The Best Beer Company in a Better World - Anheuser-Busch InBev

The Best Beer Company in a Better World - Anheuser-Busch InBev

The Best Beer Company in a Better World - Anheuser-Busch InBev

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

04 05 06 07 07<br />

0%<br />

3 28.6%<br />

24.7%<br />

2008<br />

31.9% 34.6% 20 000<br />

32.7% 33.1%<br />

15 000<br />

10 000<br />

5 000<br />

04 05 06 07 07<br />

0<br />

3 50%<br />

40%<br />

30%<br />

20%<br />

15 576 16 102<br />

14 430<br />

13 308<br />

11 656<br />

8 568<br />

10%<br />

0%<br />

04 05 06 07 07 2008<br />

3 28.6%<br />

24.7%<br />

2008<br />

31.9% 34.6% 20 000<br />

32.7% 33.1%<br />

15 000<br />

10 000<br />

5 000<br />

0<br />

04 05 06 07 073 50%<br />

40%<br />

30%<br />

15 576 16 102<br />

14 430<br />

13 308<br />

11 656<br />

8 568<br />

20%<br />

10%<br />

0%<br />

05 06 07 07<br />

2008<br />

3 28.6%<br />

2008<br />

31.9% 34.6% 32.7% 33.1%<br />

20 000<br />

15 000<br />

10 000<br />

5 000<br />

04<br />

0<br />

05 06 07 073 15 576 16 102<br />

14 430<br />

13 308<br />

11 656<br />

8 568<br />

2008<br />

Percentage<br />

Normalized Normalized EBITDA EBITDA<br />

ormalized EBITDA<br />

0 000<br />

5 000<br />

0 000<br />

000<br />

Million euro<br />

Percentage<br />

Brief overview<br />

Percentage<br />

Revenue Revenue<br />

Revenue<br />

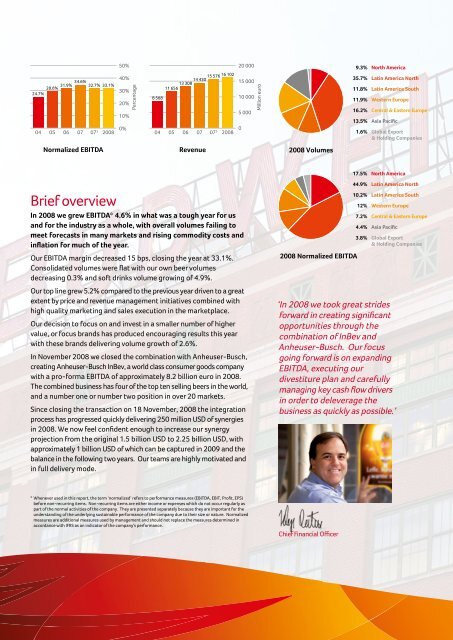

9.3% North America<br />

35.7% Lat<strong>in</strong> America North<br />

11.8% Lat<strong>in</strong> America South<br />

11.9% Western Europe<br />

In 2008 we grew EBITDA* 4.6% <strong>in</strong> 16.2% what Central was & a Eastern tough Europe year for us<br />

and for the <strong>in</strong>dustry as a whole, with 13.5% overall Asia Pacific volumes fail<strong>in</strong>g to<br />

meet forecasts <strong>in</strong> many markets and 1.6% ris<strong>in</strong>g Global Export commodity costs and<br />

<strong>in</strong>flation for much of the year.<br />

& Hold<strong>in</strong>g Companies<br />

Our EBITDA marg<strong>in</strong> 2008 Volumes decreased 15 bps, clos<strong>in</strong>g the year at 33.1%.<br />

Consolidated volumes were flat with our own beer volumes<br />

decreas<strong>in</strong>g 0.3% and soft dr<strong>in</strong>ks volume grow<strong>in</strong>g of 4.9%.<br />

Our top l<strong>in</strong>e grew 5.2% compared to the previous year driven to a great<br />

extent by price and revenue management <strong>in</strong>itiatives comb<strong>in</strong>ed with<br />

high quality market<strong>in</strong>g and sales execution <strong>in</strong> the marketplace.<br />

