The Best Beer Company in a Better World - Anheuser-Busch InBev

The Best Beer Company in a Better World - Anheuser-Busch InBev

The Best Beer Company in a Better World - Anheuser-Busch InBev

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

86 | Annual Report 2008 F<strong>in</strong>ancial Report<br />

<strong>The</strong> deferred tax liabilities <strong>in</strong>creased <strong>in</strong> 2008 ma<strong>in</strong>ly as result of the bus<strong>in</strong>ess comb<strong>in</strong>ation with <strong>Anheuser</strong>-<strong>Busch</strong> – see note 6 Acquisition and<br />

disposal of subsidiaries.<br />

On 31 December 2008, a deferred tax liability of 28m euro (2007 : 34m euro) relat<strong>in</strong>g to <strong>in</strong>vestments <strong>in</strong> subsidiaries has not been recognized<br />

because management believes that this liability will not be <strong>in</strong>curred <strong>in</strong> the foreseeable future.<br />

Tax losses carried forward and deductible temporary differences on which no deferred tax asset is recognized amount to 1 034m euro<br />

(2007 : 679m euro). 658m euro of these tax losses do not have an expiration date, 92m euro, 50m euro and 39m euro expire with<strong>in</strong> respectively<br />

1, 2 and 3 years, while 195m euro has an expiration date of more than 3 years. Deferred tax assets have not been recognized on these items<br />

because it is not probable that future taxable profits will be available aga<strong>in</strong>st which the unused tax losses can be utilized.<br />

When reconcil<strong>in</strong>g the 2008 deferred tax <strong>in</strong>come of 259m euro with the movement from a net deferred tax asset <strong>in</strong> 2007 to a net deferred tax<br />

liability <strong>in</strong> 2008, it should be noted that this movement is ma<strong>in</strong>ly impacted by the acquisition of <strong>Anheuser</strong>-<strong>Busch</strong> (9 057m euro – see note 6<br />

Acquisitions and disposals of subsidiaries).<br />

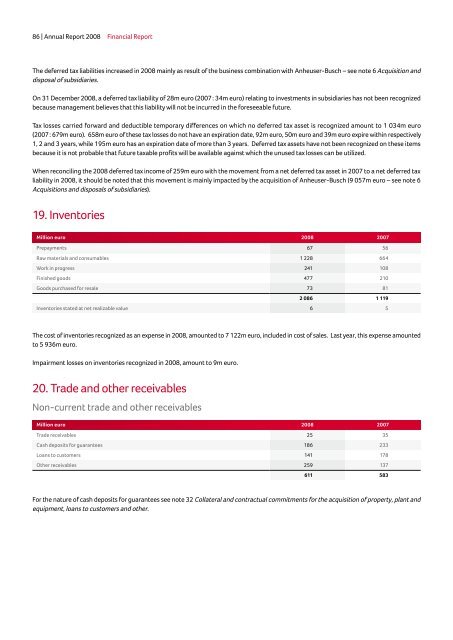

19. Inventories<br />

Million euro 2008 2007<br />

Prepayments 67 56<br />

Raw materials and consumables 1 228 664<br />

Work <strong>in</strong> progress 241 108<br />

F<strong>in</strong>ished goods 477 210<br />

Goods purchased for resale 73 81<br />

2 086 1 119<br />

Inventories stated at net realizable value 6 5<br />

<strong>The</strong> cost of <strong>in</strong>ventories recognized as an expense <strong>in</strong> 2008, amounted to 7 122m euro, <strong>in</strong>cluded <strong>in</strong> cost of sales. Last year, this expense amounted<br />

to 5 936m euro.<br />

Impairment losses on <strong>in</strong>ventories recognized <strong>in</strong> 2008, amount to 9m euro.<br />

20. Trade and other receivables<br />

Non-current trade and other receivables<br />

Million euro 2008 2007<br />

Trade receivables 25 35<br />

Cash deposits for guarantees 186 233<br />

Loans to customers 141 178<br />

Other receivables 259 137<br />

611 583<br />

For the nature of cash deposits for guarantees see note 32 Collateral and contractual commitments for the acquisition of property, plant and<br />

equipment, loans to customers and other.