The Best Beer Company in a Better World - Anheuser-Busch InBev

The Best Beer Company in a Better World - Anheuser-Busch InBev

The Best Beer Company in a Better World - Anheuser-Busch InBev

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

F<strong>in</strong>ancial Report Annual Report 2008 | 97<br />

S<strong>in</strong>ce the acceptance period of the options is 2 months, the fair value was determ<strong>in</strong>ed as the average of the fair values calculated on a weekly<br />

basis dur<strong>in</strong>g the two months offer period.<br />

Expected volatility is based on historical volatility calculated us<strong>in</strong>g 1 068 days of historical data. <strong>The</strong> Hull b<strong>in</strong>omial model assumes that all<br />

employees would immediately exercise their options if the AB <strong>InBev</strong> share price is 2.5 times above the exercise price. As a result, no s<strong>in</strong>gle<br />

expected option life applies.<br />

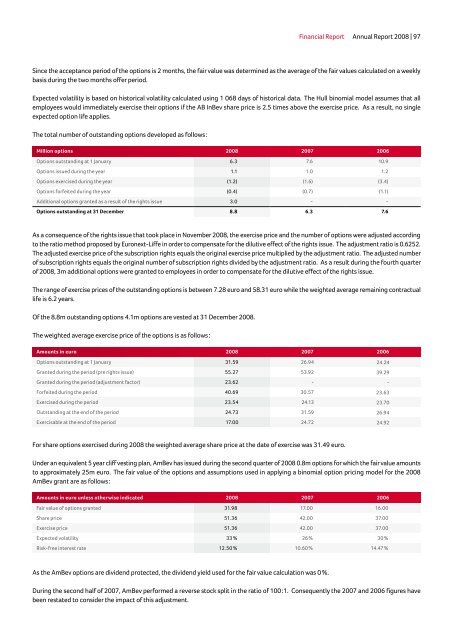

<strong>The</strong> total number of outstand<strong>in</strong>g options developed as follows :<br />

Million options 2008 2007 2006<br />

Options outstand<strong>in</strong>g at 1 January 6.3 7.6 10.9<br />

Options issued dur<strong>in</strong>g the year 1.1 1.0 1.2<br />

Options exercised dur<strong>in</strong>g the year (1.2) (1.6) (3.4)<br />

Options forfeited dur<strong>in</strong>g the year (0.4) (0.7) (1.1)<br />

Additional options granted as a result of the rights issue 3.0 - -<br />

Options outstand<strong>in</strong>g at 31 December 8.8 6.3 7.6<br />

As a consequence of the rights issue that took place <strong>in</strong> November 2008, the exercise price and the number of options were adjusted accord<strong>in</strong>g<br />

to the ratio method proposed by Euronext-Liffe <strong>in</strong> order to compensate for the dilutive effect of the rights issue. <strong>The</strong> adjustment ratio is 0.6252.<br />

<strong>The</strong> adjusted exercise price of the subscription rights equals the orig<strong>in</strong>al exercise price multiplied by the adjustment ratio. <strong>The</strong> adjusted number<br />

of subscription rights equals the orig<strong>in</strong>al number of subscription rights divided by the adjustment ratio. As a result dur<strong>in</strong>g the fourth quarter<br />

of 2008, 3m additional options were granted to employees <strong>in</strong> order to compensate for the dilutive effect of the rights issue.<br />

<strong>The</strong> range of exercise prices of the outstand<strong>in</strong>g options is between 7.28 euro and 58.31 euro while the weighted average rema<strong>in</strong><strong>in</strong>g contractual<br />

life is 6.2 years.<br />

Of the 8.8m outstand<strong>in</strong>g options 4.1m options are vested at 31 December 2008.<br />

<strong>The</strong> weighted average exercise price of the options is as follows :<br />

Amounts <strong>in</strong> euro 2008 2007 2006<br />

Options outstand<strong>in</strong>g at 1 January 31.59 26.94 24.24<br />

Granted dur<strong>in</strong>g the period (pre rights issue) 55.27 53.92 39.29<br />

Granted dur<strong>in</strong>g the period (adjustment factor) 23.62 - -<br />

Forfeited dur<strong>in</strong>g the period 40.69 30.57 23.63<br />

Exercised dur<strong>in</strong>g the period 23.54 24.13 23.70<br />

Outstand<strong>in</strong>g at the end of the period 24.73 31.59 26.94<br />

Exercisable at the end of the period 17.00 24.72 24.92<br />

For share options exercised dur<strong>in</strong>g 2008 the weighted average share price at the date of exercise was 31.49 euro.<br />

Under an equivalent 5 year cliff vest<strong>in</strong>g plan, AmBev has issued dur<strong>in</strong>g the second quarter of 2008 0.8m options for which the fair value amounts<br />

to approximately 25m euro. <strong>The</strong> fair value of the options and assumptions used <strong>in</strong> apply<strong>in</strong>g a b<strong>in</strong>omial option pric<strong>in</strong>g model for the 2008<br />

AmBev grant are as follows :<br />

Amounts <strong>in</strong> euro unless otherwise <strong>in</strong>dicated 2008 2007 2006<br />

Fair value of options granted 31.98 17.00 16.00<br />

Share price 51.36 42.00 37.00<br />

Exercise price 51.36 42.00 37.00<br />

Expected volatility 33 % 26 % 30 %<br />

Risk-free <strong>in</strong>terest rate 12.50 % 10.60 % 14.47 %<br />

As the AmBev options are dividend protected, the dividend yield used for the fair value calculation was 0 %.<br />

Dur<strong>in</strong>g the second half of 2007, AmBev performed a reverse stock split <strong>in</strong> the ratio of 100 :1. Consequently the 2007 and 2006 figures have<br />

been restated to consider the impact of this adjustment.