Annual REPORT

2015-Annual-Report-Financial-Statements

2015-Annual-Report-Financial-Statements

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ANNUAL <strong>REPORT</strong> AND FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 DECEMBER 2015<br />

NOTES TO THE FINANCIAL STATEMENTS (Continued)<br />

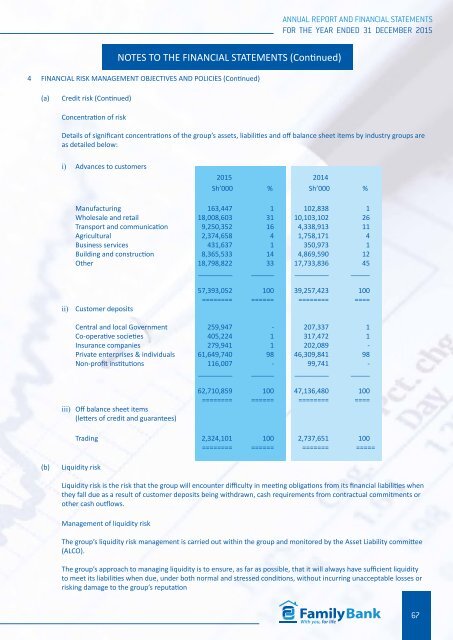

4 FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (Continued)<br />

(a)<br />

Credit risk (Continued)<br />

Concentration of risk<br />

Details of significant concentrations of the group’s assets, liabilities and off balance sheet items by industry groups are<br />

as detailed below:<br />

i) Advances to customers<br />

2015 2014<br />

Sh’000 % Sh’000 %<br />

Manufacturing 163,447 1 102,838 1<br />

Wholesale and retail 18,008,603 31 10,103,102 26<br />

Transport and communication 9,250,352 16 4,338,913 11<br />

Agricultural 2,374,658 4 1,758,171 4<br />

Business services 431,637 1 350,973 1<br />

Building and construction 8,365,533 14 4,869,590 12<br />

Other 18,798,822 33 17,733,836 45<br />

_________ ______ _________ _____<br />

ii) Customer deposits<br />

57,393,052 100 39,257,423 100<br />

======== ====== ======== ====<br />

Central and local Government 259,947 - 207,337 1<br />

Co-operative societies 405,224 1 317,472 1<br />

Insurance companies 279,941 1 202,089 -<br />

Private enterprises & individuals 61,649,740 98 46,309,841 98<br />

Non-profit institutions 116,007 - 99,741 -<br />

_________ ______ _________ _____<br />

iii) Off balance sheet items<br />

(letters of credit and guarantees)<br />

62,710,859 100 47,136,480 100<br />

======== ====== ======== ====<br />

Trading 2,324,101 100 2,737,651 100<br />

======== ====== ======= =====<br />

(b)<br />

Liquidity risk<br />

Liquidity risk is the risk that the group will encounter difficulty in meeting obligations from its financial liabilities when<br />

they fall due as a result of customer deposits being withdrawn, cash requirements from contractual commitments or<br />

other cash outflows.<br />

Management of liquidity risk<br />

The group’s liquidity risk management is carried out within the group and monitored by the Asset Liability committee<br />

(ALCO).<br />

The group’s approach to managing liquidity is to ensure, as far as possible, that it will always have sufficient liquidity<br />

to meet its liabilities when due, under both normal and stressed conditions, without incurring unacceptable losses or<br />

risking damage to the group’s reputation<br />

67