The group takes on exposure to the effects of fluctuations in the prevailing foreign currency exchange rates on its financial<br />

position and cash flows. The board sets limits on the level of exposure by currency and in total for both overnight<br />

and intra-day positions which are monitored daily.<br />

USD GBP EURO TOTAL<br />

As at 31 December 2015 Sh’000 Sh’000 Sh’000 Sh’000<br />

Financial assets<br />

Deposits and balances due from banking institutions 310,724 30,342 43,383 384,449<br />

======= ====== ====== =======<br />

As at 31 December 2014<br />

Financial assets<br />

Deposits and balances due from banking institutions 14,840 92,071 49,512 156,423<br />

________ _______ _______ ________<br />

Financial liabilities<br />

Borrowings (381,976) - - (381,976)<br />

________ _______ _______ ________<br />

Sensitivity gap (367,136) 92,071 49,512 (225,553)<br />

======= ====== ====== =======<br />

Market Risks - Sensitivity Analysis<br />

A principal part of the group’s management of market risk is to monitor the sensitivity of projected net interest income<br />

under varying interest rate scenarios (simulation modelling) and the sensitivity of future earnings and capital to varying<br />

foreign exchange rates. Stress tests provide an indication of the potential size of losses that could arise in extreme conditions.<br />

The group aims, through its management of market risk, to mitigate the impact of prospective interest rate movements<br />

and foreign exchange fluctuations which could reduce future earnings and capital.<br />

For simulation modelling, the group uses a combination of scenarios relevant to local businesses and local markets.<br />

These scenarios are used to illustrate the effect on the group’s earnings and capital.<br />

71