a market conditions and project evaluation summary of - Georgia ...

a market conditions and project evaluation summary of - Georgia ...

a market conditions and project evaluation summary of - Georgia ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Novogradac & Company, LLP 61<br />

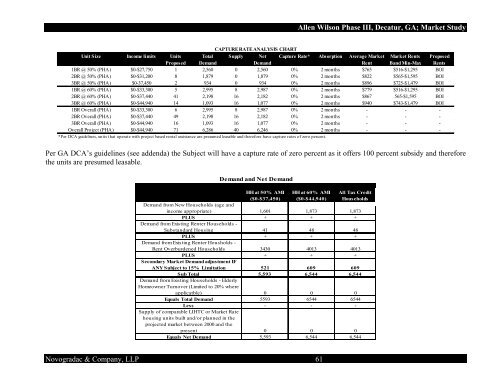

Allen Wilson Phase III, Decatur, GA; Market Study<br />

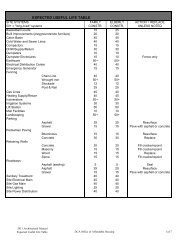

CAPTURE RATE ANALYSIS CHART<br />

Unit Size Income limits Units Total Supply Net Capture Rate* Absorption Average Market Market Rents Proposed<br />

Proposed Dem<strong>and</strong><br />

Dem<strong>and</strong><br />

Rent B<strong>and</strong> Min-Max Rents<br />

1BR @ 50% (PHA) $0-$27,750 1 2,560 0 2,560 0% 2 months $765 $516-$1,295 BOI<br />

2BR @ 50% (PHA) $0-$31,200 8 1,879 0 1,879 0% 2 months $822 $565-$1,595 BOI<br />

3BR @ 50% (PHA) $0-37,450 2 934 0 934 0% 2 months $896 $725-$1,479 BOI<br />

1BR @ 60% (PHA) $0-$33,300 5 2,995 8 2,987 0% 2 months $779 $516-$1,295 BOI<br />

2BR @ 60% (PHA) $0-$37,440 41 2,198 16 2,182 0% 2 months $867 565-$1,595 BOI<br />

3BR @ 60% (PHA) $0-$44,940 14 1,093 16 1,077 0% 2 months $940 $743-$1,479 BOI<br />

1BR Overall (PHA) $0-$33,300 6 2,995 8 2,987 0% 2 months - - -<br />

2BR Overall (PHA) $0-$37,440 49 2,198 16 2,182 0% 2 months - - -<br />

3BR Overall (PHA) $0-$44,940 16 1,093 16 1,077 0% 2 months - - -<br />

Overall Project (PHA) $0-$44,940 71 6,286 40 6,246 0% 2 months - - -<br />

*Per DCA guidelines, units that operate with <strong>project</strong> based rental assistance are presumed leasable <strong>and</strong> therefore have capture rates <strong>of</strong> zero percent.<br />

Per GA DCA’s guidelines (see addenda) the Subject will have a capture rate <strong>of</strong> zero percent as it <strong>of</strong>fers 100 percent subsidy <strong>and</strong> therefore<br />

the units are presumed leasable.<br />

Dem<strong>and</strong> <strong>and</strong> Net Dem<strong>and</strong><br />

HH at 50% AMI<br />

($0-$37,450)<br />

HH at 60% AMI<br />

($0-$44,940)<br />

All Tax Credit<br />

Households<br />

Dem<strong>and</strong> from New Households (age <strong>and</strong><br />

income appropriate) 1,601 1,873 1,873<br />

PLUS + + +<br />

Dem<strong>and</strong> from Existing Renter Households -<br />

Subst<strong>and</strong>ard Housing 41 48 48<br />

PLUS + + +<br />

Dem<strong>and</strong> from Existing Renter Housholds -<br />

Rent Overburdened Households 3430 4013 4013<br />

PLUS + + +<br />

Secondary Market Dem<strong>and</strong> adjustment IF<br />

ANY Subject to 15% Limitation 521 609 609<br />

Sub Total 5,593 6,544 6,544<br />

Dem<strong>and</strong> from Existing Households - Elderly<br />

Homeowner Turnover (Limited to 20% where<br />

applicatble) 0 0 0<br />

Equals Total Dem<strong>and</strong> 5593 6544 6544<br />

Less - - -<br />

Supply <strong>of</strong> comparable LIHTC or Market Rate<br />

housing units built <strong>and</strong>/or planned in the<br />

<strong>project</strong>ed <strong>market</strong> between 2000 <strong>and</strong> the<br />

present 0 0 0<br />

Equals Net Dem<strong>and</strong> 5,593 6,544 6,544