Annual REPORT

2015-Annual-Report-Financial-Statements

2015-Annual-Report-Financial-Statements

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ANNUAL <strong>REPORT</strong> AND FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 DECEMBER 2015<br />

NOTES TO THE FINANCIAL STATEMENTS (Continued)<br />

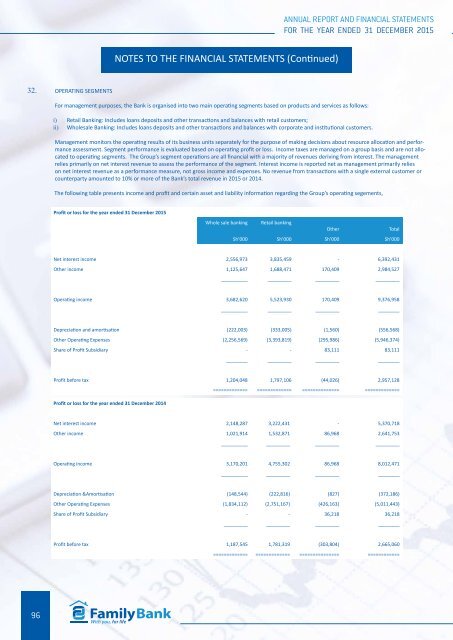

32. OPERATING SEGMENTS<br />

For management purposes, the Bank is organised into two main operating segments based on products and services as follows:<br />

i) Retail Banking: Includes loans deposits and other transactions and balances with retail customers;<br />

ii) Wholesale Banking: Includes loans deposits and other transactions and balances with corporate and institutional customers.<br />

Management monitors the operating results of its business units separately for the purpose of making decisions about resource allocation and performance<br />

assessment. Segment performance is evaluated based on operating profit or loss. Income taxes are managed on a group basis and are not allocated<br />

to operating segments. The Group’s segment operations are all financial with a majority of revenues deriving from interest. The management<br />

relies primarily on net interest revenue to assess the performance of the segment. Interest income is reported net as management primarily relies<br />

on net interest revenue as a performance measure, not gross income and expenses. No revenue from transactions with a single external customer or<br />

counterparty amounted to 10% or more of the Bank’s total revenue in 2015 or 2014.<br />

The following table presents income and profit and certain asset and liability information regarding the Group’s operating segements,<br />

Profit or loss for the year ended 31 December 2015<br />

Whole sale banking Retail banking<br />

Other<br />

Total<br />

Sh’000 Sh’000 Sh’000 Sh’000<br />

Net interest income 2,556,973 3,835,459 - 6,392,431<br />

Other income 1,125,647 1,688,471 170,409 2,984,527<br />

__________ _________ _________ _________<br />

Operating income 3,682,620 5,523,930 170,409 9,376,958<br />

__________ _________ _________ ________<br />

Depreciation and amortisation (222,003) (333,005) (1,560) (556,568)<br />

Other Operating Expenses (2,256,569) (3,393,819) (295,986) (5,946,374)<br />

Share of Profit Subsidiary - - 83,111 83,111<br />

________ _________ _________ ________<br />

Profit before tax 1,204,048 1,797,106 (44,026) 2,957,128<br />

Profit or loss for the year ended 31 December 2014<br />

============= ============= ============== =============<br />

Net interest income 2,148,287 3,222,431 - 5,370,718<br />

Other income 1,021,914 1,532,871 86,968 2,641,753<br />

__________ _________ _________ _________<br />

Operating income 3,170,201 4,755,302 86,968 8,012,471<br />

__________ _________ _________ ________<br />

Depreciation &Amortisation (148,544) (222,816) (827) (372,186)<br />

Other Operating Expenses (1,834,112) (2,751,167) (426,163) (5,011,443)<br />

Share of Profit Subsidiary - - 36,218 36,218<br />

_________ _________ _________ ________<br />

Profit before tax 1,187,545 1,781,319 (303,804) 2,665,060<br />

============= ============= =============== ============<br />

96