Annual REPORT

2015-Annual-Report-Financial-Statements

2015-Annual-Report-Financial-Statements

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

26 BORROWINGS – Group & Bank (Continued)<br />

Facilities:<br />

NOTES TO THE FINANCIAL STATEMENTS (Continued)<br />

ANNUAL <strong>REPORT</strong> AND FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 DECEMBER 2015<br />

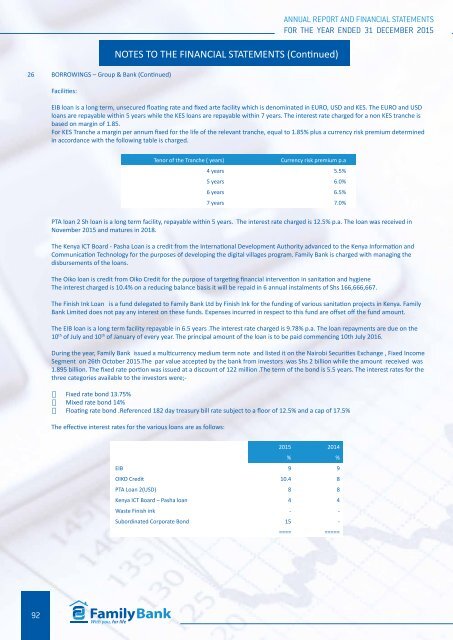

EIB loan is a long term, unsecured floating rate and fixed arte facility which is denominated in EURO, USD and KES. The EURO and USD<br />

loans are repayable within 5 years while the KES loans are repayable within 7 years. The interest rate charged for a non KES tranche is<br />

based on margin of 1.85.<br />

For KES Tranche a margin per annum fixed for the life of the relevant tranche, equal to 1.85% plus a currency risk premium determined<br />

in accordance with the following table is charged.<br />

Tenor of the Tranche ( years)<br />

Currency risk premium p.a<br />

4 years 5.5%<br />

5 years 6.0%<br />

6 years 6.5%<br />

7 years 7.0%<br />

PTA loan 2 Sh loan is a long term facility, repayable within 5 years. The interest rate charged is 12.5% p.a. The loan was received in<br />

November 2015 and matures in 2018.<br />

The Kenya ICT Board - Pasha Loan is a credit from the International Development Authority advanced to the Kenya Information and<br />

Communication Technology for the purposes of developing the digital villages program. Family Bank is charged with managing the<br />

disbursements of the loans.<br />

The Oiko loan is credit from Oiko Credit for the purpose of targeting financial intervention in sanitation and hygiene<br />

The interest charged is 10.4% on a reducing balance basis it will be repaid in 6 annual instalments of Shs 166,666,667.<br />

The Finish Ink Loan is a fund delegated to Family Bank Ltd by Finish Ink for the funding of various sanitation projects in Kenya. Family<br />

Bank Limited does not pay any interest on these funds. Expenses incurred in respect to this fund are offset off the fund amount.<br />

The EIB loan is a long term facility repayable in 6.5 years .The interest rate charged is 9.78% p.a. The loan repayments are due on the<br />

10 th of July and 10 th of January of every year. The principal amount of the loan is to be paid commencing 10th July 2016.<br />

During the year, Family Bank issued a multicurrency medium term note and listed it on the Nairobi Securities Exchange , Fixed Income<br />

Segment on 26th October 2015.The par value accepted by the bank from investors was Shs 2 billion while the amount received was<br />

1.895 billion. The fixed rate portion was issued at a discount of 122 million .The term of the bond is 5.5 years. The interest rates for the<br />

three categories available to the investors were;-<br />

· Fixed rate bond 13.75%<br />

· Mixed rate bond 14%<br />

· Floating rate bond .Referenced 182 day treasury bill rate subject to a floor of 12.5% and a cap of 17.5%<br />

The effective interest rates for the various loans are as follows:<br />

2015 2014<br />

% %<br />

EIB 9 9<br />

OIKO Credit 10.4 8<br />

PTA Loan 2(USD) 8 8<br />

Kenya ICT Board – Pasha loan 4 4<br />

Waste Finish ink - -<br />

Subordinated Corporate Bond 15 -<br />

==== =====<br />

92