The Best Beer Company in a Better World - Anheuser-Busch InBev

The Best Beer Company in a Better World - Anheuser-Busch InBev

The Best Beer Company in a Better World - Anheuser-Busch InBev

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

92 | Annual Report 2008 F<strong>in</strong>ancial Report<br />

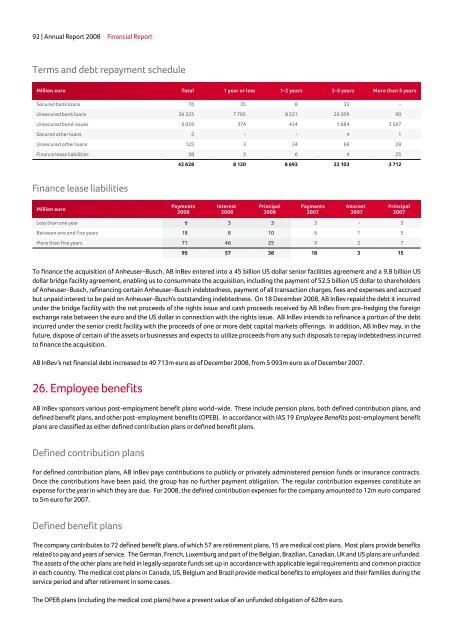

Terms and debt repayment schedule<br />

Million euro Total 1 year or less 1-2 years 2-5 years More than 5 years<br />

Secured bank loans 76 35 8 33 -<br />

Unsecured bank loans 36 325 7 705 8 221 20 309 90<br />

Unsecured bond issues 6 059 374 434 1 684 3 567<br />

Secured other loans 5 - - 4 1<br />

Unsecured other loans 125 3 24 69 29<br />

F<strong>in</strong>ance lease liabilities 38 3 6 4 25<br />

F<strong>in</strong>ance lease liabilities<br />

Million euro<br />

42 628 8 120 8 693 22 103 3 712<br />

Payments<br />

2008<br />

Interest<br />

2008<br />

Pr<strong>in</strong>cipal<br />

2008<br />

Payments<br />

2007<br />

Interest<br />

2007<br />

Less than one year 6 3 3 3 - 3<br />

Between one and five years 18 8 10 6 1 5<br />

More than five years 71 46 25 9 2 7<br />

Pr<strong>in</strong>cipal<br />

2007<br />

95 57 38 18 3 15<br />

To f<strong>in</strong>ance the acquisition of <strong>Anheuser</strong>-<strong>Busch</strong>, AB <strong>InBev</strong> entered <strong>in</strong>to a 45 billion US dollar senior facilities agreement and a 9.8 billion US<br />

dollar bridge facility agreement, enabl<strong>in</strong>g us to consummate the acquisition, <strong>in</strong>clud<strong>in</strong>g the payment of 52.5 billion US dollar to shareholders<br />

of <strong>Anheuser</strong>-<strong>Busch</strong>, ref<strong>in</strong>anc<strong>in</strong>g certa<strong>in</strong> <strong>Anheuser</strong>-<strong>Busch</strong> <strong>in</strong>debtedness, payment of all transaction charges, fees and expenses and accrued<br />

but unpaid <strong>in</strong>terest to be paid on <strong>Anheuser</strong>-<strong>Busch</strong>’s outstand<strong>in</strong>g <strong>in</strong>debtedness. On 18 December 2008, AB <strong>InBev</strong> repaid the debt it <strong>in</strong>curred<br />

under the bridge facility with the net proceeds of the rights issue and cash proceeds received by AB <strong>InBev</strong> from pre-hedg<strong>in</strong>g the foreign<br />

exchange rate between the euro and the US dollar <strong>in</strong> connection with the rights issue. AB <strong>InBev</strong> <strong>in</strong>tends to ref<strong>in</strong>ance a portion of the debt<br />

<strong>in</strong>curred under the senior credit facility with the proceeds of one or more debt capital markets offer<strong>in</strong>gs. In addition, AB <strong>InBev</strong> may, <strong>in</strong> the<br />

future, dispose of certa<strong>in</strong> of the assets or bus<strong>in</strong>esses and expects to utilize proceeds from any such disposals to repay <strong>in</strong>debtedness <strong>in</strong>curred<br />

to f<strong>in</strong>ance the acquisition.<br />

AB <strong>InBev</strong>’s net f<strong>in</strong>ancial debt <strong>in</strong>creased to 40 713m euro as of December 2008, from 5 093m euro as of December 2007.<br />

26. Employee benefits<br />

AB <strong>InBev</strong> sponsors various post-employment benefit plans world-wide. <strong>The</strong>se <strong>in</strong>clude pension plans, both def<strong>in</strong>ed contribution plans, and<br />

def<strong>in</strong>ed benefit plans, and other post-employment benefits (OPEB). In accordance with IAS 19 Employee Benefits post-employment benefit<br />

plans are classified as either def<strong>in</strong>ed contribution plans or def<strong>in</strong>ed benefit plans.<br />

Def<strong>in</strong>ed contribution plans<br />

For def<strong>in</strong>ed contribution plans, AB <strong>InBev</strong> pays contributions to publicly or privately adm<strong>in</strong>istered pension funds or <strong>in</strong>surance contracts.<br />

Once the contributions have been paid, the group has no further payment obligation. <strong>The</strong> regular contribution expenses constitute an<br />

expense for the year <strong>in</strong> which they are due. For 2008, the def<strong>in</strong>ed contribution expenses for the company amounted to 12m euro compared<br />

to 5m euro for 2007.<br />

Def<strong>in</strong>ed benefit plans<br />

<strong>The</strong> company contributes to 72 def<strong>in</strong>ed benefit plans, of which 57 are retirement plans, 15 are medical cost plans. Most plans provide benefits<br />

related to pay and years of service. <strong>The</strong> German, French, Luxemburg and part of the Belgian, Brazilian, Canadian, UK and US plans are unfunded.<br />

<strong>The</strong> assets of the other plans are held <strong>in</strong> legally separate funds set up <strong>in</strong> accordance with applicable legal requirements and common practice<br />

<strong>in</strong> each country. <strong>The</strong> medical cost plans <strong>in</strong> Canada, US, Belgium and Brazil provide medical benefits to employees and their families dur<strong>in</strong>g the<br />

service period and after retirement <strong>in</strong> some cases.<br />

<strong>The</strong> OPEB plans (<strong>in</strong>clud<strong>in</strong>g the medical cost plans) have a present value of an unfunded obligation of 628m euro.