Annual REPORT

2015-Annual-Report-Financial-Statements

2015-Annual-Report-Financial-Statements

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ANNUAL <strong>REPORT</strong> AND FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 DECEMBER 2015<br />

NOTES TO THE FINANCIAL STATEMENTS (Continued)<br />

5 CAPITAL MANAGEMENT (Continued)<br />

Regulatory capital (Continued)<br />

The Central Bank of Kenya requires each bank to:<br />

a) Hold the minimum level of regulatory capital of Shs 1 billion.<br />

b) Maintain a ratio of total regulatory capital; to risk weighted assets plus risk weighted off balance assets at above<br />

the required minimum of 10.5%;<br />

c) Maintain a core capital of not less than 8 % of total deposit liabilities<br />

d) Maintain total capital of not less than 14.5% of risk weighted assets plus risk weighted off balance sheet items.<br />

It is expected that with the introduction additional capital requirements which require the bank to have higher ratios<br />

of total capital to risk weighted assets the capital requirements are going to be more stringent with expectation of<br />

adoption of the additional capital requirements for market and operational risks. The bank has until December 2015 to<br />

comply with the new capital requirements.<br />

The Insurance Regulatory Authority requires Family Insurance Agency to maintain a minimum level of regulatory capital<br />

of Shs 1,000,000. The agency has complied with the capital requirement.<br />

The group’s policy is to maintain a strong capital base so as to maintain investor, creditor and market confidence and to<br />

sustain future development of the business.<br />

The impact of the level of capital on shareholders’ return is also recognised and the group recognises the need to maintain<br />

a balance between the higher returns that might be possible with greater gearing and the advantages and security<br />

afforded by a sound capital position.<br />

The group and its individually regulated operations have complied with all externally imposed capital requirements<br />

throughout the year.<br />

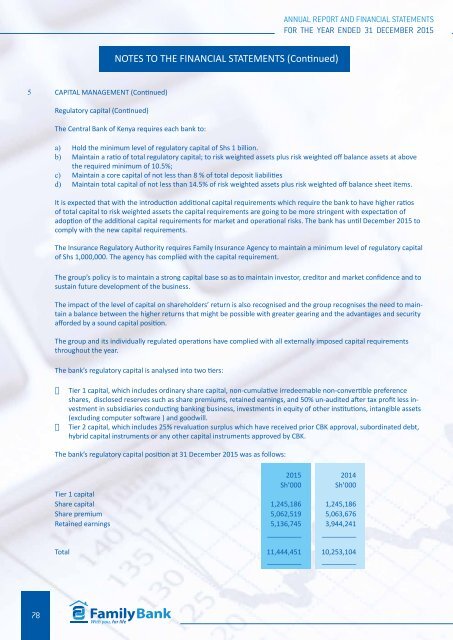

The bank’s regulatory capital is analysed into two tiers:<br />

· Tier 1 capital, which includes ordinary share capital, non-cumulative irredeemable non-convertible preference<br />

shares, disclosed reserves such as share premiums, retained earnings, and 50% un-audited after tax profit less investment<br />

in subsidiaries conducting banking business, investments in equity of other institutions, intangible assets<br />

(excluding computer software ) and goodwill.<br />

· Tier 2 capital, which includes 25% revaluation surplus which have received prior CBK approval, subordinated debt,<br />

hybrid capital instruments or any other capital instruments approved by CBK.<br />

The bank’s regulatory capital position at 31 December 2015 was as follows:<br />

2015 2014<br />

Sh’000 Sh’000<br />

Tier 1 capital<br />

Share capital 1,245,186 1,245,186<br />

Share premium 5,062,519 5,063,676<br />

Retained earnings 5,136,745 3,944,241<br />

_________ _________<br />

Total 11,444,451 10,253,104<br />

_________ _________<br />

78