a market conditions and project evaluation summary of - Georgia ...

a market conditions and project evaluation summary of - Georgia ...

a market conditions and project evaluation summary of - Georgia ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Allen Wilson Phase III, Decatur, GA; Market Study<br />

The City <strong>of</strong> Decatur’s major employers are almost all in the<br />

services industries. Education services, government, <strong>and</strong><br />

healthcare services are all represented among Decatur’s top<br />

employers. While the economy does not appear to be very<br />

diverse, the major employers are primarily contained in<br />

stable industries such as education services, healthcare<br />

services, <strong>and</strong> government <strong>and</strong> therefore we do not believe<br />

this will negatively affect the Subject<br />

Between 2008 <strong>and</strong> 2009, total employment in the MSA<br />

decreased by 5.3 percent, causing the unemployment rate to<br />

increase 3.6 percentage points. In 2010, the unemployment<br />

rate was 10.2 percent, the highest in a decade, <strong>and</strong> 0.6<br />

percent higher than the national average. Between March<br />

2011 <strong>and</strong> March 2012, total employment increased 2.3<br />

percent, <strong>and</strong> the unemployment rate decreased 0.9<br />

percentage points. As <strong>of</strong> March 2012, the unemployment<br />

rate was slightly above the unemployment rate <strong>of</strong> the<br />

Nation.<br />

The <strong>Georgia</strong> Department <strong>of</strong> Labor provided the major<br />

Business Expansions in the MSA. Expansions in the<br />

metropolitan Atlanta <strong>market</strong> have been in various industries<br />

like retail <strong>and</strong> manufacturing, which are industries that that<br />

are typically affected negatively by the economic<br />

downturn. However, these industries have adapted to the<br />

current <strong>market</strong> including Macy’s, which is exp<strong>and</strong>ing its ecommerce<br />

department.<br />

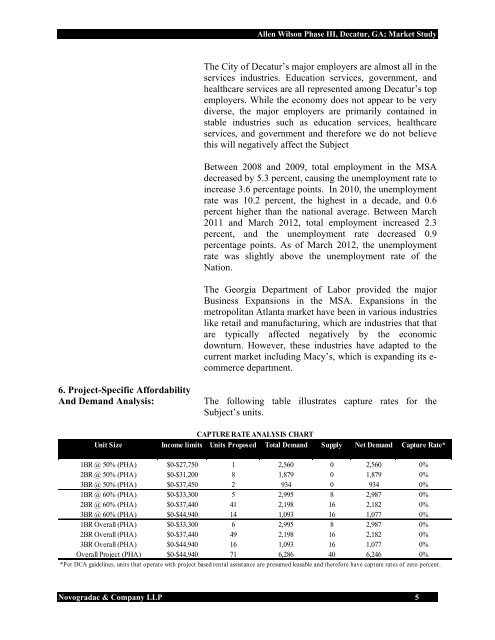

6. Project-Specific Affordability<br />

And Dem<strong>and</strong> Analysis: The following table illustrates capture rates for the<br />

Subject’s units.<br />

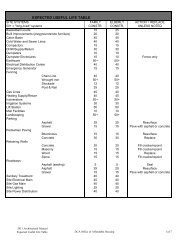

CAPTURE RATE ANALYSIS CHART<br />

Unit Size Income limits Units Proposed Total Dem<strong>and</strong> Supply Net Dem<strong>and</strong> Capture Rate*<br />

1BR @ 50% (PHA) $0-$27,750 1 2,560 0 2,560 0%<br />

2BR @ 50% (PHA) $0-$31,200 8 1,879 0 1,879 0%<br />

3BR @ 50% (PHA) $0-$37,450 2 934 0 934 0%<br />

1BR @ 60% (PHA) $0-$33,300 5 2,995 8 2,987 0%<br />

2BR @ 60% (PHA) $0-$37,440 41 2,198 16 2,182 0%<br />

3BR @ 60% (PHA) $0-$44,940 14 1,093 16 1,077 0%<br />

1BR Overall (PHA) $0-$33,300 6 2,995 8 2,987 0%<br />

2BR Overall (PHA) $0-$37,440 49 2,198 16 2,182 0%<br />

3BR Overall (PHA) $0-$44,940 16 1,093 16 1,077 0%<br />

Overall Project (PHA) $0-$44,940 71 6,286 40 6,246 0%<br />

*Per DCA guidelines, units that operate with <strong>project</strong> based rental assistance are presumed leasable <strong>and</strong> therefore have capture rates <strong>of</strong> zero percent.<br />

Novogradac & Company LLP 5