Annual REPORT

2015-Annual-Report-Financial-Statements

2015-Annual-Report-Financial-Statements

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ANNUAL <strong>REPORT</strong> AND FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 DECEMBER 2015<br />

NOTES TO THE FINANCIAL STATEMENTS (Continued)<br />

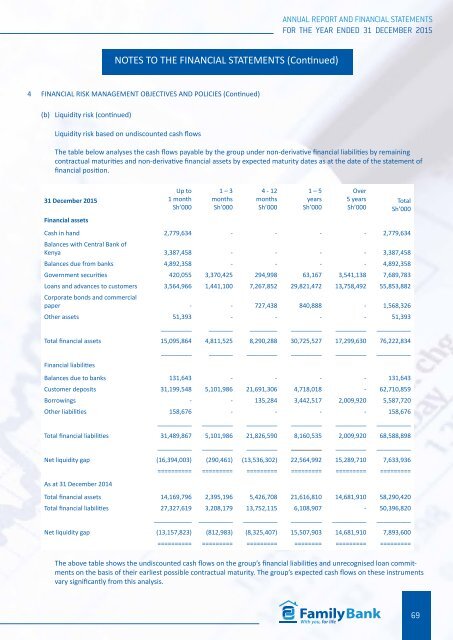

4 FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (Continued)<br />

(b) Liquidity risk (continued)<br />

Liquidity risk based on undiscounted cash flows<br />

The table below analyses the cash flows payable by the group under non-derivative financial liabilities by remaining<br />

contractual maturities and non-derivative financial assets by expected maturity dates as at the date of the statement of<br />

financial position.<br />

31 December 2015<br />

Financial assets<br />

Up to<br />

1 month<br />

Sh’000<br />

1 – 3<br />

months<br />

Sh’000<br />

4 - 12<br />

months<br />

Sh’000<br />

1 – 5<br />

years<br />

Sh’000<br />

Over<br />

5 years<br />

Sh’000<br />

Total<br />

Sh’000<br />

Cash in hand 2,779,634 - - - - 2,779,634<br />

Balances with Central Bank of<br />

Kenya 3,387,458 - - - - 3,387,458<br />

Balances due from banks 4,892,358 - - - - 4,892,358<br />

Government securities 420,055 3,370,425 294,998 63,167 3,541,138 7,689,783<br />

Loans and advances to customers 3,564,966 1,441,100 7,267,852 29,821,472 13,758,492 55,853,882<br />

Corporate bonds and commercial<br />

paper - - 727,438 840,888 - 1,568,326<br />

Other assets 51,393 - - - - 51,393<br />

_________ _______ ________ _________ _________ __________<br />

Total financial assets 15,095,864 4,811,525 8,290,288 30,725,527 17,299,630 76,222,834<br />

_________ _______ _________ _________ _________ __________<br />

Financial liabilities<br />

Balances due to banks 131,643 - - - - 131,643<br />

Customer deposits 31,199,548 5,101,986 21,691,306 4,718,018 - 62,710,859<br />

Borrowings - - 135,284 3,442,517 2,009,920 5,587,720<br />

Other liabilities 158,676 - - - - 158,676<br />

__________ _________ _________ _________ _________ __________<br />

Total financial liabilities 31,489,867 5,101,986 21,826,590 8,160,535 2,009,920 68,588,898<br />

__________ _________ _________ _________ _________ __________<br />

Net liquidity gap (16,394,003) (290,461) (13,536,302) 22,564,992 15,289,710 7,633,936<br />

========== ========= ========= ========= ========= =========<br />

As at 31 December 2014<br />

Total financial assets 14,169,796 2,395,196 5,426,708 21,616,810 14,681,910 58,290,420<br />

Total financial liabilities 27,327,619 3,208,179 13,752,115 6,108,907 - 50,396,820<br />

___________ __________ __________ _________ __________ __________<br />

Net liquidity gap (13,157,823) (812,983) (8,325,407) 15,507,903 14,681,910 7,893,600<br />

========== ========= ========= ======== ========= =========<br />

The above table shows the undiscounted cash flows on the group’s financial liabilities and unrecognised loan commitments<br />

on the basis of their earliest possible contractual maturity. The group’s expected cash flows on these instruments<br />

vary significantly from this analysis.<br />

69