Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

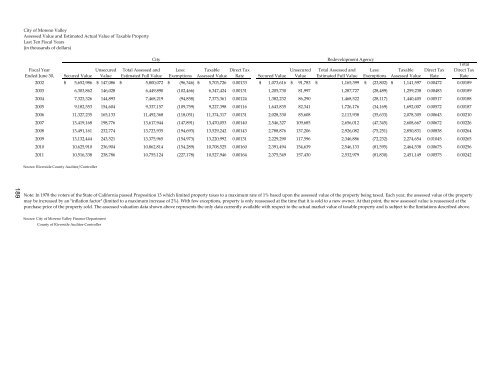

189<br />

City of <strong>Moreno</strong> <strong>Valley</strong><br />

Assessed Value and Estimated Actual Value of Taxable Property<br />

Last Ten Fiscal Years<br />

(in thousands of dollars)<br />

Fiscal Year<br />

Ended June 30, Secured Value<br />

Unsecured<br />

Value<br />

Total Assessed and<br />

Estimated Full Value<br />

Less:<br />

Exemptions<br />

Taxable Direct Tax<br />

Assessed Value Rate Secured Value<br />

Unsecured<br />

Value<br />

Total Assessed and<br />

Estimated Full Value<br />

Less:<br />

Exemptions<br />

Taxable<br />

Assessed Value<br />

2002 $ 5,652,986 $ 147,086 $ 5,800,072 $ (96,346) $ 5,703,726 0.00133 $ 1,073,616 $ 91,783 $ 1,165,399 $ (23,802) $ 1,141,597 0.00472 0.00189<br />

2003 6,303,862 146,028<br />

6,449,890 (102,466) 6,347,424 0.00131 1,205,730 81,997<br />

1,287,727 (28,489) 1,259,238 0.00483 0.00189<br />

2004 7,323,326 144,893<br />

7,468,219 (94,858) 7,373,361 0.00124 1,382,232 86,290<br />

1,468,522 (28,117) 1,440,405 0.00517 0.00188<br />

2005 9,182,553 154,604<br />

9,337,157 (109,759) 9,227,398 0.00116 1,643,835 82,341<br />

1,726,176 (34,169) 1,692,007 0.00572 0.00187<br />

2006 11,327,235 165,133<br />

11,492,368 (118,051) 11,374,317 0.00131 2,028,330 85,608<br />

2,113,938 (35,633) 2,078,305 0.00643 0.00210<br />

2007 13,419,168 198,776<br />

13,617,944 (147,891) 13,470,053 0.00140 2,546,327 109,685<br />

2,656,012 (47,345) 2,608,667 0.00672 0.00226<br />

2008 13,491,161 232,774<br />

13,723,935 (194,693) 13,529,242 0.00143 2,788,876 137,206<br />

2,926,082 (75,251) 2,850,831 0.00838 0.00264<br />

2009 13,132,444 243,521<br />

13,375,965 (154,973) 13,220,992 0.00131 2,229,290 117,596<br />

2,346,886 (72,232) 2,274,654 0.01045 0.00265<br />

2010 10,625,910 236,904<br />

10,862,814 (154,289) 10,708,525 0.00160 2,391,494 154,639<br />

2,546,133 (81,595) 2,464,538 0.00675 0.00256<br />

2011 10,516,338 238,786<br />

10,755,124 (227,178) 10,527,946 0.00164 2,375,549 157,430<br />

2,532,979 (81,830) 2,451,149 0.00575 0.00242<br />

Source: Riverside County Auditor/Controller<br />

Source: City of <strong>Moreno</strong> <strong>Valley</strong> Finance Department<br />

County of Riverside Auditor-Controller<br />

City Redevelopment Agency<br />

Note: In 1978 the voters of the State of California passed Proposition 13 which limited property taxes to a maximum rate of 1% based upon the assessed value of the property being taxed. Each year, the assessed value of the property<br />

may be increased by an "inflation factor" (limited to a maximum increase of 2%). With few exceptions, property is only reassessed at the time that it is sold to a new owner. At that point, the new assessed value is reassessed at the<br />

purchase price of the property sold. The assessed valuation data shown above represents the only data currently available with respect to the actual market value of taxable property and is subject to the limitations described above.<br />

Direct Tax<br />

Rate<br />

Total<br />

Direct Tax<br />

Rate