a market conditions and project evaluation summary of - Georgia ...

a market conditions and project evaluation summary of - Georgia ...

a market conditions and project evaluation summary of - Georgia ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

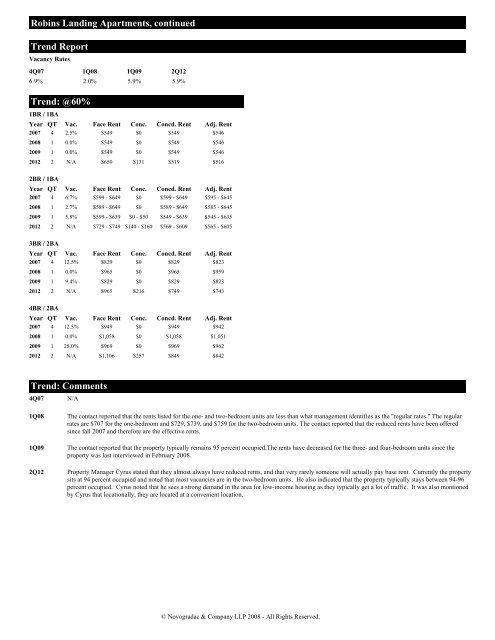

Robins L<strong>and</strong>ing Apartments, continued<br />

Trend Report<br />

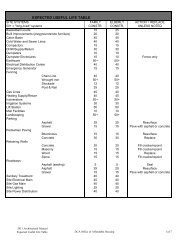

Vacancy Rates<br />

4Q07<br />

1Q08<br />

6.9% 2.0%<br />

Trend: @60%<br />

1BR / 1BA<br />

1Q09<br />

5.9%<br />

2Q12<br />

5.9%<br />

Year QT Vac. Face Rent Conc. Concd. Rent Adj. Rent<br />

2007 4 2.5% $549 $0 $549<br />

$546<br />

2008 1 0.0% $549 $0 $549<br />

$546<br />

2009 1 0.0% $549 $0 $549<br />

$546<br />

2012 2 N/A $650 $131 $519<br />

$516<br />

2BR / 1BA<br />

Year QT Vac. Face Rent Conc. Concd. Rent Adj. Rent<br />

2007 4 6.7% $599 - $649 $0 $599 - $649 $595 - $645<br />

2008 1 2.7% $589 - $649 $0 $589 - $649 $585 - $645<br />

2009 1 5.8% $599 - $639 $0 - $50 $549 - $639 $545 - $635<br />

2012 2 N/A $729 - $749 $140 - $160 $569 - $609 $565 - $605<br />

3BR / 2BA<br />

Year QT Vac. Face Rent Conc. Concd. Rent Adj. Rent<br />

2007 4 12.5% $829 $0 $829<br />

$823<br />

2008 1 0.0% $965 $0 $965<br />

$959<br />

2009 1 9.4% $829 $0 $829<br />

$823<br />

2012 2 N/A $965 $216 $749<br />

$743<br />

4BR / 2BA<br />

Year QT Vac. Face Rent Conc. Concd. Rent Adj. Rent<br />

2007 4 12.5% $949 $0 $949<br />

$942<br />

2008 1 0.0% $1,058 $0 $1,058<br />

$1,051<br />

2009 1 25.0% $969 $0 $969<br />

$962<br />

2012 2 N/A $1,106 $257 $849<br />

$842<br />

Trend: Comments<br />

4Q07<br />

1Q08<br />

1Q09<br />

2Q12<br />

N/A<br />

The contact reported that the rents listed for the one- <strong>and</strong> two-bedroom units are less than what management identifies as the "regular rates." The regular<br />

rates are $707 for the one-bedroom <strong>and</strong> $729, $739, <strong>and</strong> $759 for the two-bedroom units. The contact reported that the reduced rents have been <strong>of</strong>fered<br />

since fall 2007 <strong>and</strong> therefore are the effective rents.<br />

The contact reported that the property typically remains 95 percent occupied.The rents have decreased for the three- <strong>and</strong> four-bedroom units since the<br />

property was last interviewed in February 2008.<br />

Property Manager Cyrus stated that they almost always have reduced rents, <strong>and</strong> that very rarely someone will actually pay base rent. Currently the property<br />

sits at 94 percent occupied <strong>and</strong> noted that most vacancies are in the two-bedroom units. He also indicated that the property typically stays between 94-96<br />

percent occupied. Cyrus noted that he sees a strong dem<strong>and</strong> in the area for low-income housing as they typically get a lot <strong>of</strong> traffic. It was also montioned<br />

by Cyrus that locationally, they are located at a convenient location.<br />

© Novogradac & Company LLP 2008 - All Rights Reserved.