a market conditions and project evaluation summary of - Georgia ...

a market conditions and project evaluation summary of - Georgia ...

a market conditions and project evaluation summary of - Georgia ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Allen Wilson Phase III, Decatur, GA; Market Study<br />

to its respective income cohorts by percentage. This number does not reflect lower income<br />

households losing population, as this may be a result <strong>of</strong> simple dollar value inflation.<br />

3B. DEMAND FROM EXISTING HOUSEHOLDS<br />

Dem<strong>and</strong> for existing households is estimated by summing three sources <strong>of</strong> potential tenants. The<br />

first source (2a.) is tenants who are rent overburdened. These are households who are paying<br />

over 35 percent for family households <strong>and</strong> 40 percent for senior households <strong>of</strong> their income in<br />

housing costs. This data is interpolated using CHAS data based on appropriate income levels.<br />

The second source (2b.) is households living in subst<strong>and</strong>ard housing. We will utilize this data to<br />

determine the number <strong>of</strong> current residents that are income eligible, renter tenure, overburdened<br />

<strong>and</strong>/or living in subst<strong>and</strong>ard housing <strong>and</strong> likely to consider the Subject. The third source (2c.) is<br />

those seniors likely to move from their own homes into rental housing. This source is only<br />

appropriate when evaluating senior properties <strong>and</strong> is determined by interviews with property<br />

managers in the PMA. Because the Subject will not target seniors, we have not accounted for<br />

senior homeownership conversion in our dem<strong>and</strong> analysis.<br />

In general, we will utilize this data to determine the number <strong>of</strong> current residents that are income<br />

eligible, renter tenure, overburdened <strong>and</strong>/or living in subst<strong>and</strong>ard housing <strong>and</strong> likely to consider<br />

the Subject.<br />

3C. SECONDARY MARKET AREA<br />

To accommodate for the secondary <strong>market</strong> area, the Dem<strong>and</strong> from Existing Qualified<br />

Households within the primary <strong>market</strong> area will be multiplied by 115% to account for dem<strong>and</strong><br />

from the secondary <strong>market</strong> area.<br />

Our conversation with the Subject’s property manager indicates that approximately 15 percent <strong>of</strong><br />

the Subject’s tenants can be expected to come from outside the PMA boundaries.<br />

3D. OTHER<br />

DCA does not consider household turnover to be a source <strong>of</strong> <strong>market</strong> dem<strong>and</strong>.<br />

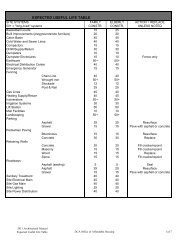

4. NET DEMAND, CAPTURE RATES AND STABILIZATION CALCULATIONS<br />

The following pages will outline the overall dem<strong>and</strong> components added together (3(a), 3(b) <strong>and</strong><br />

3(c)) less the supply <strong>of</strong> competitive developments awarded <strong>and</strong>/or constructed from 2000 to the<br />

present.<br />

ADDITIONS TO SUPPLY<br />

Additions to supply will lower the number <strong>of</strong> potential qualified households. Pursuant to our<br />

underst<strong>and</strong>ing <strong>of</strong> DCA guidelines, we deduct additions to supply allocated since 2010 to present<br />

<strong>and</strong> those that will be constructed through 2014 that are considered directly competitive.<br />

Novogradac & Company, LLP 45