The Best Beer Company in a Better World - Anheuser-Busch InBev

The Best Beer Company in a Better World - Anheuser-Busch InBev

The Best Beer Company in a Better World - Anheuser-Busch InBev

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

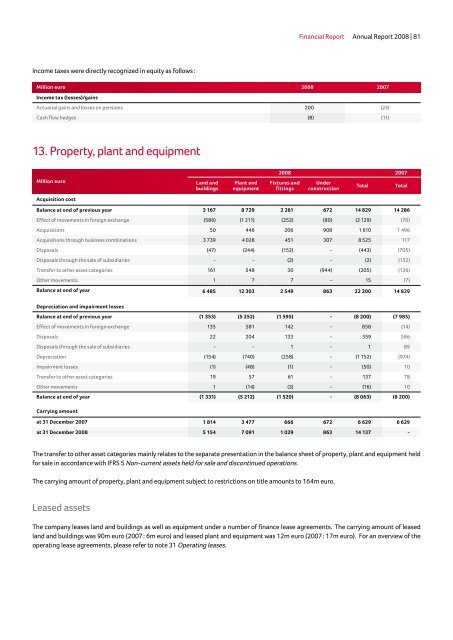

Income taxes were directly recognized <strong>in</strong> equity as follows :<br />

F<strong>in</strong>ancial Report Annual Report 2008 | 81<br />

Million euro 2008 2007<br />

Income tax (losses)/ga<strong>in</strong>s<br />

Actuarial ga<strong>in</strong>s and losses on pensions 200 (24)<br />

Cash flow hedges (8) (11)<br />

13. Property, plant and equipment<br />

Million euro<br />

Land and<br />

build<strong>in</strong>gs<br />

Plant and<br />

equipment<br />

2008 2007<br />

Fixtures and<br />

fitt<strong>in</strong>gs<br />

Under<br />

construction<br />

Total Total<br />

Acquisition cost<br />

Balance at end of previous year 3 167 8 729 2 261 672 14 829 14 286<br />

Effect of movements <strong>in</strong> foreign exchange (586) (1 211) (252) (80) (2 129) (70)<br />

Acquisitions 50 446 206 908 1 610 1 496<br />

Acquisitions through bus<strong>in</strong>ess comb<strong>in</strong>ations 3 739 4 028 451 307 8 525 117<br />

Disposals (47) (244) (152) - (443) (705)<br />

Disposals through the sale of subsidiaries - - (2) - (2) (152)<br />

Transfer to other asset categories 161 548 30 (944) (205) (136)<br />

Other movements 1 7 7 - 15 (7)<br />

Balance at end of year 6 485 12 303 2 549 863 22 200 14 829<br />

Depreciation and impairment losses<br />

Balance at end of previous year (1 353) (5 252) (1 595) - (8 200) (7 985)<br />

Effect of movements <strong>in</strong> foreign exchange 135 581 142 - 858 (14)<br />

Disposals 22 204 133 - 359 586<br />

Disposals through the sale of subsidiaries - - 1 - 1 89<br />

Depreciation (154) (740) (258) - (1 152) (974)<br />

Impairment losses (1) (48) (1) - (50) 10<br />

Transfer to other asset categories 19 57 61 - 137 78<br />

Other movements 1 (14) (3) - (16) 10<br />

Balance at end of year (1 331) (5 212) (1 520) - (8 063) (8 200)<br />

Carry<strong>in</strong>g amount<br />

at 31 December 2007 1 814 3 477 666 672 6 629 6 629<br />

at 31 December 2008 5 154 7 091 1 029 863 14 137 -<br />

<strong>The</strong> transfer to other asset categories ma<strong>in</strong>ly relates to the separate presentation <strong>in</strong> the balance sheet of property, plant and equipment held<br />

for sale <strong>in</strong> accordance with IFRS 5 Non-current assets held for sale and discont<strong>in</strong>ued operations.<br />

<strong>The</strong> carry<strong>in</strong>g amount of property, plant and equipment subject to restrictions on title amounts to 164m euro.<br />

Leased assets<br />

<strong>The</strong> company leases land and build<strong>in</strong>gs as well as equipment under a number of f<strong>in</strong>ance lease agreements. <strong>The</strong> carry<strong>in</strong>g amount of leased<br />

land and build<strong>in</strong>gs was 90m euro (2007 : 6m euro) and leased plant and equipment was 12m euro (2007 : 17m euro). For an overview of the<br />

operat<strong>in</strong>g lease agreements, please refer to note 31 Operat<strong>in</strong>g leases.