Tropicana Nov-Dec 2020 #133 The Festive Issue

Tropicana Nov-Dec 2020 #133 The Festive Issue

Tropicana Nov-Dec 2020 #133 The Festive Issue

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

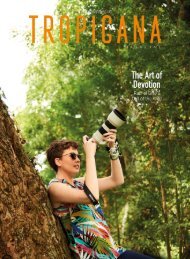

Charles Tan<br />

“<strong>The</strong>re are lots of<br />

good choices in the<br />

secondary property<br />

market”<br />

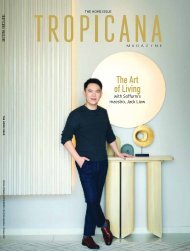

Joanne Lee<br />

“Access to wellestablished<br />

neighbourhoods, good<br />

facilities, amenities<br />

and connectivity are<br />

important”<br />

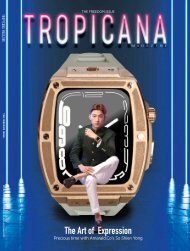

Daniel Gambero<br />

“Choose carefully<br />

the developer,<br />

location and<br />

infrastructures<br />

provided”<br />

New Opportunities<br />

<strong>The</strong>re are going to be opportunities that probably didn’t<br />

exist even just a few months ago. If your job is secure and you<br />

have some savings, it’s actually a good time to buy, buy, buy.<br />

According to Charles Tan Chia Lih, owner of independent<br />

blog kopiandproperty.com, the right time to buy needs to be<br />

complemented with the right property and the right price<br />

too. “It would be good just to write down five to 10 reasons and<br />

evaluate all those properties based on these reasons.”<br />

According to Tan, if the properties advertised or researched<br />

fit as a good investment, then it should just be the right<br />

choice. “Yes, this is still a perfect time for first-time<br />

homebuyers. Preferably, they will try to take advantage of<br />

all the incentives like the Home Ownership Campaign (HOC)<br />

that is currently being offered.”<br />

“Try also to expand the choices and not be too focused on<br />

just the primary market. <strong>The</strong>re are lots of good choices in the<br />

secondary property market too,” he advised.<br />

Tan said sellers need to understand the opportunity<br />

cost when they want to sell in this market. “Sell now or<br />

wait until a better price comes along? This is a dilemma that<br />

many investors have in the present market.”<br />

Choose Carefully<br />

Property consultant, REI Group CEO Dr Daniele Gambero,<br />

said that it is definitely a good time to buy property provided<br />

you choose the right one.<br />

“Choose carefully the developer, location and infrastructures<br />

provided. For instance, optical fibre and good reception for the<br />

internet is a must-have criteria for some buyers.”<br />

Gambero advised the buyer to not simply accept ridiculous<br />

discounts or rebates as it might be tricky. “Please double check<br />

with bankers your loan eligibility then only you can plan for a<br />

visit at the sales gallery.”<br />

According to Gambero, this moment of time is worth for<br />

home investment, especially for residential properties priced<br />

between RM200,000 to RM800,000.<br />

“Demand for residential units is still strong, and the<br />

shortfall equals roughly RM800,000. In the next 15 to 20 years,<br />

Malaysia will see an additional six to eight million population<br />

increase or growth and our senior citizens will move from<br />

the current seven million to above 14 million, generating<br />

additional demand.”<br />

Ability To Obtain Loan<br />

“What matters is the importance of having the ability to<br />

obtain a loan and being able to hold the units if, when<br />

delivered, it will not be easy or fast to find a tenant,”<br />

said Gambero.<br />

It may take more than five years for unsold residential<br />

units to be absorbed into the market. After all, the current<br />

overnight policy rate (OPR) is at its all-time-low at 1.75%<br />

since 2004, with a total of 125 basis points (bps) cuts thus<br />

far this year to help cushion the economic impact of the<br />

Covid-19 outbreak.<br />

This shows that low bank lending rate is a big<br />

advantage if you are looking to take out a home loan to<br />

buy a property now as it could reduce your monthly<br />

loan repayments by over RM1,000 or more for bigger<br />

loan amounts.<br />

49 NOVEMBER/DECEMBER <strong>2020</strong> | TM