Climate Action 2011-2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

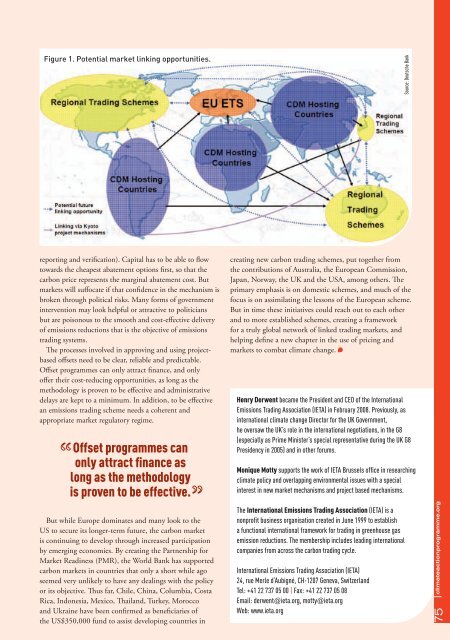

Figure 1. Potential market linking opportunities.<br />

Source: Deutsche Bank<br />

reporting and verification). Capital has to be able to flow<br />

towards the cheapest abatement options first, so that the<br />

carbon price represents the marginal abatement cost. But<br />

markets will suffocate if that confidence in the mechanism is<br />

broken through political risks. Many forms of government<br />

intervention may look helpful or attractive to politicians<br />

but are poisonous to the smooth and cost-effective delivery<br />

of emissions reductions that is the objective of emissions<br />

trading systems.<br />

The processes involved in approving and using projectbased<br />

offsets need to be clear, reliable and predictable.<br />

Offset programmes can only attract finance, and only<br />

offer their cost-reducing opportunities, as long as the<br />

methodology is proven to be effective and administrative<br />

delays are kept to a minimum. In addition, to be effective<br />

an emissions trading scheme needs a coherent and<br />

appropriate market regulatory regime.<br />

Offset programmes can<br />

only attract finance as<br />

long as the methodology<br />

is proven to be effective.<br />

But while Europe dominates and many look to the<br />

US to secure its longer-term future, the carbon market<br />

is continuing to develop through increased participation<br />

by emerging economies. By creating the Partnership for<br />

Market Readiness (PMR), the World Bank has supported<br />

carbon markets in countries that only a short while ago<br />

seemed very unlikely to have any dealings with the policy<br />

or its objective. Thus far, Chile, China, Columbia, Costa<br />

Rica, Indonesia, Mexico, Thailand, Turkey, Morocco<br />

and Ukraine have been confirmed as beneficiaries of<br />

the US$350,000 fund to assist developing countries in<br />

creating new carbon trading schemes, put together from<br />

the contributions of Australia, the European Commission,<br />

Japan, Norway, the UK and the USA, among others. The<br />

primary emphasis is on domestic schemes, and much of the<br />

focus is on assimilating the lessons of the European scheme.<br />

But in time these initiatives could reach out to each other<br />

and to more established schemes, creating a framework<br />

for a truly global network of linked trading markets, and<br />

helping define a new chapter in the use of pricing and<br />

markets to combat climate change.<br />

Henry Derwent became the President and CEO of the International<br />

Emissions Trading Association (IETA) in February 2008. Previously, as<br />

international climate change Director for the UK Government,<br />

he oversaw the UK’s role in the international negotiations, in the G8<br />

(especially as Prime Minister’s special representative during the UK G8<br />

Presidency in 2005) and in other forums.<br />

Monique Motty supports the work of IETA Brussels office in researching<br />

climate policy and overlapping environmental issues with a special<br />

interest in new market mechanisms and project based mechanisms.<br />

The International Emissions Trading Association (IETA) is a<br />

nonprofit business organisation created in June 1999 to establish<br />

a functional international framework for trading in greenhouse gas<br />

emission reductions. The membership includes leading international<br />

companies from across the carbon trading cycle.<br />

International Emissions Trading Association (IETA)<br />

24, rue Merle d’Aubigné, CH-1207 Geneva, Switzerland<br />

Tel: +41 22 737 05 00 | Fax: +41 22 737 05 08<br />

Email: derwent@ieta.org, motty@ieta.org<br />

Web: www.ieta.org<br />

75 climateactionprogramme.org