The Best Beer Company in a Better World - Anheuser-Busch InBev

The Best Beer Company in a Better World - Anheuser-Busch InBev

The Best Beer Company in a Better World - Anheuser-Busch InBev

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

106 | Annual Report 2008 F<strong>in</strong>ancial Report<br />

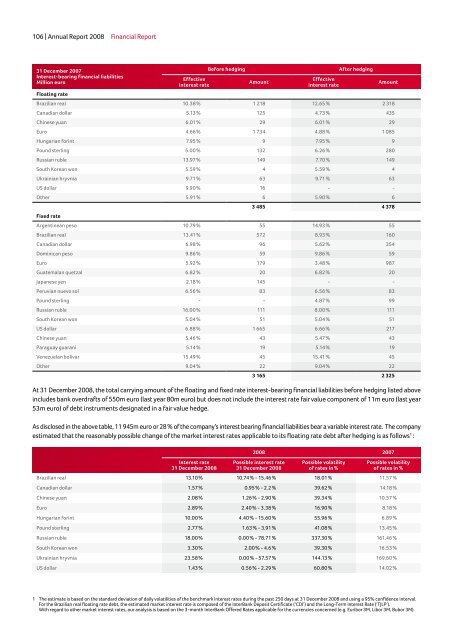

31 December 2007<br />

Interest-bear<strong>in</strong>g f<strong>in</strong>ancial liabilities<br />

Million euro<br />

Effective<br />

<strong>in</strong>terest rate<br />

Before hedg<strong>in</strong>g After hedg<strong>in</strong>g<br />

Amount<br />

Effective<br />

<strong>in</strong>terest rate<br />

Float<strong>in</strong>g rate<br />

Brazilian real 10.38 % 1 218 12.65 % 2 318<br />

Canadian dollar 5.13 % 125 4.73 % 435<br />

Ch<strong>in</strong>ese yuan 6.01 % 29 6.01 % 29<br />

Euro 4.66 % 1 734 4.88 % 1 085<br />

Hungarian for<strong>in</strong>t 7.95 % 9 7.95 % 9<br />

Pound sterl<strong>in</strong>g 5.00 % 132 6.26 % 280<br />

Russian ruble 13.97 % 149 7.70 % 149<br />

South Korean won 5.59 % 4 5.59 % 4<br />

Ukra<strong>in</strong>ian hryvnia 9.71 % 63 9.71 % 63<br />

US dollar 9.90 % 16 - -<br />

Other 5.91 % 6 5.90 % 6<br />

Fixed rate<br />

3 485 4 378<br />

Argent<strong>in</strong>ean peso 10.79 % 55 14.93 % 55<br />

Brazilian real 13.41 % 572 8.93 % 160<br />

Canadian dollar 6.98 % 96 5.62 % 354<br />

Dom<strong>in</strong>ican peso 9.86 % 59 9.86 % 59<br />

Euro 5.92 % 179 3.48 % 987<br />

Guatemalan quetzal 6.82 % 20 6.82 % 20<br />

Japanese yen 2.18 % 145 - -<br />

Peruvian nuevo sol 6.56 % 83 6.56 % 83<br />

Pound sterl<strong>in</strong>g - - 4.87 % 99<br />

Russian ruble 16.00 % 111 8.00 % 111<br />

South Korean won 5.04 % 51 5.04 % 51<br />

US dollar 6.88 % 1 665 6.66 % 217<br />

Ch<strong>in</strong>ese yuan 5.46 % 43 5.47 % 43<br />

Paraguay guarani 5.14 % 19 5.14 % 19<br />

Venezuelan bolivar 15.49 % 45 15.41 % 45<br />

Other 9.04 % 22 9.04 % 22<br />

3 165 2 325<br />

At 31 December 2008, the total carry<strong>in</strong>g amount of the float<strong>in</strong>g and fixed rate <strong>in</strong>terest-bear<strong>in</strong>g f<strong>in</strong>ancial liabilities before hedg<strong>in</strong>g listed above<br />

<strong>in</strong>cludes bank overdrafts of 550m euro (last year 80m euro) but does not <strong>in</strong>clude the <strong>in</strong>terest rate fair value component of 11m euro (last year<br />

53m euro) of debt <strong>in</strong>struments designated <strong>in</strong> a fair value hedge.<br />

As disclosed <strong>in</strong> the above table, 11 945m euro or 28 % of the company’s <strong>in</strong>terest bear<strong>in</strong>g f<strong>in</strong>ancial liabilities bear a variable <strong>in</strong>terest rate. <strong>The</strong> company<br />

estimated that the reasonably possible change of the market <strong>in</strong>terest rates applicable to its float<strong>in</strong>g rate debt after hedg<strong>in</strong>g is as follows 1 :<br />

Interest rate<br />

31 December 2008<br />

Amount<br />

2008 2007<br />

Possible <strong>in</strong>terest rate<br />

31 December 2008<br />

Possible volatility<br />

of rates <strong>in</strong> %<br />

Possible volatility<br />

of rates <strong>in</strong> %<br />

Brazilian real 13.10 % 10.74 % - 15.46 % 18.01 % 11.57 %<br />

Canadian dollar 1.57 % 0.95 % - 2.2 % 39.62 % 14.18 %<br />

Ch<strong>in</strong>ese yuan 2.08 % 1.26 % - 2.90 % 39.34 % 10.57 %<br />

Euro 2.89 % 2.40 % - 3.38 % 16.90 % 8.18 %<br />

Hungarian for<strong>in</strong>t 10.00 % 4.40 % - 15.60 % 55.96 % 6.89 %<br />

Pound sterl<strong>in</strong>g 2.77 % 1.63 % - 3.91 % 41.08 % 13.45 %<br />

Russian ruble 18.00 % 0.00 % - 78.71 % 337.30 % 161.46 %<br />

South Korean won 3.30 % 2.00 % - 4.6 % 39.30 % 16.53 %<br />

Ukra<strong>in</strong>ian hryvnia 23.58 % 0.00 % - 57.57 % 144.13 % 169.60 %<br />

US dollar 1.43 % 0.56 % - 2.29 % 60.80 % 14.02 %<br />

1 <strong>The</strong> estimate is based on the standard deviation of daily volatilities of the benchmark <strong>in</strong>terest rates dur<strong>in</strong>g the past 250 days at 31 December 2008 and us<strong>in</strong>g a 95% confidence <strong>in</strong>terval.<br />

For the Brazilian real float<strong>in</strong>g rate debt, the estimated market <strong>in</strong>terest rate is composed of the InterBank Deposit Certificate (‘CDI’) and the Long-Term Interest Rate (‘TJLP’).<br />

With regard to other market <strong>in</strong>terest rates, our analysis is based on the 3-month InterBank Offered Rates applicable for the currencies concerned (e.g. Euribor 3M, Libor 3M, Bubor 3M).