Annual REPORT

2015-Annual-Report-Financial-Statements

2015-Annual-Report-Financial-Statements

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ANNUAL <strong>REPORT</strong> AND FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 DECEMBER 2015<br />

NOTES TO THE FINANCIAL STATEMENTS (Continued)<br />

4 FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (Continued)<br />

(a) Credit risk (Continued)<br />

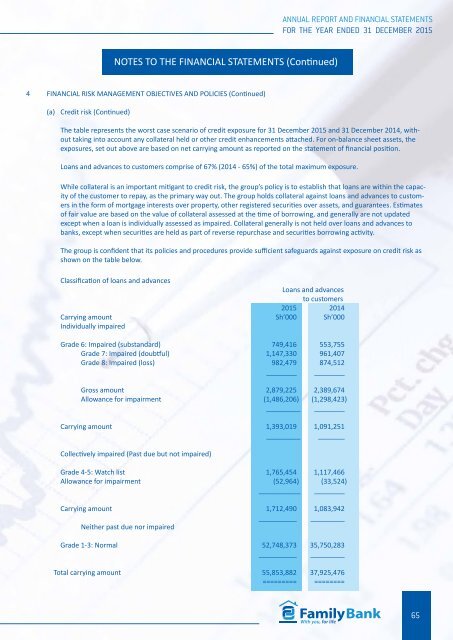

The table represents the worst case scenario of credit exposure for 31 December 2015 and 31 December 2014, without<br />

taking into account any collateral held or other credit enhancements attached. For on-balance sheet assets, the<br />

exposures, set out above are based on net carrying amount as reported on the statement of financial position.<br />

Loans and advances to customers comprise of 67% (2014 - 65%) of the total maximum exposure.<br />

While collateral is an important mitigant to credit risk, the group’s policy is to establish that loans are within the capacity<br />

of the customer to repay, as the primary way out. The group holds collateral against loans and advances to customers<br />

in the form of mortgage interests over property, other registered securities over assets, and guarantees. Estimates<br />

of fair value are based on the value of collateral assessed at the time of borrowing, and generally are not updated<br />

except when a loan is individually assessed as impaired. Collateral generally is not held over loans and advances to<br />

banks, except when securities are held as part of reverse repurchase and securities borrowing activity.<br />

The group is confident that its policies and procedures provide sufficient safeguards against exposure on credit risk as<br />

shown on the table below.<br />

Classification of loans and advances<br />

Loans and advances<br />

to customers<br />

2015 2014<br />

Carrying amount Sh’000 Sh’000<br />

Individually impaired<br />

Grade 6: Impaired (substandard) 749,416 553,755<br />

Grade 7: Impaired (doubtful) 1,147,330 961,407<br />

Grade 8: Impaired (loss) 982,479 874,512<br />

________ ________<br />

Gross amount 2,879,225 2,389,674<br />

Allowance for impairment (1,486,206) (1,298,423)<br />

_________<br />

________<br />

Carrying amount 1,393,019 1,091,251<br />

_________<br />

_______<br />

Collectively impaired (Past due but not impaired)<br />

Grade 4-5: Watch list 1,765,454 1,117,466<br />

Allowance for impairment (52,964) (33,524)<br />

___________<br />

________<br />

Carrying amount 1,712,490 1,083,942<br />

__________ _________<br />

Neither past due nor impaired<br />

Grade 1-3: Normal 52,748,373 35,750,283<br />

__________ _________<br />

Total carrying amount 55,853,882 37,925,476<br />

========= ========<br />

65