Annual REPORT

2015-Annual-Report-Financial-Statements

2015-Annual-Report-Financial-Statements

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS (Continued)<br />

ANNUAL <strong>REPORT</strong> AND FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 DECEMBER 2015<br />

4 FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (Continued)<br />

(b)<br />

Liquidity risk (Continued)<br />

Liquidity risk is addressed through the following measures:<br />

· The treasury department monitors liquidity ratios on a daily basis against internal and regulatory requirements<br />

· Day to day funding is managed by monitoring future cash flows to ensure that requirements can be met. This<br />

includes replenishment of funds as they mature or are borrowed by customers.<br />

The group invests in short term liquid instruments which can easily be sold in the market when the need arises<br />

· The group enters into lending contracts subject to availability of funds.<br />

· The group has an aggressive strategy aimed at increasing the customer deposit base.<br />

· The group borrows from the market through interbank transactions with other banks and The Central Bank of<br />

Kenya for short term liquidity requirements.<br />

· Investments in property and equipment are properly budgeted for and done when the group has sufficient cash<br />

flows.<br />

The daily liquidity position is monitored and regular liquidity stress testing is conducted under a variety of scenarios<br />

covering both normal and more severe market conditions. All liquidity policies and procedures are subject to review<br />

and approval by the board. Daily reports covering the liquidity position of the group are regularly submitted to Asset<br />

and Liability Committee.<br />

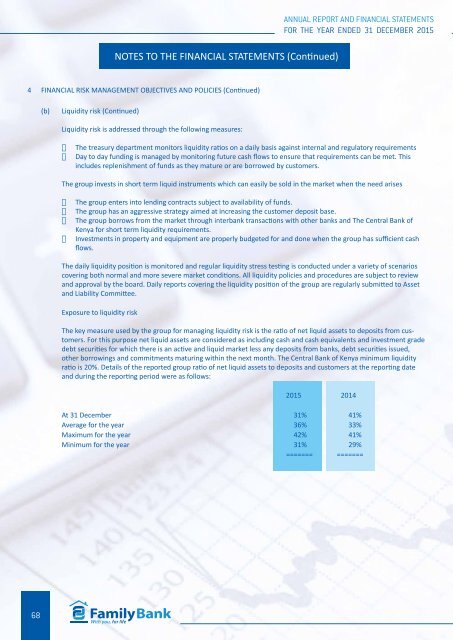

Exposure to liquidity risk<br />

The key measure used by the group for managing liquidity risk is the ratio of net liquid assets to deposits from customers.<br />

For this purpose net liquid assets are considered as including cash and cash equivalents and investment grade<br />

debt securities for which there is an active and liquid market less any deposits from banks, debt securities issued,<br />

other borrowings and commitments maturing within the next month. The Central Bank of Kenya minimum liquidity<br />

ratio is 20%. Details of the reported group ratio of net liquid assets to deposits and customers at the reporting date<br />

and during the reporting period were as follows:<br />

2015 2014<br />

At 31 December 31% 41%<br />

Average for the year 36% 33%<br />

Maximum for the year 42% 41%<br />

Minimum for the year 31% 29%<br />

==== === =======<br />

68