Our decision to focus on and <strong>in</strong>vest <strong>in</strong> a smaller number of higher<br />

value, or focus brands has produced encourag<strong>in</strong>g results this year<br />

with these brands deliver<strong>in</strong>g volume growth of 2.6%.<br />

In November 2008 we closed the comb<strong>in</strong>ation with <strong>Anheuser</strong>-<strong>Busch</strong>,<br />

creat<strong>in</strong>g <strong>Anheuser</strong>-<strong>Busch</strong> <strong>InBev</strong>, a world class consumer goods company<br />

with a pro-forma EBITDA of approximately 8.2 billion euro <strong>in</strong> 2008.<br />

<strong>The</strong> comb<strong>in</strong>ed bus<strong>in</strong>ess has four of the top ten sell<strong>in</strong>g beers <strong>in</strong> the world,<br />

and a number one or number two position <strong>in</strong> over 20 markets.<br />

S<strong>in</strong>ce clos<strong>in</strong>g the transaction on 18 November, 2008 the <strong>in</strong>tegration<br />

process has progressed quickly deliver<strong>in</strong>g 250 million USD of synergies<br />

<strong>in</strong> 2008. We now feel confident enough to <strong>in</strong>crease our synergy<br />

projection from the orig<strong>in</strong>al 1.5 billion USD to 2.25 billion USD, with<br />

approximately 1 billion USD of which can be captured <strong>in</strong> 2009 and the<br />

balance <strong>in</strong> the follow<strong>in</strong>g two years. Our teams are highly motivated and<br />

<strong>in</strong> full delivery mode.<br />

* Whenever used <strong>in</strong> this report, the term ‘normalized’ refers to performance measures (EBITDA, EBIT, Profit, EPS)<br />

before non-recurr<strong>in</strong>g items. Non-recurr<strong>in</strong>g items are either <strong>in</strong>come or expenses which do not occur regularly as<br />

part of the normal activities of the company. <strong>The</strong>y are presented separately because they are important for the<br />

understand<strong>in</strong>g of the underly<strong>in</strong>g susta<strong>in</strong>able performance of the company due to their size or nature. Normalized<br />

measures are additional measures used by management and should not replace the measures determ<strong>in</strong>ed <strong>in</strong><br />

accordance with IFRS as an <strong>in</strong>dicator of the company’s performance.<br />

Million euro<br />

Million euro<br />

Million euro<br />

2008 Volumes 2008 Volumes<br />

2008 Volumes<br />

2008 Normalized EBITDA<br />

‘In 2008 we took great strides<br />

forward <strong>in</strong> creat<strong>in</strong>g significant<br />

opportunities through the<br />

comb<strong>in</strong>ation of <strong>InBev</strong> and<br />

<strong>Anheuser</strong>-<strong>Busch</strong>. Our focus<br />

go<strong>in</strong>g forward is on expand<strong>in</strong>g<br />

EBITDA, execut<strong>in</strong>g our<br />

divestiture plan and carefully<br />

manag<strong>in</strong>g key cash flow drivers<br />

<strong>in</strong> order to deleverage the<br />

bus<strong>in</strong>ess as quickly as possible.’<br />

Chief F<strong>in</strong>ancial Officer<br />

9.3% North 9.3% America North America<br />

9.3% North America<br />

35.7% Lat<strong>in</strong> 35.7% America Lat<strong>in</strong> North America N<br />

35.7% Lat<strong>in</strong> America North<br />

11.8% Lat<strong>in</strong> 11.8% America Lat<strong>in</strong> South America So<br />

11.8% Lat<strong>in</strong> America South<br />

11.9% Western 11.9% Europe Western Europe<br />

11.9% Western Europe<br />

16.2% Central 16.2% & Central Eastern & Europe Eastern<br />

16.2% Central & Eastern Europe<br />

13.5% Asia 13.5% Pacific Asia Pacific<br />

13.5% Asia Pacific<br />

1.6% Global 1.6% Export Global Export<br />

1.6% Global Export & Hold<strong>in</strong>g & Companies Hold<strong>in</strong>g Comp<br />

& Hold<strong>in</strong>g Companies<br />

17.5% North America<br />

44.9% Lat<strong>in</strong> America North<br />

10.2% Lat<strong>in</strong> America South<br />

12% Western Europe<br />

7.2% Central & Eastern Europe<br />

4.4% Asia Pacific<br />

3.8% Global Export<br />

& Hold<strong>in</strong>g Companies