Annual REPORT

2015-Annual-Report-Financial-Statements

2015-Annual-Report-Financial-Statements

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

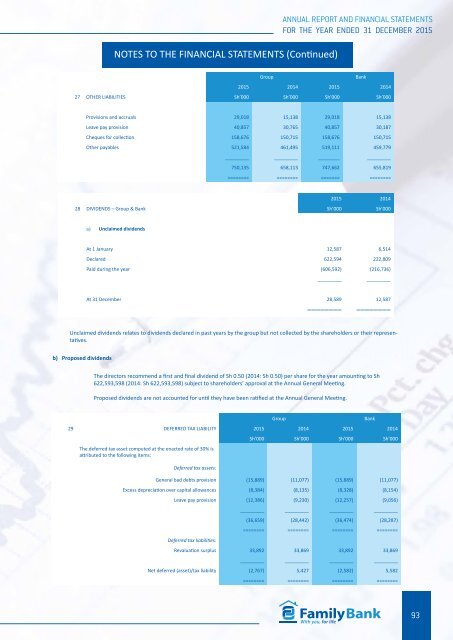

NOTES TO THE FINANCIAL STATEMENTS (Continued)<br />

ANNUAL <strong>REPORT</strong> AND FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 DECEMBER 2015<br />

Group<br />

Bank<br />

2015 2014 2015 2014<br />

27 OTHER LIABILITIES Sh’000 Sh’000 Sh’000 Sh’000<br />

Provisions and accruals 29,018 15,138 29,018 15,138<br />

Leave pay provision 40,857 30,765 40,857 30,187<br />

Cheques for collection 158,676 150,715 158,676 150,715<br />

Other payables 521,584 461,495 519,111 459,779<br />

_________ _________ ________ _________<br />

750,135 658,113 747,662 655,819<br />

======== ======== ======= ========<br />

2015 2014<br />

28 DIVIDENDS – Group & Bank Sh’000 Sh’000<br />

a) Unclaimed dividends<br />

At 1 January 12,587 6,514<br />

Declared 622,594 222,809<br />

Paid during the year (606,592) (216,736)<br />

_________<br />

_________<br />

At 31 December 28,589 12,587<br />

======== ========<br />

Unclaimed dividends relates to dividends declared in past years by the group but not collected by the shareholders or their representatives.<br />

b) Proposed dividends<br />

The directors recommend a first and final dividend of Sh 0.50 (2014: Sh 0.50) per share for the year amounting to Sh<br />

622,593,598 (2014: Sh 622,593,598) subject to shareholders’ approval at the <strong>Annual</strong> General Meeting.<br />

Proposed dividends are not accounted for until they have been ratified at the <strong>Annual</strong> General Meeting.<br />

Group<br />

Bank<br />

29 DEFERRED TAX LIABILITY 2015 2014 2015 2014<br />

Sh’000 Sh’000 Sh’000 Sh’000<br />

The deferred tax asset computed at the enacted rate of 30% is<br />

attributed to the following items:<br />

Deferred tax assets:<br />

General bad debts provision (15,889) (11,077) (15,889) (11,077)<br />

Excess depreciation over capital allowances (8,384) (8,135) (8,328) (8,154)<br />

Leave pay provision (12,386) (9,230) (12,257) (9,056)<br />

Deferred tax liabilities:<br />

_________ _________ _________ _________<br />

(36,659) (28,442) (36,474) (28,287)<br />

======== ======== ======== ========<br />

Revaluation surplus 33,892 33,869 33,892 33,869<br />

_________ _________ _________ _________<br />

Net deferred (asset)/tax liability (2,767) 5,427 (2,582) 5,582<br />

======== ======== ======== ========<br />

93