Debt Service Fund Community Redevelopment Nonmajor Total Agency Debt Governmental Governmental Service Funds Funds $ 6,500,538 $ 8,325 $ 22,699,683 Revenues: Taxes: Property taxes - - 13,055,796 Property taxes in lieu - - 15,317,439 Utility taxes 994,015 - 12,277,450 Sales taxes - 190,183 8,413,326 Other taxes - - 1,532,514 Licenses and permits 1,090,264 25,531,615 27,591,342 Intergovernmental - 1,779,260 21,497,689 Charges for services 511,926 763,445 7,027,197 Use of money and property - - 833,799 Fines and forfeitures 2,686,000 660,410 4,251,577 Miscellaneous 11,782,743 28,933,238 134,497,812 Total Revenues 3,163,638 505,026 14,504,781 Expenditures: Current: General government - 863,652 58,152,125 Public safety - 4,825,884 17,181,128 Community development - 66,712,713 712 713 23 23,006,061 006 061 Community and cultural - 11,604,583 15,018,071 Public works - 15,685,059 15,759,712 Capital outlay Debt service: 417,581 11,306,440 11,724,021 Principal retirement 4,988,816 3,356,268 8,345,084 Interest and fiscal charges 8,570,035 3,212,708 - (2,881,220) - - (2,881,220) 331,488 (33,335,207) - (33,335,207) 54,859,625 (25,926,387) 16,038,077 (9,441,025) 7,615,500 (167,736) 14,044,816 (11,881,571) 70,186,868 (243,259) 69,943,609 163,690,983 (29,193,171) 18,994,235 (19,012,256) 7,615,500 (167,736) 7,429,743 (21,763,428) 188,899,410 (243,259) 188,656,151 Total Expenditures Excess (Deficiency) of Revenues Over (Under) Expenditures Other Financing Sources (Uses): Transfers in (note 7) Transfers out (note 7) Refunding bonds issued Refunding bonds issuance cost Total Other Financing Sources (Uses) Net Change in Fund Balances Fund Balances, Beginning of Year, as previously reported Restatements (note 10) Fund Balances, Beginning of Year, as restated $ (33,003,719) $ 58,062,038 $ 166,892,723 Fund Balances, End of Year See Notes to <strong>Financial</strong> Statements 25

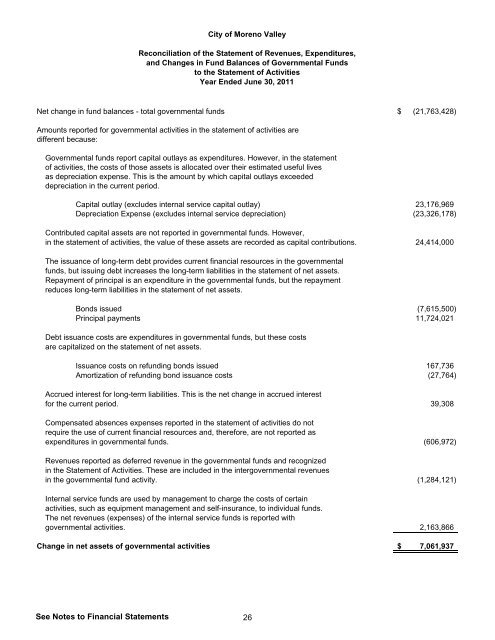

City of <strong>Moreno</strong> <strong>Valley</strong> Reconciliation of the Statement of Revenues, Expenditures, and Changes in Fund Balances of Governmental Funds to the Statement of Activities Year Ended June 30, 2011 Net change in fund balances - total governmental funds $ (21,763,428) Amounts reported for governmental activities in the statement of activities are different because: Governmental funds report capital outlays as expenditures. However, in the statement of activities, the costs of those assets is allocated over their estimated useful lives as depreciation expense. This is the amount by which capital outlays exceeded depreciation in the current period. Capital outlay (excludes internal service capital outlay) 23,176,969 Depreciation Expense (excludes internal service depreciation) (23,326,178) Contributed capital assets are not reported in governmental funds. However, in the statement of activities, the value of these assets are recorded as capital contributions. 24,414,000 The issuance of long-term debt provides current financial resources in the governmental funds, but issuing debt increases the long-term liabilities in the statement of net assets. Repayment of principal is an expenditure in the governmental funds, but the repayment reduces long-term liabilities in the statement of net assets. Bonds issued (7,615,500) Principal payments 11,724,021 Debt issuance costs are expenditures in governmental funds, but these costs are capitalized on the statement of net assets. Issuance costs on refunding bonds issued 167,736 Amortization of refunding bond issuance costs (27,764) Accrued interest for long-term liabilities. This is the net change in accrued interest for the current period. 39,308 Compensated absences expenses reported in the statement of activities do not require the use of current financial resources and, therefore, are not reported as expenditures in governmental funds. (606,972) Revenues reported as deferred revenue in the governmental funds and recognized in the Statement of Activities. These are included in the intergovernmental revenues in the governmental fund activity. (1,284,121) Internal service funds are used by management to charge the costs of certain activities, such as equipment management and self-insurance, to individual funds. The net revenues (expenses) of the internal service funds is reported with governmental activities. 2,163,866 Change in net assets of governmental activities $ 7,061,937 See Notes to <strong>Financial</strong> Statements 26

