The Best Beer Company in a Better World - Anheuser-Busch InBev

The Best Beer Company in a Better World - Anheuser-Busch InBev

The Best Beer Company in a Better World - Anheuser-Busch InBev

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

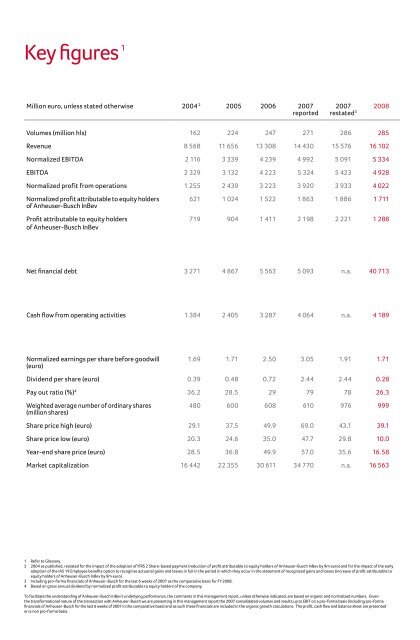

Key figures 1<br />

Million euro, unless stated otherwise 2004 2 2005 2006 2007<br />

reported<br />

04<br />

N<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

04 05 06 07 07<br />

0%<br />

3 28.6%<br />

24.7%<br />

2008<br />

31.9% 34.6% 2<br />

32.7% 33.1%<br />

1<br />

1<br />

5<br />

04 05 06 07 07<br />

0<br />

3 Volumes (million hls) 162 224 247 271 286 285<br />

Revenue 8 568 11 656 13 308 14 430 15 576 16 102<br />

Normalized EBITDA 2 116 3 339 4 239 4 992 5 091 5 334<br />

EBITDA 2 329 3 132 4 223 5 324 5 423 4 928<br />

Normalized profit from operations<br />

Normalized profit attributable to equity holders<br />

of <strong>Anheuser</strong>-<strong>Busch</strong> <strong>InBev</strong><br />

1 255 2 439 3 223<br />

621 1 024 1 522<br />

3 920<br />

1 863<br />

3 933 4 02215<br />

576 16 102<br />

14 430<br />

13 308<br />

1 886 11 656 1 711<br />

8 568<br />

Profit attributable to equity holders<br />

of <strong>Anheuser</strong>-<strong>Busch</strong> <strong>InBev</strong><br />

719 904 1 411 2 198 2 221 1 288<br />

2008<br />

Normalized EBITDA<br />

Revenue<br />

Net f<strong>in</strong>ancial debt 3 271 4 867 5 563 5 093 n.a. 40 713<br />

Percentage<br />

2007<br />

restated 3<br />

Cash flow from operat<strong>in</strong>g activities 1 384 2 405 3 287 4 064 n.a. 4 189<br />

Normalized earn<strong>in</strong>gs per share before goodwill<br />

(euro)<br />

2008<br />

1.69 1.71 2.50 3.05 1.91 1.71<br />

Dividend per share (euro) 0.39 0.48 0.72 2.44 2.44 0.28<br />

Pay out ratio (%) 4 36.2 28.5 29 79 78 26.3<br />

Weighted average number of ord<strong>in</strong>ary shares<br />

(million shares)<br />

480 600 608 610 976 999<br />

Share price high (euro) 29.1 37.5 49.9 69.0 43.1 39.1<br />

Share price low (euro) 20.3 24.6 35.0 47.7 29.8 10.0<br />

Year-end share price (euro) 28.5 36.8 49.9 57.0 35.6 16.58<br />

Market capitalization 16 442 22 355 30 611 34 770 n.a. 16 563<br />

1 Refer to Glossary.<br />

2 2004 as published, restated for the impact of the adoption of IFRS 2 Share-based payment (reduction of profit attributable to equity holders of <strong>Anheuser</strong>-<strong>Busch</strong> <strong>InBev</strong> by 9m euro) and for the impact of the early<br />

adoption of the IAS 19 Employee benefits option to recognize actuarial ga<strong>in</strong>s and losses <strong>in</strong> full <strong>in</strong> the period <strong>in</strong> which they occur <strong>in</strong> the statement of recognized ga<strong>in</strong>s and losses (<strong>in</strong>crease of profit attributable to<br />

equity holders of <strong>Anheuser</strong>-<strong>Busch</strong> <strong>InBev</strong> by 9m euro).<br />

3 Includ<strong>in</strong>g pro-forma f<strong>in</strong>ancials of <strong>Anheuser</strong>-<strong>Busch</strong> for the last 6 weeks of 2007 as the comparative basis for FY 2008.<br />

4 Based on gross annual dividend by normalized profit attributable to equity holders of the company.<br />

To facilitate the understand<strong>in</strong>g of <strong>Anheuser</strong>-<strong>Busch</strong> <strong>InBev</strong>’s underly<strong>in</strong>g performance, the comments <strong>in</strong> this management report, unless otherwise <strong>in</strong>dicated, are based on organic and normalized numbers. Given<br />

the transformational nature of the transaction with <strong>Anheuser</strong>-<strong>Busch</strong> we are present<strong>in</strong>g <strong>in</strong> this management report the 2007 consolidated volumes and results up to EBIT on a pro-forma basis (<strong>in</strong>clud<strong>in</strong>g pro-forma<br />

f<strong>in</strong>ancials of <strong>Anheuser</strong>-<strong>Busch</strong> for the last 6 weeks of 2007 <strong>in</strong> the comparative base) and as such these f<strong>in</strong>ancials are <strong>in</strong>cluded <strong>in</strong> the organic growth calculations. <strong>The</strong> profit, cash flow and balance sheet are presented<br />

on a non pro-forma basis.<br />

24.7%