Climate Action 2011-2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

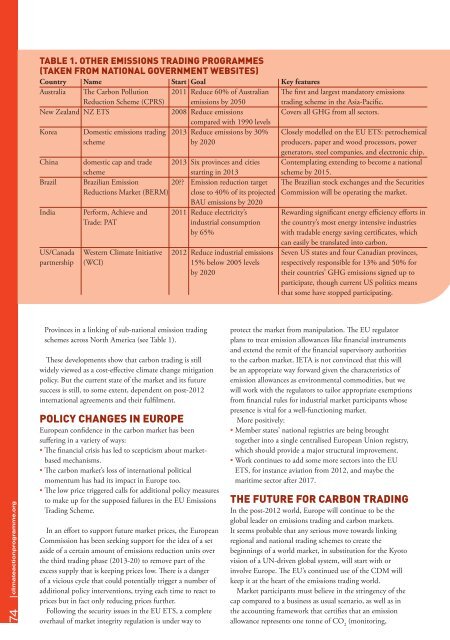

Table 1. oTher emissions TradinG ProGrammes<br />

(Taken From naTional GovernmenT websiTes)<br />

Country Name Start Goal Key features<br />

Australia The Carbon Pollution <strong>2011</strong> Reduce 60% of Australian The first and largest mandatory emissions<br />

Reduction Scheme (CPRS) emissions by 2050 trading scheme in the Asia-Pacific.<br />

New Zealand NZ ETS 2008 Reduce emissions Covers all GHG from all sectors.<br />

compared with 1990 levels<br />

Korea Domestic emissions trading 2013 Reduce emissions by 30% Closely modelled on the EU ETS: petrochemical<br />

scheme by 2020 producers, paper and wood processors, power<br />

generators, steel companies, and electronic chip.<br />

China domestic cap and trade 2013 Six provinces and cities Contemplating extending to become a national<br />

scheme starting in 2013 scheme by 2015.<br />

Brazil Brazilian Emission 20?? Emission reduction target The Brazilian stock exchanges and the Securities<br />

Reductions Market (BERM) close to 40% of its projected Commission will be operating the market.<br />

BAU emissions by 2020<br />

India Perform, Achieve and <strong>2011</strong> Reduce electricity’s Rewarding significant energy efficiency efforts in<br />

Trade: PAT industrial consumption the country’s most energy intensive industries<br />

by 65%<br />

with tradable energy saving certificates, which<br />

can easily be translated into carbon.<br />

US/Canada Western <strong>Climate</strong> Initiative <strong>2012</strong> Reduce industrial emissions Seven US states and four Canadian provinces,<br />

partnership (WCI) 15% below 2005 levels respectively responsible for 13% and 50% for<br />

by 2020<br />

their countries’ GHG emissions signed up to<br />

participate, though current US politics means<br />

that some have stopped participating.<br />

74 climateactionprogramme.org<br />

Provinces in a linking of sub-national emission trading<br />

schemes across North America (see Table 1).<br />

These developments show that carbon trading is still<br />

widely viewed as a cost-effective climate change mitigation<br />

policy. But the current state of the market and its future<br />

success is still, to some extent, dependent on post-<strong>2012</strong><br />

international agreements and their fulfilment.<br />

Policy chanGes in euroPe<br />

European confidence in the carbon market has been<br />

suffering in a variety of ways:<br />

• The financial crisis has led to scepticism about marketbased<br />

mechanisms.<br />

• The carbon market’s loss of international political<br />

momentum has had its impact in Europe too.<br />

• The low price triggered calls for additional policy measures<br />

to make up for the supposed failures in the EU Emissions<br />

Trading Scheme.<br />

In an effort to support future market prices, the European<br />

Commission has been seeking support for the idea of a set<br />

aside of a certain amount of emissions reduction units over<br />

the third trading phase (2013-20) to remove part of the<br />

excess supply that is keeping prices low. There is a danger<br />

of a vicious cycle that could potentially trigger a number of<br />

additional policy interventions, trying each time to react to<br />

prices but in fact only reducing prices further.<br />

Following the security issues in the EU ETS, a complete<br />

overhaul of market integrity regulation is under way to<br />

protect the market from manipulation. The EU regulator<br />

plans to treat emission allowances like financial instruments<br />

and extend the remit of the financial supervisory authorities<br />

to the carbon market. IETA is not convinced that this will<br />

be an appropriate way forward given the characteristics of<br />

emission allowances as environmental commodities, but we<br />

will work with the regulators to tailor appropriate exemptions<br />

from financial rules for industrial market participants whose<br />

presence is vital for a well-functioning market.<br />

More positively:<br />

• Member states’ national registries are being brought<br />

together into a single centralised European Union registry,<br />

which should provide a major structural improvement.<br />

• Work continues to add some more sectors into the EU<br />

ETS, for instance aviation from <strong>2012</strong>, and maybe the<br />

maritime sector after 2017.<br />

The FuTure For carbon TradinG<br />

In the post-<strong>2012</strong> world, Europe will continue to be the<br />

global leader on emissions trading and carbon markets.<br />

It seems probable that any serious move towards linking<br />

regional and national trading schemes to create the<br />

beginnings of a world market, in substitution for the Kyoto<br />

vision of a UN-driven global system, will start with or<br />

involve Europe. The EU’s continued use of the CDM will<br />

keep it at the heart of the emissions trading world.<br />

Market participants must believe in the stringency of the<br />

cap compared to a business as usual scenario, as well as in<br />

the accounting framework that certifies that an emission<br />

allowance represents one tonne of CO 2<br />

(monitoring,