- Page 1 and 2: Comprehensive Annual Financial Repo

- Page 3 and 4: INTRODUCTORY SECTION City of Moreno

- Page 5 and 6: City of Moreno Valley Comprehensive

- Page 7: Introductory Section

- Page 10 and 11: iii

- Page 12: City of Moreno Valley Organization

- Page 15 and 16: Brandon W. Burrows, CPA David E. Ha

- Page 17 and 18: Management’s Discussion and Analy

- Page 19 and 20: Fiduciary funds. Fiduciary funds ar

- Page 21 and 22: Charges for services increased $4.5

- Page 23 and 24: Millions As illustrated in the Tabl

- Page 25 and 26: At June 30, 2011, the City’s busi

- Page 27: While new office and industrial dev

- Page 30 and 31: City of Moreno Valley Statement of

- Page 32: Net (Expenses) Revenues and Changes

- Page 35 and 36: City of Moreno Valley Balance Sheet

- Page 38 and 39: City of Moreno Valley Reconciliatio

- Page 42 and 43: Revenues: Taxes: City of Moreno Val

- Page 44: City of Moreno Valley Budgetary Com

- Page 47 and 48: Assets: Current: Governmental Activ

- Page 49 and 50: City of Moreno Valley Statement of

- Page 51 and 52: City of Moreno Valley Statement of

- Page 53 and 54: City of Moreno Valley Notes to Fina

- Page 55 and 56: City of Moreno Valley Notes to Fina

- Page 57 and 58: City of Moreno Valley Notes to Fina

- Page 59 and 60: City of Moreno Valley Notes to Fina

- Page 61 and 62: City of Moreno Valley Notes to Fina

- Page 63 and 64: Note 3: Cash and Investments (Conti

- Page 65 and 66: Note 3: Cash and Investments (Conti

- Page 67 and 68: Note 5: Capital Assets (Continued)

- Page 69 and 70: Note 6: Long Term Debt (Continued)

- Page 71 and 72: Note 6: Long Term Debt (Continued)

- Page 73 and 74: Note 6: Long Term Debt (Continued)

- Page 75 and 76: Note 6: Long Term Debt (Continued)

- Page 77 and 78: Note 6: Long Term Debt (Continued)

- Page 79 and 80: City of Moreno Valley Notes to Fina

- Page 81 and 82: Note 8: Employee Pension Plan (Cont

- Page 83 and 84: City of Moreno Valley Notes to Fina

- Page 85 and 86: Note 13: Commitments and Contingenc

- Page 87 and 88: City of Moreno Valley Notes to Fina

- Page 89 and 90: Non‐Major Governmental Funds

- Page 91 and 92:

NONMAJOR GOVERNMENTAL FUNDS (CONTIN

- Page 93 and 94:

NONMAJOR GOVERNMENTAL FUNDS (CONTIN

- Page 95 and 96:

NONMAJOR GOVERNMENTAL FUNDS (CONTIN

- Page 97 and 98:

City of Moreno Valley Combining Bal

- Page 99 and 100:

City of Moreno Valley Combining Bal

- Page 101 and 102:

City of Moreno Valley Combining Bal

- Page 103 and 104:

City of Moreno Valley Combining Bal

- Page 105 and 106:

City of Moreno Valley Combining Bal

- Page 107 and 108:

City of Moreno Valley Combining Bal

- Page 109 and 110:

City of Moreno Valley Combining Bal

- Page 111 and 112:

City of Moreno Valley Combining Bal

- Page 113 and 114:

City of Moreno Valley Combining Bal

- Page 115 and 116:

City of Moreno Valley Combining Sta

- Page 117 and 118:

Revenues: Taxes City of Moreno Vall

- Page 119 and 120:

Revenues: Taxes City of Moreno Vall

- Page 121 and 122:

Revenues: Taxes City of Moreno Vall

- Page 123 and 124:

City of Moreno Valley Combining Sta

- Page 125 and 126:

Revenues: Taxes City of Moreno Vall

- Page 127 and 128:

Revenues: Taxes City of Moreno Vall

- Page 129 and 130:

Revenues: Taxes City of Moreno Vall

- Page 131 and 132:

Revenues: Taxes City of Moreno Vall

- Page 133 and 134:

City of Moreno Valley Budgetary Com

- Page 135 and 136:

City of Moreno Valley Budgetary Com

- Page 137 and 138:

City of Moreno Valley Budgetary Com

- Page 139 and 140:

City of Moreno Valley Budgetary Com

- Page 141 and 142:

City of Moreno Valley Budgetary Com

- Page 143 and 144:

City of Moreno Valley Budgetary Com

- Page 145 and 146:

City of Moreno Valley Budgetary Com

- Page 147 and 148:

City of Moreno Valley Budgetary Com

- Page 149 and 150:

City of Moreno Valley Budgetary Com

- Page 151 and 152:

City of Moreno Valley Budgetary Com

- Page 153 and 154:

City of Moreno Valley Budgetary Com

- Page 155 and 156:

City of Moreno Valley Budgetary Com

- Page 157 and 158:

City of Moreno Valley Budgetary Com

- Page 159 and 160:

City of Moreno Valley Budgetary Com

- Page 161 and 162:

Expenditures Current: City of Moren

- Page 163 and 164:

Revenues: Taxes: City of Moreno Val

- Page 165 and 166:

Expenditures Current: City of Moren

- Page 167 and 168:

City of Moreno Valley Budgetary Com

- Page 169 and 170:

Revenues: Taxes: City of Moreno Val

- Page 171 and 172:

Expenditures: Debt service: City of

- Page 173 and 174:

City of Moreno Valley Budgetary Com

- Page 175 and 176:

Revenues: Taxes: City of Moreno Val

- Page 177 and 178:

City of Moreno Valley Budgetary Com

- Page 179 and 180:

General Liability Insurance Fund IN

- Page 181 and 182:

Equipment Equipment Replacement Mai

- Page 183 and 184:

Equipment Equipment Replacement Mai

- Page 185 and 186:

Equipment Equipment Replacement Mai

- Page 187 and 188:

Agency Funds

- Page 189 and 190:

City of Moreno Valley Combining Bal

- Page 191 and 192:

Deposit Liability Balance Balance 7

- Page 193 and 194:

174

- Page 195 and 196:

175

- Page 197 and 198:

Vehicles Infrastructure Total $ 84,

- Page 199 and 200:

Statistical Section

- Page 201 and 202:

180 City of Moreno Valley Net Asset

- Page 203 and 204:

182 City of Moreno Valley Change in

- Page 205 and 206:

184 City of Moreno Valley Fund Bala

- Page 207 and 208:

186 City of Moreno Valley Changes i

- Page 209 and 210:

188 City of Moreno Valley Key Reven

- Page 211 and 212:

190 City of Moreno Valley Property

- Page 213 and 214:

192 City of Moreno Valley Property

- Page 215 and 216:

194 City of Moreno Valley Legal Deb

- Page 217 and 218:

196 City of Moreno Valley Ratio of

- Page 219 and 220:

198 City of Moreno Valley Demograph

- Page 221 and 222:

City of Moreno Valley Full-time and

- Page 223 and 224:

City of Moreno Valley Operating Ind

- Page 225 and 226:

COMMUNITY REDEVELOPMENT AGENCY OF T

- Page 228 and 229:

Brandon W. Burrows, CPA David E. Ha

- Page 230 and 231:

Brandon W. Burrows, CPA David E. Ha

- Page 232 and 233:

Governmental Activities Assets: Poo

- Page 234 and 235:

Community Redevelopment Agency of t

- Page 236 and 237:

Community Redevelopment Agency of t

- Page 238 and 239:

COMMUNITY REDEVELOPMENT AGENCY CITY

- Page 240 and 241:

COMMUNITY REDEVELOPMENT AGENCY CITY

- Page 242 and 243:

COMMUNITY REDEVELOPMENT AGENCY CITY

- Page 244 and 245:

COMMUNITY REDEVELOPMENT AGENCY CITY

- Page 246 and 247:

COMMUNITY REDEVELOPMENT AGENCY CITY

- Page 248 and 249:

COMMUNITY REDEVELOPMENT AGENCY CITY

- Page 250 and 251:

COMMUNITY REDEVELOPMENT AGENCY CITY

- Page 252 and 253:

Tax Increment Fund 2007 TABS, Serie

- Page 254 and 255:

Tax 2007 TABS, 2007 Tabs, Increment

- Page 256 and 257:

Community Services District City of

- Page 258 and 259:

FINANCIAL SECTION City of Moreno Va

- Page 260 and 261:

Board of Directors City of Moreno V

- Page 262 and 263:

Functions/Programs Primary Governme

- Page 264 and 265:

Special Revenue Funds Nonmajor Tota

- Page 266 and 267:

Revenues: Taxes: City of Moreno Val

- Page 268 and 269:

City of Moreno Valley, California C

- Page 270 and 271:

Revenues: Taxes: City of Moreno Val

- Page 272 and 273:

Revenues: Taxes: City of Moreno Val

- Page 274 and 275:

City of Moreno Valley, California C

- Page 276 and 277:

City of Moreno Valley, California C

- Page 278 and 279:

Note 2: Cash and Investments (Conti

- Page 280 and 281:

City of Moreno Valley, California C

- Page 282 and 283:

Revenues: Taxes: City of Moreno Val

- Page 284 and 285:

Revenues: Taxes: City of Moreno Val

- Page 286 and 287:

City of Moreno Valley, California C

- Page 288:

City of Moreno Valley, California C