The Best Beer Company in a Better World - Anheuser-Busch InBev

The Best Beer Company in a Better World - Anheuser-Busch InBev

The Best Beer Company in a Better World - Anheuser-Busch InBev

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

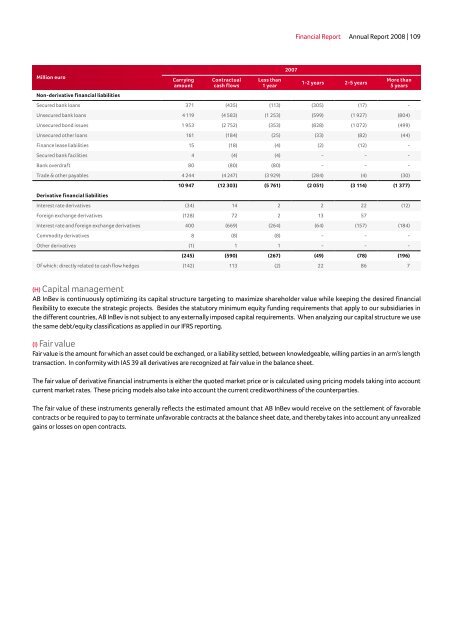

Million euro<br />

Carry<strong>in</strong>g<br />

amount<br />

Contractual<br />

cash flows<br />

Less than<br />

1 year<br />

2007<br />

F<strong>in</strong>ancial Report Annual Report 2008 | 109<br />

1-2 years 2-5 years<br />

More than<br />

5 years<br />

Non-derivative f<strong>in</strong>ancial liabilities<br />

Secured bank loans 371 (435) (113) (305) (17) -<br />

Unsecured bank loans 4 119 (4 583) (1 253) (599) (1 927) (804)<br />

Unsecured bond issues 1 953 (2 752) (353) (828) (1 072) (499)<br />

Unsecured other loans 161 (184) (25) (33) (82) (44)<br />

F<strong>in</strong>ance lease liabilities 15 (18) (4) (2) (12) -<br />

Secured bank facilities 4 (4) (4) - - -<br />

Bank overdraft 80 (80) (80) - - -<br />

Trade & other payables 4 244 (4 247) (3 929) (284) (4) (30)<br />

Derivative f<strong>in</strong>ancial liabilities<br />

10 947 (12 303) (5 761) (2 051) (3 114) (1 377)<br />

Interest rate derivatives (34) 14 2 2 22 (12)<br />

Foreign exchange derivatives (128) 72 2 13 57<br />

Interest rate and foreign exchange derivatives 400 (669) (264) (64) (157) (184)<br />

Commodity derivatives 8 (8) (8) - - -<br />

Other derivatives (1) 1 1 - - -<br />

(245) (590) (267) (49) (78) (196)<br />

Of which : directly related to cash flow hedges (142) 113 (2) 22 86 7<br />

(H) Capital management<br />

AB <strong>InBev</strong> is cont<strong>in</strong>uously optimiz<strong>in</strong>g its capital structure target<strong>in</strong>g to maximize shareholder value while keep<strong>in</strong>g the desired f<strong>in</strong>ancial<br />

flexibility to execute the strategic projects. Besides the statutory m<strong>in</strong>imum equity fund<strong>in</strong>g requirements that apply to our subsidiaries <strong>in</strong><br />

the different countries, AB <strong>InBev</strong> is not subject to any externally imposed capital requirements. When analyz<strong>in</strong>g our capital structure we use<br />

the same debt/equity classifications as applied <strong>in</strong> our IFRS report<strong>in</strong>g.<br />

(I) Fair value<br />

Fair value is the amount for which an asset could be exchanged, or a liability settled, between knowledgeable, will<strong>in</strong>g parties <strong>in</strong> an arm’s length<br />

transaction. In conformity with IAS 39 all derivatives are recognized at fair value <strong>in</strong> the balance sheet.<br />

<strong>The</strong> fair value of derivative f<strong>in</strong>ancial <strong>in</strong>struments is either the quoted market price or is calculated us<strong>in</strong>g pric<strong>in</strong>g models tak<strong>in</strong>g <strong>in</strong>to account<br />

current market rates. <strong>The</strong>se pric<strong>in</strong>g models also take <strong>in</strong>to account the current creditworth<strong>in</strong>ess of the counterparties.<br />

<strong>The</strong> fair value of these <strong>in</strong>struments generally reflects the estimated amount that AB <strong>InBev</strong> would receive on the settlement of favorable<br />

contracts or be required to pay to term<strong>in</strong>ate unfavorable contracts at the balance sheet date, and thereby takes <strong>in</strong>to account any unrealized<br />

ga<strong>in</strong>s or losses on open contracts.