Annual REPORT

2015-Annual-Report-Financial-Statements

2015-Annual-Report-Financial-Statements

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ANNUAL <strong>REPORT</strong> AND FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 DECEMBER 2015<br />

NOTES TO THE FINANCIAL STATEMENTS (Continued)<br />

4 FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (Continued)<br />

(c)<br />

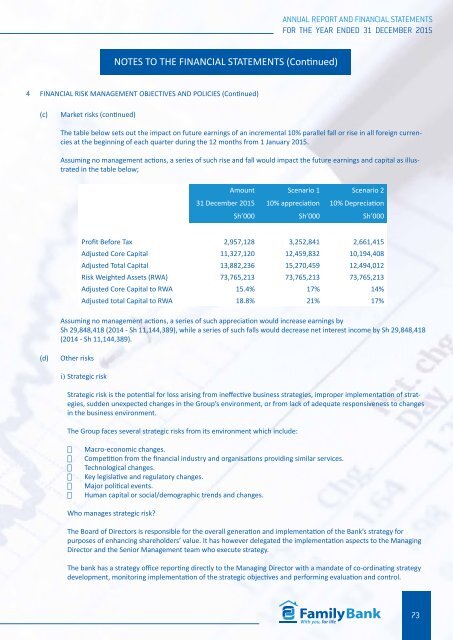

Market risks (continued)<br />

The table below sets out the impact on future earnings of an incremental 10% parallel fall or rise in all foreign currencies<br />

at the beginning of each quarter during the 12 months from 1 January 2015.<br />

Assuming no management actions, a series of such rise and fall would impact the future earnings and capital as illustrated<br />

in the table below;<br />

Amount Scenario 1 Scenario 2<br />

31 December 2015 10% appreciation 10% Depreciation<br />

Sh’000 Sh’000 Sh’000<br />

Profit Before Tax 2,957,128 3,252,841 2,661,415<br />

Adjusted Core Capital 11,327,120 12,459,832 10,194,408<br />

Adjusted Total Capital 13,882,236 15,270,459 12,494,012<br />

Risk Weighted Assets (RWA) 73,765,213 73,765,213 73,765,213<br />

Adjusted Core Capital to RWA 15.4% 17% 14%<br />

Adjusted total Capital to RWA 18.8% 21% 17%<br />

Assuming no management actions, a series of such appreciation would increase earnings by<br />

Sh 29,848,418 (2014 - Sh 11,144,389), while a series of such falls would decrease net interest income by Sh 29,848,418<br />

(2014 - Sh 11,144,389).<br />

(d)<br />

Other risks<br />

i) Strategic risk<br />

Strategic risk is the potential for loss arising from ineffective business strategies, improper implementation of strategies,<br />

sudden unexpected changes in the Group’s environment, or from lack of adequate responsiveness to changes<br />

in the business environment.<br />

The Group faces several strategic risks from its environment which include:<br />

· Macro-economic changes.<br />

· Competition from the financial industry and organisations providing similar services.<br />

· Technological changes.<br />

· Key legislative and regulatory changes.<br />

· Major political events.<br />

· Human capital or social/demographic trends and changes.<br />

Who manages strategic risk?<br />

The Board of Directors is responsible for the overall generation and implementation of the Bank’s strategy for<br />

purposes of enhancing shareholders’ value. It has however delegated the implementation aspects to the Managing<br />

Director and the Senior Management team who execute strategy.<br />

The bank has a strategy office reporting directly to the Managing Director with a mandate of co-ordinating strategy<br />

development, monitoring implementation of the strategic objectives and performing evaluation and control.<br />

73