Climate Action 2011-2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

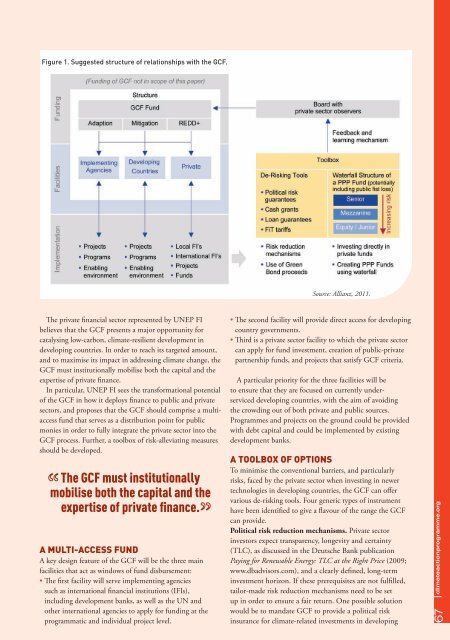

Figure 1. Suggested structure of relationships with the GCF.<br />

Source: Allianz, <strong>2011</strong>.<br />

The private financial sector represented by UNEP FI<br />

believes that the GCF presents a major opportunity for<br />

catalysing low-carbon, climate-resilient development in<br />

developing countries. In order to reach its targeted amount,<br />

and to maximise its impact in addressing climate change, the<br />

GCF must institutionally mobilise both the capital and the<br />

expertise of private finance.<br />

In particular, UNEP FI sees the transformational potential<br />

of the GCF in how it deploys finance to public and private<br />

sectors, and proposes that the GCF should comprise a multiaccess<br />

fund that serves as a distribution point for public<br />

monies in order to fully integrate the private sector into the<br />

GCF process. Further, a toolbox of risk-alleviating measures<br />

should be developed.<br />

The GCF must institutionally<br />

mobilise both the capital and the<br />

expertise of private finance.<br />

a mulTi-aCCess Fund<br />

A key design feature of the GCF will be the three main<br />

facilities that act as windows of fund disbursement:<br />

• The first facility will serve implementing agencies<br />

such as international financial institutions (IFIs),<br />

including development banks, as well as the UN and<br />

other international agencies to apply for funding at the<br />

programmatic and individual project level.<br />

• The second facility will provide direct access for developing<br />

country governments.<br />

• Third is a private sector facility to which the private sector<br />

can apply for fund investment, creation of public-private<br />

partnership funds, and projects that satisfy GCF criteria.<br />

A particular priority for the three facilities will be<br />

to ensure that they are focused on currently underserviced<br />

developing countries, with the aim of avoiding<br />

the crowding out of both private and public sources.<br />

Programmes and projects on the ground could be provided<br />

with debt capital and could be implemented by existing<br />

development banks.<br />

a Toolbox oF oPTions<br />

To minimise the conventional barriers, and particularly<br />

risks, faced by the private sector when investing in newer<br />

technologies in developing countries, the GCF can offer<br />

various de-risking tools. Four generic types of instrument<br />

have been identified to give a flavour of the range the GCF<br />

can provide.<br />

Political risk reduction mechanisms. Private sector<br />

investors expect transparency, longevity and certainty<br />

(TLC), as discussed in the Deutsche Bank publication<br />

Paying for Renewable Energy: TLC at the Right Price (2009;<br />

www.dbadvisors.com), and a clearly defined, long-term<br />

investment horizon. If these prerequisites are not fulfilled,<br />

tailor-made risk reduction mechanisms need to be set<br />

up in order to ensure a fair return. One possible solution<br />

would be to mandate GCF to provide a political risk<br />

insurance for climate-related investments in developing<br />

67 climateactionprogramme.org