The Best Beer Company in a Better World - Anheuser-Busch InBev

The Best Beer Company in a Better World - Anheuser-Busch InBev

The Best Beer Company in a Better World - Anheuser-Busch InBev

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

F<strong>in</strong>ancial Report Annual Report 2008 | 77<br />

In connection with the comb<strong>in</strong>ation with <strong>Anheuser</strong>-<strong>Busch</strong>, the company recognized a non recurr<strong>in</strong>g f<strong>in</strong>ancial expense of 138m euro per end<br />

of 2008. This expense related for 90m euro to the commitment fees for the syndicated senior loan and equity bridge facility and the<br />

underwrit<strong>in</strong>g and arrangement fees for the equity bridge facility. In addition a 48m euro loss was recognized for <strong>in</strong>effectiveness of the hedg<strong>in</strong>g<br />

on the <strong>Anheuser</strong>-<strong>Busch</strong> f<strong>in</strong>anc<strong>in</strong>g prior to the clos<strong>in</strong>g of the acquisition.<br />

<strong>The</strong> sale of Immobrew to Cof<strong>in</strong>immo and the disposal of some dormant companies and assets held for sale resulted <strong>in</strong> a ga<strong>in</strong> before taxes of<br />

393m euro as at December 2007.<br />

Further, profit from operations as at 31 December 2007 was positively affected by a net reversal of provisions for disputes of 24m euro.<br />

All the above amounts are before <strong>in</strong>come taxes. <strong>The</strong> 2008 non-recurr<strong>in</strong>g items as at 31 December decreased <strong>in</strong>come taxes by (112)m euro,<br />

whereas the 2007 non-recurr<strong>in</strong>g items as at 31 December <strong>in</strong>creased <strong>in</strong>come taxes by 35m euro.<br />

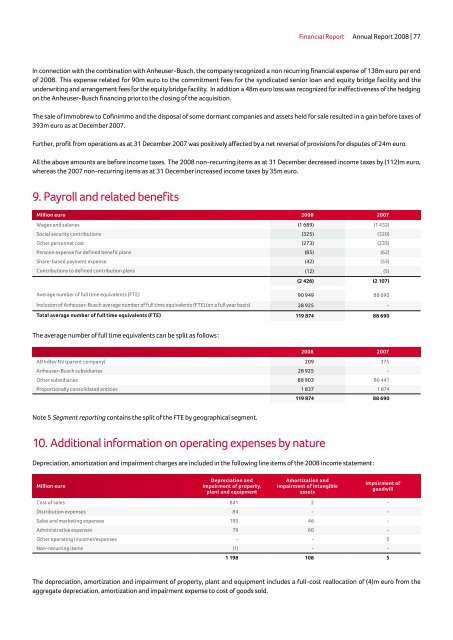

9. Payroll and related benefits<br />

Million euro 2008 2007<br />

Wages and salaries (1 689) (1 432)<br />

Social security contributions (325) (320)<br />

Other personnel cost (273) (235)<br />

Pension expense for def<strong>in</strong>ed benefit plans (85) (62)<br />

Share-based payment expense (42) (53)<br />

Contributions to def<strong>in</strong>ed contribution plans (12) (5)<br />

(2 426) (2 107)<br />

Average number of full time equivalents (FTE) 90 949 88 690<br />

Inclusion of <strong>Anheuser</strong>-<strong>Busch</strong> average number of full time equivalents (FTE) (on a full year basis) 28 925 -<br />

Total average number of full time equivalents (FTE) 119 874 88 690<br />

<strong>The</strong> average number of full time equivalents can be split as follows :<br />

2008 2007<br />

AB <strong>InBev</strong> NV (parent company) 209 375<br />

<strong>Anheuser</strong>-<strong>Busch</strong> subsidiaries 28 925 -<br />

Other subsidiaries 88 903 86 441<br />

Proportionally consolidated entities 1 837 1 874<br />

Note 5 Segment report<strong>in</strong>g conta<strong>in</strong>s the split of the FTE by geographical segment.<br />

10. Additional <strong>in</strong>formation on operat<strong>in</strong>g expenses by nature<br />

119 874 88 690<br />

Depreciation, amortization and impairment charges are <strong>in</strong>cluded <strong>in</strong> the follow<strong>in</strong>g l<strong>in</strong>e items of the 2008 <strong>in</strong>come statement :<br />

Million euro<br />

Depreciation and<br />

impairment of property,<br />

plant and equipment<br />

Amortization and<br />

impairment of <strong>in</strong>tangible<br />

assets<br />

Impairment of<br />

goodwill<br />

Cost of sales 841 2 -<br />

Distribution expenses 84 - -<br />

Sales and market<strong>in</strong>g expenses 195 46 -<br />

Adm<strong>in</strong>istrative expenses 79 60 -<br />

Other operat<strong>in</strong>g (<strong>in</strong>come)/expenses - - 5<br />

Non-recurr<strong>in</strong>g items (1) - -<br />

1 198 108 5<br />

<strong>The</strong> depreciation, amortization and impairment of property, plant and equipment <strong>in</strong>cludes a full-cost reallocation of (4)m euro from the<br />

aggregate depreciation, amortization and impairment expense to cost of goods sold.