The Best Beer Company in a Better World - Anheuser-Busch InBev

The Best Beer Company in a Better World - Anheuser-Busch InBev

The Best Beer Company in a Better World - Anheuser-Busch InBev

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

108 | Annual Report 2008 F<strong>in</strong>ancial Report<br />

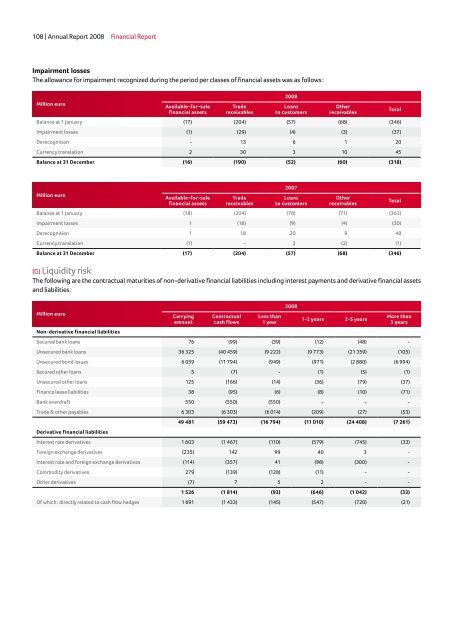

Impairment losses<br />

<strong>The</strong> allowance for impairment recognized dur<strong>in</strong>g the period per classes of f<strong>in</strong>ancial assets was as follows :<br />

Million euro<br />

Available-for-sale<br />

f<strong>in</strong>ancial assets<br />

Trade<br />

receivables<br />

2008<br />

Loans<br />

to customers<br />

Other<br />

receivables<br />

Balance at 1 January (17) (204) (57) (68) (346)<br />

Impairment losses (1) (29) (4) (3) (37)<br />

Derecognition - 13 6 1 20<br />

Currency translation 2 30 3 10 45<br />

Balance at 31 December (16) (190) (52) (60) (318)<br />

Million euro<br />

Available-for-sale<br />

f<strong>in</strong>ancial assets<br />

Trade<br />

receivables<br />

2007<br />

Loans<br />

to customers<br />

Other<br />

receivables<br />

Balance at 1 January (18) (204) (70) (71) (363)<br />

Impairment losses 1 (18) (9) (4) (30)<br />

Derecognition 1 18 20 9 48<br />

Currency translation (1) - 2 (2) (1)<br />

Balance at 31 December (17) (204) (57) (68) (346)<br />

(G) Liquidity risk<br />

<strong>The</strong> follow<strong>in</strong>g are the contractual maturities of non-derivative f<strong>in</strong>ancial liabilities <strong>in</strong>clud<strong>in</strong>g <strong>in</strong>terest payments and derivative f<strong>in</strong>ancial assets<br />

and liabilities :<br />

Million euro<br />

Carry<strong>in</strong>g<br />

amount<br />

Contractual<br />

cash flows<br />

Less than<br />

1 year<br />

2008<br />

1-2 years 2-5 years<br />

Total<br />

Total<br />

More than<br />

5 years<br />

Non-derivative f<strong>in</strong>ancial liabilities<br />

Secured bank loans 76 (99) (39) (12) (48) -<br />

Unsecured bank loans 36 325 (40 459) (9 222) (9 773) (21 359) (105)<br />

Unsecured bond issues 6 059 (11 794) (949) (971) (2 880) (6 994)<br />

Secured other loans 5 (7) - (1) (5) (1)<br />

Unsecured other loans 125 (166) (14) (36) (79) (37)<br />

F<strong>in</strong>ance lease liabilities 38 (95) (6) (8) (10) (71)<br />

Bank overdraft 550 (550) (550) - - -<br />

Trade & other payables 6 303 (6 303) (6 014) (209) (27) (53)<br />

Derivative f<strong>in</strong>ancial liabilities<br />

49 481 (59 473) (16 794) (11 010) (24 408) (7 261)<br />

Interest rate derivatives 1 603 (1 467) (110) (579) (745) (33)<br />

Foreign exchange derivatives (235) 142 99 40 3 -<br />

Interest rate and foreign exchange derivatives (114) (357) 41 (98) (300) -<br />

Commodity derivatives 279 (139) (128) (11) - -<br />

Other derivatives (7) 7 5 2 - -<br />

1 526 (1 814) (93) (646) (1 042) (33)<br />

Of which : directly related to cash flow hedges 1 691 (1 433) (145) (547) (720) (21)