a market conditions and project evaluation summary of - Georgia ...

a market conditions and project evaluation summary of - Georgia ...

a market conditions and project evaluation summary of - Georgia ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

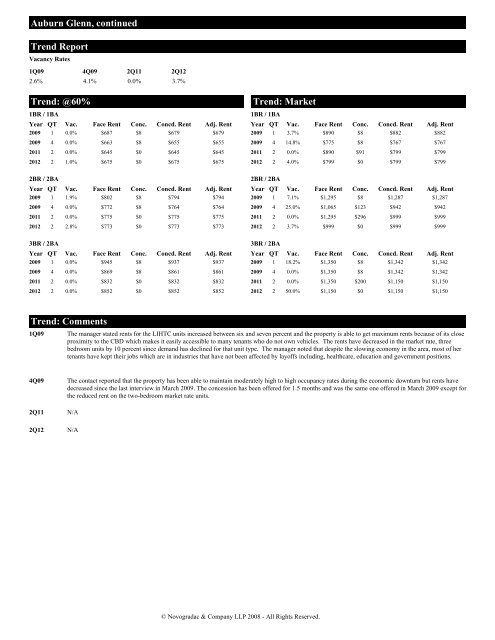

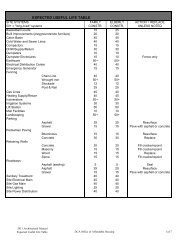

Auburn Glenn, continued<br />

Trend Report<br />

Vacancy Rates<br />

1Q09<br />

4Q09<br />

2.6% 4.1%<br />

1BR / 1BA<br />

2Q11<br />

0.0%<br />

2Q12<br />

3.7%<br />

Trend: @60% Trend: Market<br />

Year QT Vac. Face Rent Conc. Concd. Rent Adj. Rent<br />

2009 1 0.0% $687 $8 $679<br />

$679<br />

2009 4 0.0% $663 $8 $655<br />

$655<br />

2011 2 0.0% $645 $0 $645<br />

$645<br />

2012 2 1.0% $675 $0 $675<br />

$675<br />

2BR / 2BA<br />

Year QT Vac. Face Rent Conc. Concd. Rent Adj. Rent<br />

2009 1 1.9% $802 $8 $794<br />

$794<br />

2009 4 0.0% $772 $8 $764<br />

$764<br />

2011 2 0.0% $775 $0 $775<br />

$775<br />

2012 2 2.8% $773 $0 $773<br />

$773<br />

3BR / 2BA<br />

Year QT Vac. Face Rent Conc. Concd. Rent Adj. Rent<br />

2009 1 0.0% $945 $8 $937<br />

$937<br />

2009 4 0.0% $869 $8 $861<br />

$861<br />

2011 2 0.0% $832 $0 $832<br />

$832<br />

2012 2 0.0% $852 $0 $852<br />

$852<br />

Trend: Comments<br />

1Q09<br />

4Q09<br />

2Q11<br />

2Q12<br />

1BR / 1BA<br />

Year QT Vac. Face Rent Conc. Concd. Rent Adj. Rent<br />

2009 1 3.7% $890 $8 $882<br />

$882<br />

2009 4 14.8% $775 $8 $767<br />

$767<br />

2011 2 0.0% $890 $91 $799<br />

$799<br />

2012 2 4.0% $799 $0 $799<br />

$799<br />

2BR / 2BA<br />

Year QT Vac. Face Rent Conc. Concd. Rent Adj. Rent<br />

2009 1 7.1% $1,295 $8 $1,287<br />

$1,287<br />

2009 4 25.0% $1,065 $123 $942<br />

$942<br />

2011 2 0.0% $1,295 $296 $999<br />

$999<br />

2012 2 3.7% $999 $0 $999<br />

$999<br />

3BR / 2BA<br />

Year QT Vac. Face Rent Conc. Concd. Rent Adj. Rent<br />

2009 1 18.2% $1,350 $8 $1,342<br />

$1,342<br />

2009 4 0.0% $1,350 $8 $1,342<br />

$1,342<br />

2011 2 0.0% $1,350 $200 $1,150<br />

$1,150<br />

2012 2 50.0% $1,150 $0 $1,150<br />

$1,150<br />

The manager stated rents for the LIHTC units increased between six <strong>and</strong> seven percent <strong>and</strong> the property is able to get maximum rents because <strong>of</strong> its close<br />

proximity to the CBD which makes it easily accessible to many tenants who do not own vehicles. The rents have decreased in the <strong>market</strong> rate, three<br />

bedroom units by 10 percent since dem<strong>and</strong> has declined for that unit type. The manager noted that despite the slowing economy in the area, most <strong>of</strong> her<br />

tenants have kept their jobs which are in industries that have not been affected by lay<strong>of</strong>fs including, healthcare, education <strong>and</strong> government positions.<br />

The contact reported that the property has been able to maintain moderately high to high occupancy rates during the economic downturn but rents have<br />

decreased since the last interview in March 2009. The concession has been <strong>of</strong>fered for 1.5 months <strong>and</strong> was the same one <strong>of</strong>fered in March 2009 except for<br />

the reduced rent on the two-bedroom <strong>market</strong> rate units.<br />

N/A<br />

N/A<br />

© Novogradac & Company LLP 2008 - All Rights Reserved.