Annual REPORT

2015-Annual-Report-Financial-Statements

2015-Annual-Report-Financial-Statements

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CHAIRMAN’S STATEMENT (Continued)<br />

ANNUAL <strong>REPORT</strong> AND FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 DECEMBER 2015<br />

Outlook for 2016<br />

The Bank shall continue to rely on the support and goodwill of all our stakeholders and specifically our shareholders and customers<br />

to drive its growth strategy. We are collectively determined to exceed our stretching targets for 2016 with renewed determination,<br />

resilience and commitment of our Board, management and staff.<br />

Our commitment to focus on positively transforming peoples’ lives through the provision of quality financial services and efficient<br />

customer service remains steadfast. We will leverage on Information and Communications Technology and innovating new products<br />

and services to support the growing financial needs of our customers. The bank will continue to invest substantial amount in<br />

capital to upgrade its IT infrastructure and architecture and also continue expanding its branch and virtual networks.<br />

Funding<br />

As a bank we will continue to ensure that we support the growth momentum and meet the statutory ratios with the Board<br />

continuing to explore various funding options both in equity and debt financing.<br />

In mid-2015 we signed our second tranche of Ksh 4 billion debt financing agreement with the European Investment Bank (EIB)<br />

having successfully exhausted the first facility of Ksh2Billion in 2014. We confirm that the EIB funds have now been received in<br />

our accounts to support our growth especially in the SME sector. We also received another Ksh1Billion from Oiko Credit and are<br />

currently in advanced discussions with other international partners like Africa Development Bank (AfDB) for more funding to<br />

support our growth strategy.<br />

The Bank remains committed to its five year capital plan as per the latest CBK Guidelines. As stated earlier, we continue to explore<br />

various equity and Debt Financing options to maintain our fast paced but sustainable growth. On the Equity side, we once more<br />

call on our shareholders to approve and participate in a Rights issue to support this noble agenda.<br />

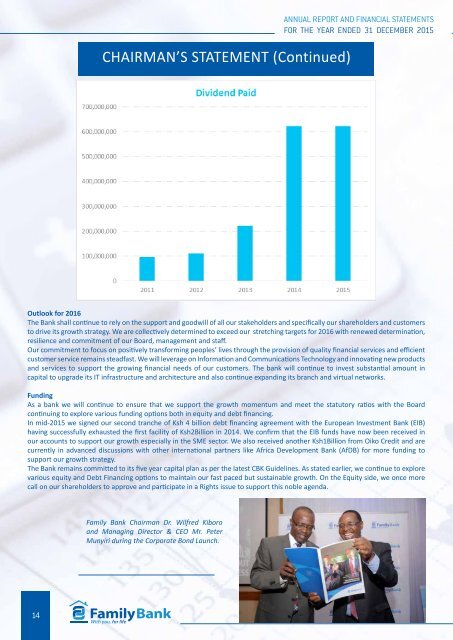

Family Bank Chairman Dr. Wilfred Kiboro<br />

and Managing Director & CEO Mr. Peter<br />

Munyiri during the Corporate Bond Launch.<br />

14