a market conditions and project evaluation summary of - Georgia ...

a market conditions and project evaluation summary of - Georgia ...

a market conditions and project evaluation summary of - Georgia ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

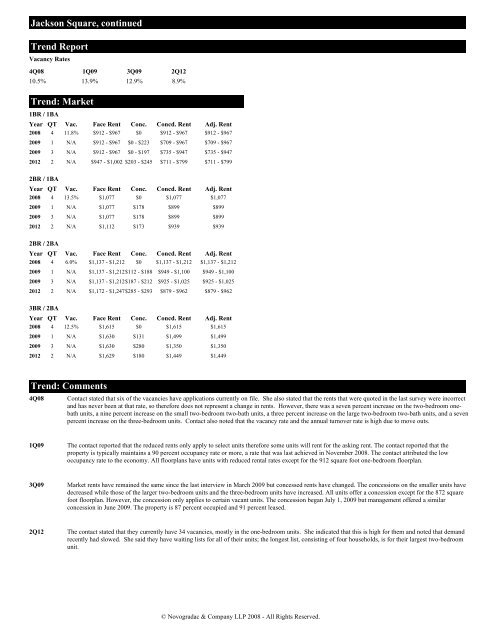

Jackson Square, continued<br />

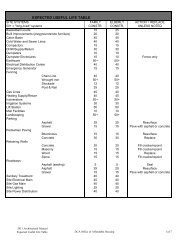

Trend Report<br />

Vacancy Rates<br />

4Q08<br />

1Q09<br />

10.5% 13.9%<br />

Trend: Market<br />

1BR / 1BA<br />

3Q09<br />

12.9%<br />

2Q12<br />

8.9%<br />

Year QT Vac. Face Rent Conc. Concd. Rent Adj. Rent<br />

2008 4 11.8% $912 - $967 $0 $912 - $967 $912 - $967<br />

2009 1 N/A $912 - $967 $0 - $223 $709 - $967 $709 - $967<br />

2009 3 N/A $912 - $967 $0 - $197 $735 - $947 $735 - $947<br />

2012 2 N/A $947 - $1,002 $203 - $245 $711 - $799 $711 - $799<br />

2BR / 1BA<br />

Year QT Vac. Face Rent Conc. Concd. Rent Adj. Rent<br />

2008 4 13.5% $1,077 $0 $1,077<br />

$1,077<br />

2009 1 N/A $1,077 $178 $899<br />

$899<br />

2009 3 N/A $1,077 $178 $899<br />

$899<br />

2012 2 N/A $1,112 $173 $939<br />

$939<br />

2BR / 2BA<br />

Year QT Vac. Face Rent Conc. Concd. Rent Adj. Rent<br />

2008 4 6.0% $1,137 - $1,212 $0 $1,137 - $1,212 $1,137 - $1,212<br />

2009 1 N/A $1,137 - $1,212 $112 - $188 $949 - $1,100 $949 - $1,100<br />

2009 3 N/A $1,137 - $1,212 $187 - $212 $925 - $1,025 $925 - $1,025<br />

2012 2 N/A $1,172 - $1,247 $285 - $293 $879 - $962 $879 - $962<br />

3BR / 2BA<br />

Year QT Vac. Face Rent Conc. Concd. Rent Adj. Rent<br />

2008 4 12.5% $1,615 $0 $1,615<br />

$1,615<br />

2009 1 N/A $1,630 $131 $1,499<br />

$1,499<br />

2009 3 N/A $1,630 $280 $1,350<br />

$1,350<br />

2012 2 N/A $1,629 $180 $1,449<br />

$1,449<br />

Trend: Comments<br />

4Q08<br />

1Q09<br />

3Q09<br />

2Q12<br />

Contact stated that six <strong>of</strong> the vacancies have applications currently on file. She also stated that the rents that were quoted in the last survey were incorrect<br />

<strong>and</strong> has never been at that rate, so therefore does not represent a change in rents. However, there was a seven percent increase on the two-bedroom onebath<br />

units, a nine percent increase on the small two-bedroom two-bath units, a three percent increase on the large two-bedroom two-bath units, <strong>and</strong> a seven<br />

percent increase on the three-bedroom units. Contact also noted that the vacancy rate <strong>and</strong> the annual turnover rate is high due to move outs.<br />

The contact reported that the reduced rents only apply to select units therefore some units will rent for the asking rent. The contact reported that the<br />

property is typically maintains a 90 percent occupancy rate or more, a rate that was last achieved in November 2008. The contact attributed the low<br />

occupancy rate to the economy. All floorplans have units with reduced rental rates except for the 912 square foot one-bedroom floorplan.<br />

Market rents have remained the same since the last interview in March 2009 but concessed rents have changed. The concessions on the smaller units have<br />

decreased while those <strong>of</strong> the larger two-bedroom units <strong>and</strong> the three-bedroom units have increased. All units <strong>of</strong>fer a concession except for the 872 square<br />

foot floorplan. However, the concession only applies to certain vacant units. The concession began July 1, 2009 but management <strong>of</strong>fered a similar<br />

concession in June 2009. The property is 87 percent occupied <strong>and</strong> 91 percent leased.<br />

The contact stated that they currently have 34 vacancies, mostly in the one-bedroom units. She indicated that this is high for them <strong>and</strong> noted that dem<strong>and</strong><br />

recently had slowed. She said they have waiting lists for all <strong>of</strong> their units; the longest list, consisting <strong>of</strong> four households, is for their largest two-bedroom<br />

unit.<br />

© Novogradac & Company LLP 2008 - All Rights Reserved.