a market conditions and project evaluation summary of - Georgia ...

a market conditions and project evaluation summary of - Georgia ...

a market conditions and project evaluation summary of - Georgia ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Allen Wilson Phase III, Decatur, GA; Market Study<br />

households in the PMA. The Decatur Housing Authority currently has 2,500 applicants on the<br />

waiting list who are pre-qualified for the Subject’s units.<br />

Analysis <strong>of</strong> “Market Rents”<br />

Per DCA’s <strong>market</strong> study guidelines, “average <strong>market</strong> rent is to be a reflection <strong>of</strong> rents that are<br />

achieved in the <strong>market</strong>. In other words, the rents the competitive properties are currently receiving.<br />

Average <strong>market</strong> rent is not “Achievable unrestricted <strong>market</strong> rent.” In an urban <strong>market</strong> with many tax<br />

credit comps, the average <strong>market</strong> rent might be the weighted average <strong>of</strong> those tax credit comps. In<br />

cases where there are few tax credit comps, but many <strong>market</strong> rate comps with similar unit designs<br />

<strong>and</strong> amenity packages, then the average <strong>market</strong> rent might be the weighted average <strong>of</strong> those <strong>market</strong><br />

rate comps. In a small rural <strong>market</strong> there may be neither tax credit comps nor <strong>market</strong> rate comps with<br />

similar positioning as the subject. In a case like that the average <strong>market</strong> rent would be a weighted<br />

average <strong>of</strong> whatever rents were present in the <strong>market</strong>.”<br />

When comparing the Subject’s rents to the average <strong>market</strong> rent, we have not included rents at<br />

lower AMI levels given that this artificially lowers the average <strong>market</strong> rent as those rents are<br />

constricted. Including rents at lower AMI levels does reflect an accurate average rent for rents at<br />

higher income levels. For example, if the Subject <strong>of</strong>fers 50 <strong>and</strong> 60 percent AMI rents <strong>and</strong> there<br />

is a distinct difference at comparable properties between rents at the two AMI levels, we have<br />

not included the 50 percent AMI rents in the average <strong>market</strong> rent for the 60 percent AMI<br />

comparison.<br />

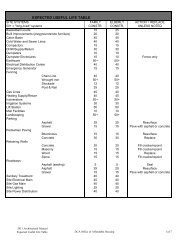

The overall average <strong>and</strong> the maximum <strong>and</strong> minimum adjusted rents for the <strong>market</strong> properties<br />

surveyed are illustrated in the table below in comparison with net rents for the Subject.<br />

Subject Comparison To Market Rents<br />

Surveyed Surveyed Surveyed Subject Rent<br />

Unit Type Subject Min Max Average Advantage<br />

1 BR 50% BOI $516 $1,295 $765 N/Ap<br />

2 BR 50% BOI $565 $1,595 $822 N/Ap<br />

3 BR 50% BOI $725 $1,479 $896 N/Ap<br />

1 BR 60% BOI $516 $1,295 $779 N/Ap<br />

2 BR 60% BOI $565 $1,595 $867 N/Ap<br />

3 BR 60% BOI $743 $1,479 $940 N/Ap<br />

The Subject will operate with 100 percent public housing subsidy <strong>and</strong> therefore will have a rental<br />

advantage over the comparables that do not <strong>of</strong>fer a subsidy.<br />

9. LIHTC Competition – Recent Allocations within Two Miles<br />

According to information on <strong>Georgia</strong> Department <strong>of</strong> Community Affairs LIHTC allocation lists,<br />

Retreat at Edgewood II was allocated tax credits in 2010 <strong>and</strong> is currently under construction.<br />

This property will contain 40 units <strong>and</strong> will be located approximately 3.0 miles from the Subject<br />

site. The following table illustrates the proposed rents <strong>and</strong> unit mix for the property.<br />

Novogradac & Company, LLP 97