Annual REPORT

2015-Annual-Report-Financial-Statements

2015-Annual-Report-Financial-Statements

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ANNUAL <strong>REPORT</strong> AND FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 DECEMBER 2015<br />

NOTES TO THE FINANCIAL STATEMENTS (Continued)<br />

2015 2014<br />

Sh’000<br />

Sh’000<br />

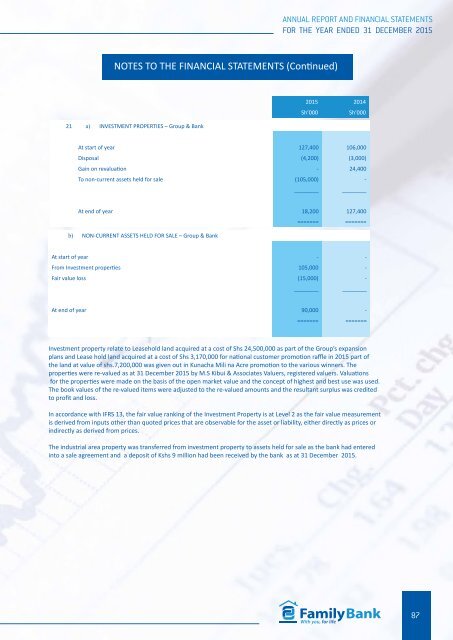

21 a) INVESTMENT PROPERTIES – Group & Bank<br />

At start of year 127,400 106,000<br />

Disposal (4,200) (3,000)<br />

Gain on revaluation - 24,400<br />

To non-current assets held for sale (105,000) -<br />

________ ________<br />

At end of year 18,200 127,400<br />

b) NON-CURRENT ASSETS HELD FOR SALE – Group & Bank<br />

======= =======<br />

At start of year - -<br />

From Investment properties 105,000 -<br />

Fair value loss (15,000) -<br />

________ ________<br />

At end of year 90,000 -<br />

======= =======<br />

Investment property relate to Leasehold land acquired at a cost of Shs 24,500,000 as part of the Group’s expansion<br />

plans and Lease hold land acquired at a cost of Shs 3,170,000 for national customer promotion raffle in 2015 part of<br />

the land at value of shs.7,200,000 was given out in Kunacha Mili na Acre promotion to the various winners. The<br />

properties were re-valued as at 31 December 2015 by M.S Kibui & Associates Valuers, registered valuers. Valuations<br />

for the properties were made on the basis of the open market value and the concept of highest and best use was used.<br />

The book values of the re-valued items were adjusted to the re-valued amounts and the resultant surplus was credited<br />

to profit and loss.<br />

In accordance with IFRS 13, the fair value ranking of the Investment Property is at Level 2 as the fair value measurement<br />

is derived from inputs other than quoted prices that are observable for the asset or liability, either directly as prices or<br />

indirectly as derived from prices.<br />

The industrial area property was transferred from investment property to assets held for sale as the bank had entered<br />

into a sale agreement and a deposit of Kshs 9 million had been received by the bank as at 31 December 2015.<br />

87